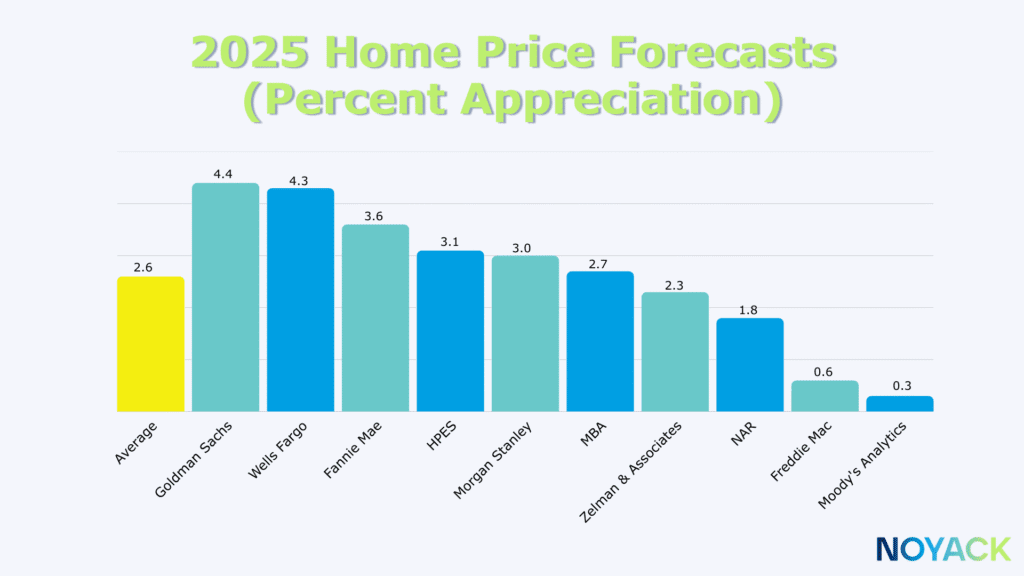

Buying a home is rarely about perfect timing—it’s about prepared timing. The Fed’s first cut of 2025 has nudged mortgage rates to their lowest level in nearly a year, sparking the inevitable question: “Is now my moment?” For high earners, the answer isn’t about chasing the bottom; it’s about readiness, strategy, and controlling what you can.

What the Fed Really Changed

Big headlines can distract from practical decisions. A Fed cut doesn’t mean mortgage rates automatically plunge tomorrow, but it does create a short-term window where home buying opportunity and preparation meet. Your goal isn’t to time perfection—it’s to move when your personal and financial “green lights” are aligned.

