If you’re a Millennial HENRY (High Earner, Not Rich Yet), you’ve probably stared at your credit score in a banking app and thought: “Great—I’m in the clear for a mortgage.” Then comes the shocker: your lender pulls different scores, two or three of them, and suddenly your “great” looks more like “meh.”

It’s confusing, frustrating, and in some cases, expensive.

But here’s the twist: the mortgage scoring system you’re trying to master today won’t be the same system in a year or two. It’s a massive shift. For first-time buyers and HENRYs navigating high-cost markets, it could mean the difference between renting for another five years or finally owning a home.

Let’s unpack how the system works today, what’s coming, and how to play both sides of the transition.

How are you scored now?

When you apply for a mortgage today, lenders don’t just pull “a credit score.” They pull three reports:

- Equifax → scored with FICO 5

- Experian → scored with FICO 2

- TransUnion → scored with FICO 4

These aren’t the slick FICO 8 or FICO 9 scores you see on your bank app. They’re legacy models that date back nearly 20 years. Why? Because Fannie Mae and Freddie Mac, the two government-sponsored enterprises (GSEs) that buy most mortgages, have required these versions for loan eligibility since the early 2000s.

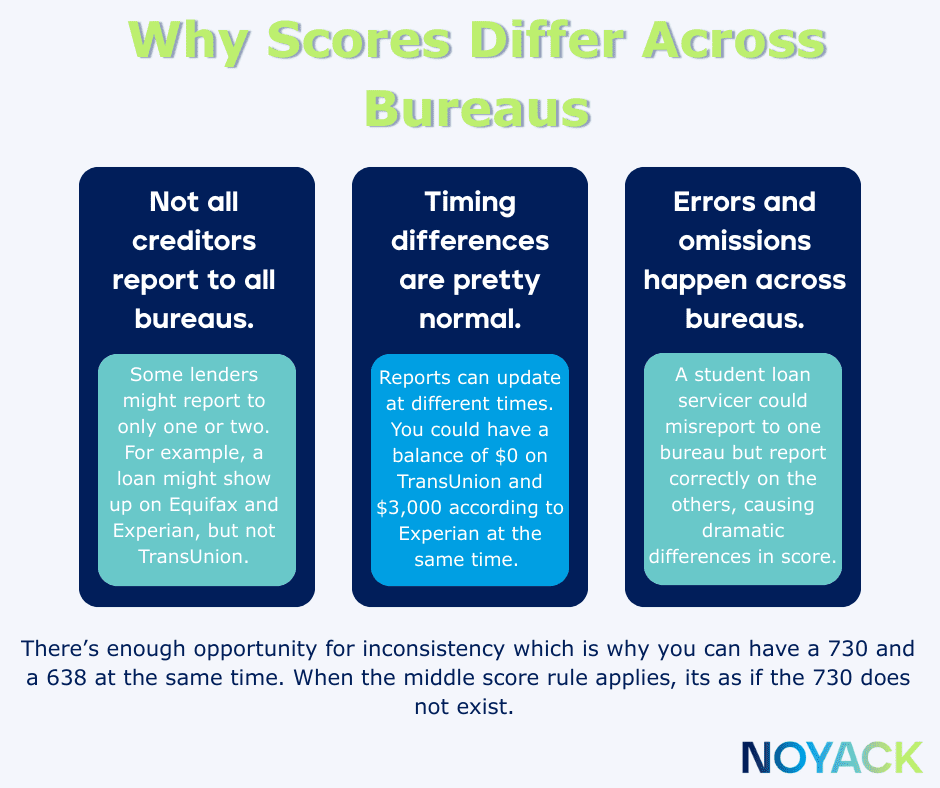

So what does a lender do with these three numbers? They apply the middle score rule:

- With three scores, the middle score is used (not the highest, not the lowest).

- With two scores, the lower score is used.

- With co-borrowers, each borrower’s middle score is calculated, then the lower of the two middles determines the rate.

It’s a conservative system designed to reduce risk for lenders. But it also means one error or one weak co-borrower can sink an otherwise strong application. Learn more about where you stand with our Credit Assessment.