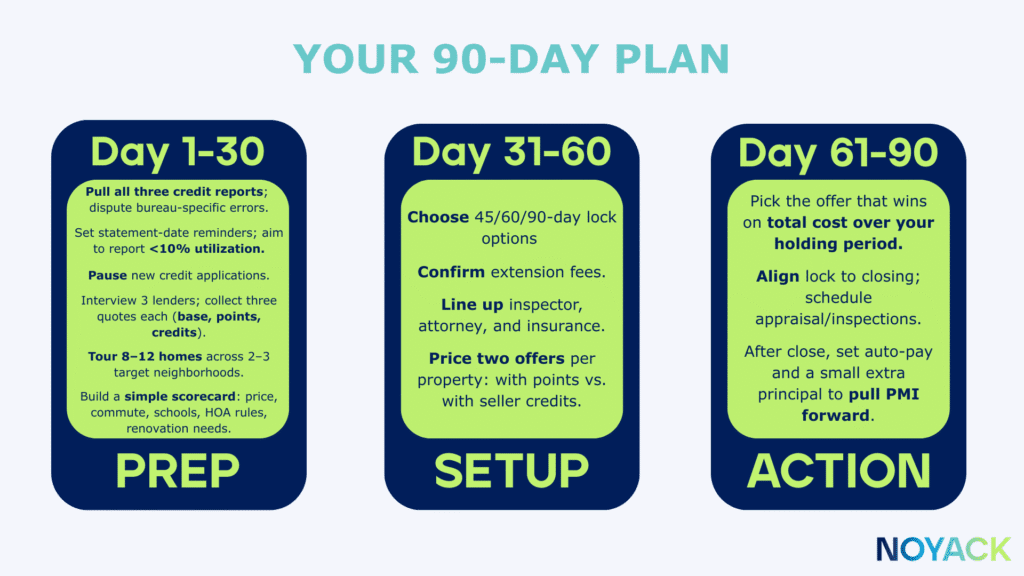

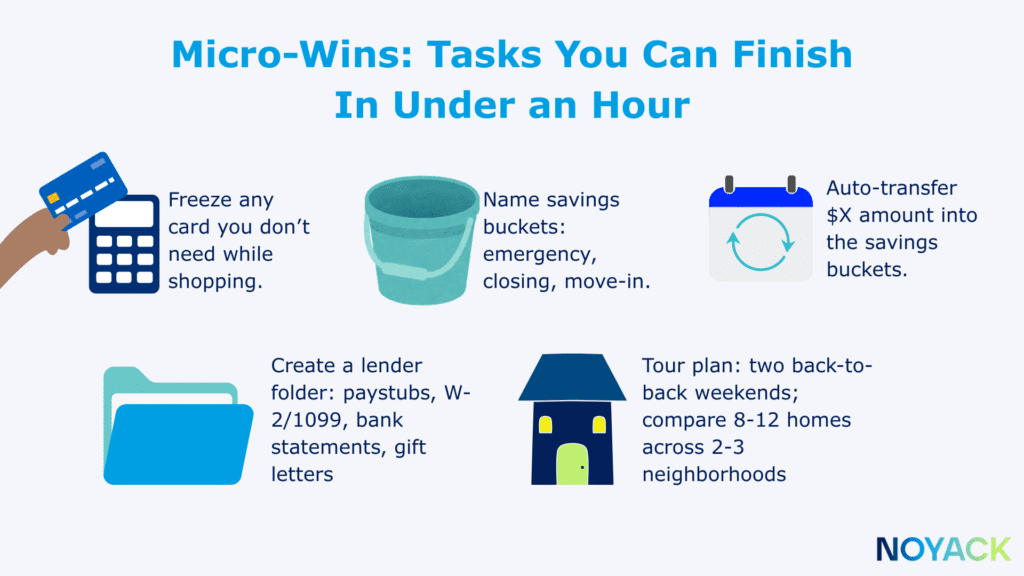

In Short — A Fed cut can open a 60–90 day window where prepared buyers win. Control what you can: fix credit-file errors, lower card balances, shortlist neighborhoods, and pick the right rate-lock strategy.

The connection between Fed policy and your mortgage payment isn’t as direct as most headlines suggest. Rates respond to bond markets and inflation expectations—not Fed soundbites. Think of future cuts as potential upside, not guaranteed savings.

👉 Translation: make today’s choice based on today’s affordability and life timing. Make sure to:

- Price your loan at today’s rate, not a hoped-for future number.

- Ask each lender for three quotes: base rate, rate with 1 point, and rate with seller credits.

- If rates fall later and a refinance makes sense, treat it as a bonus — not the plan.

Why High Earners Hold More Cards Right Now

High earners face unique advantages in this market cycle. Stable income, flexible debt structures, and geographic mobility all give you levers that others don’t. The challenge is not wasting those advantages by waiting too long or overextending.

- Income stability edge. Many high earners in tech/finance/professional services have relatively predictable income. That stability lets you act decisively during short windows when competition softens.

- Debt flexibility. If your student loans sit in the mid-single digits, a well-structured mortgage at roughly mid-6s can still be productive leverage — especially if you plan to hold long enough for compounding and potential refi optionality.

- Geographic advantage. Hybrid/remote options let you arbitrage cost between metros without sacrificing compensation. Banking the spread for 24–36 months can replace PMI quickly and build equity faster.

Should You Really Buy a Home?

The Fed’s recent rate cut has created buzz that “now is the time to buy.” But the truth is more nuanced. A Fed move doesn’t directly slash mortgage rates—it simply improves the odds of a short-term window where rates and competition might ease. The real question isn’t whether the Fed cut, but whether you are financially and personally ready. That’s where this framework comes in.

🟢 Green (Go Now — Fed cut is a bonus, not the reason)

Green buyers are positioned to win regardless of whether mortgage rates drift down further or bounce back. The Fed’s cut makes conditions slightly more favorable, but the decision is sustainable even without it.

- Payment ≤ 25% of gross income: Protects you from payment shock if rates bounce back before close.

- 6-month emergency fund: Gives you staying power if the market turns or the economy slows post-cut.

- 3+ year horizon: Ensures you’ll benefit from amortization and appreciation, not short-term volatility.

- Credit ≥720 or nearly there: Takes full advantage of any marginal improvement in rates post-cut.

- Rate lock fits timeline: Lets you capture today’s environment while the Fed’s cut is rippling through the market.

Greens don’t need to guess future Fed moves. If rates fall further, they can refinance. If not, they already locked sustainable terms. For them, the cut is upside optionality—not the basis of the decision.

🟡 Yellow (Wait & Watch — Fed cut creates temptation, but risk is high)

Yellow buyers feel the pull of “don’t miss it” when they hear about the Fed cut. But the foundation isn’t solid yet, and moving now could magnify risk if rates whipsaw or if competition ramps up after the cut.

- Commission-heavy or variable income: Less predictable when lenders are already cautious.

- Debt service creeping toward 40%: Means even small shifts in rates wipe out affordability gains from the Fed cut.

- Minimal research on comps/neighborhoods: Higher chance of overpaying in a cut-fueled bidding war.

- No lender pre-approvals yet: Slows your ability to act if competition spikes in the wake of falling rates.

A Fed cut makes Yellow buyers especially vulnerable—they chase opportunity without readiness. Instead, use the 60–90 day post-cut window to shore up credit, research neighborhoods, and get pre-approved so you can flip Green before conditions tighten again.

🔴 Red (Pause — Fed cut is noise, not your signal)

Red buyers risk turning the Fed cut into a dangerous excuse. Acting now could lock you into poor terms that undermine both your short-term cash flow and long-term wealth.

- Credit <700 with no plan: You won’t capture the best of the cut—you’ll get lender “penalty pricing.”

- Raiding retirement for down payment: You’d lose compounding while stretching yourself thin.

- Job instability: A Fed cut won’t convince an underwriter to ignore recent changes.

- Unclear co-borrower plan: Creates confusion that a fast-moving market won’t forgive.

Red buyers shouldn’t confuse macro headlines with personal readiness. The Fed may have pulled one lever, but until your finances are stabilized, the cut is irrelevant. Your work is building a foundation—not chasing a market move.

Advanced High Earner Moves (Simple, High-Leverage)

When the Fed cuts, headlines focus on rate drops. But the edge for high earners isn’t just lower rates—it’s using strategy to lock optionality, preserve cash flow, and outmaneuver less-prepared buyers. Here’s how to make this window work harder for you:

Lock Ladder

Get pre-approved with 2–3 lenders and compare 45/60/90-day lock options. Lock if rates jump, float if they’re falling. Know the cost to extend 15–30 days so a Fed-driven rate swing doesn’t derail your close.

PMI as a Bridge

Putting less than 20% down triggers mortgage insurance—but it can be a useful entry point. Plan to delete PMI in 24–36 months through principal paydown and appreciation. If cash flow allows, auto-apply $200–$400 extra per month to accelerate removal.

Points vs. Buy-Downs

- Points: Pay upfront to lower your rate for the life of the loan. Worth it only if you’ll keep the mortgage past break-even.

- Buy-downs: Temporary (1–3 years) relief, often funded by seller credits. Useful if Year 1–2 cash flow is tight (rent overlap, renovations, new baby).

Rule of thumb: Don’t sacrifice reserves, repairs, or PMI removal just to buy points.

Geographic Arbitrage

If your income is location-flexible, compare housing costs across metros. A $1,500–$2,000 monthly savings—redeployed into principal or reserves—compounds quickly. The Fed cut may reduce borrowing costs, but arbitrage multiplies the benefit.

Points vs. Buy-Down: Quick Break-Even Math

When the Fed cuts, lenders often get more flexible with pricing. That’s when you’ll see offers for points and buy-downs. Both can lower your monthly payment, but they work differently—and the right choice depends on how long you’ll hold the loan and how strong your cash buffer is.

- Points = pay upfront (usually 1% of loan amount) to permanently lower your rate. Makes sense if you’ll keep the mortgage past the break-even (upfront cost ÷ monthly savings).

- Buy-Downs = temporary relief for 1–3 years, often funded by seller credits. Ideal when Year 1–2 cash flow is tight (rent overlap, renovations, new baby).

Example: 1 point on a $600k loan = $6,000 cost. If it cuts your payment by ~$190/month, break-even is ~32 months. If you’ll move or refi before then, skip it.

Avoid: Using thin reserves to buy points, assuming an immediate refi, or choosing buy-downs that reset above your comfort zone.

Rule: Pick the option that lowers your total cost over your likely holding period while keeping your payment inside your Green-Light framework.

Negotiation Levers & Scripts (Optimizing the Monthly)

The Fed cut may improve affordability, but the real gains often come from negotiating terms—not just price. Credits and concessions can shift your monthly cost more than a headline discount.

Credits > Tiny Price Cuts

- A $10k credit can wipe out closing costs or fund a 2–1 buy-down.

- A $10k price cut barely moves the monthly payment.

What to Ask For:

- Seller credits toward closing or buy-downs

- Repair allowance post-inspection

- Appliance/fixture credits for near-term replacements

- Closing date aligned to your lock window

Scripts to Use:

- “We can meet your price if we receive $X in credits at close—we’ll move quickly.”

- “We prefer your price with a 2-1 buy-down funded by credits. It solves first-year cash flow. Open to it?”

- “Inspection found A/B/C. We’d like a $Y repair credit and can keep your timing.”

Mindset: Negotiate for monthly affordability—not just the sticker price.

Final Thoughts: Don’t Chase the Fed, Lead With Your Readiness

The Fed’s first cut of 2025 has opened a window—but not a guarantee. Mortgage rates move on bond markets and inflation expectations, and while they may ease further, they can just as easily snap back. What matters more than the Fed’s signal is your signal.

If you’re in the Green zone, the cut is a bonus—you’re positioned to buy with confidence, and future rate drops are simply upside. If you’re Yellow, use this 60–90 day period to shore up your credit, research your market, and get fully pre-approved. If you’re Red, the best move is to pause and build your foundation so you’re ready for the next window.

The takeaway: don’t wait for a perfect Fed cycle. Build the conditions where any market move becomes an opportunity, not a gamble.

FAQ (short answers = fast decisions)

Will mortgage rates drop because the Fed cut?

Not necessarily. Mortgages follow long-term yields and inflation expectations. Decide on today’s payment; treat future cuts as upside.

Should I wait for 5% rates?

If rates plunge, demand can spike and prices climb. Your total cost may not fall. Don’t time the absolute bottom; buy when your Green checklist is true.

Is PMI always bad?

No. PMI can bridge you into ownership sooner. Plan a 24–36 month removal timeline.

Apply together or solo?

Pricing usually follows the lowest qualifying borrower profile. Model both scenarios and choose the best combo of rate, payment, and loan size.