How to “engineer the middle” in 30 days

For Millennial HENRYs, this rule bites when one bureau has a stray error, timing mismatch, or a thin‑data quirk. That’s why your job right now is to engineer the middle, not just “raise my score.”

- Pull all three credit reports (free weekly). Mark discrepancies. Our Credit Dispute Checklist helps you know what to look for.

- Prioritize disputes on the worst bureau (the one pulling your middle down).

- Pre‑pay card balances before the statement cut to reduce reported utilization.

- If you’re applying with a partner, model solo vs. joint scenarios with your lender.

- You can get a quick look at where you stand with our Solo vs. Joint Application Comparison.

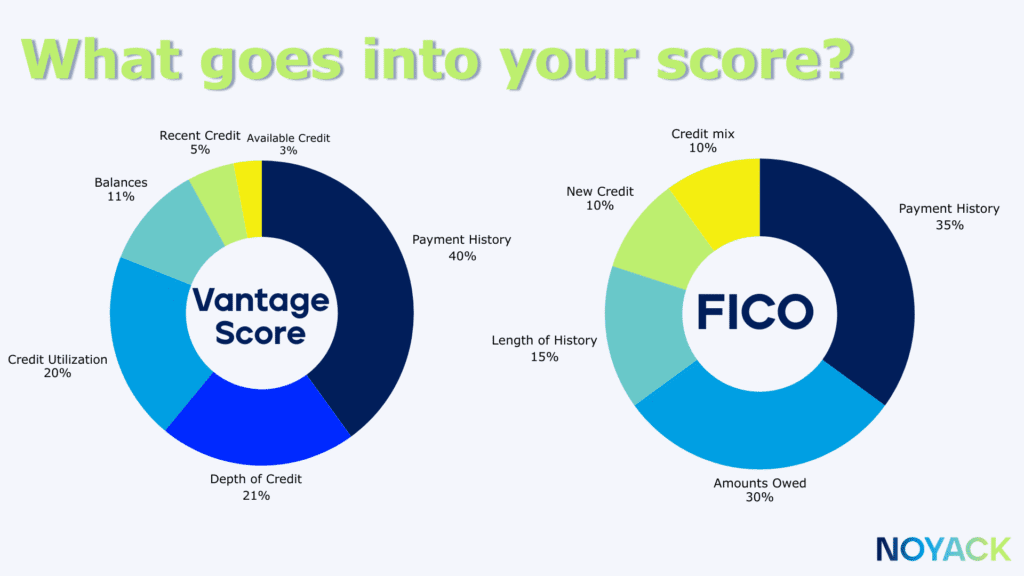

Meet the two scoring philosophies you’ll bump into

Performance claims are actively debated: VantageScore points to lift over Classic FICO; FICO counters that FICO 10T outperforms VantageScore 4.0 on mortgage default prediction. What matters for you is the behavior both models reward: on‑time payments, falling (not rising) utilization, and verifiable on‑time non‑credit bills when they’re reported.

Here’s a closer look at what both will entail.

VantageScore 4.0

VantageScore 4.0 does something groundbreaking: it expands the universe of scorable borrowers. It pulls in alternative data like rent payments, utility bills, telecom accounts, and certain BNPL (buy now, pay later) loans.

If you have a thin credit file, this is a game-changer. Suddenly, paying rent on time every month isn’t just money out the door—it’s proof you’re creditworthy.

It also improves prediction. Studies show VantageScore 4.0 can detect up to 13% more defaults than older FICO models. That’s good for lenders, and it means more approvals for borrowers who deserve them.

FICO 10T (coming to mortgages later)

Think of FICO 10T as an upgrade to the old models with a sharper lens. Instead of looking only at whether you paid a bill on time this month, it looks at patterns over the past 24 months. When it arrives for mortgage pricing, it will reward downward trends and penalize patterns of minimum‑only payments

Example:

- Borrower A pays minimum balances, carries debt month-to-month, and trends upward in utilization.

- Borrower B pays off balances steadily, reducing debt over time.

Both might have a 700 under FICO 5. But under FICO 10T, Borrower B will score higher, because the model rewards positive trends and penalizes creeping balances.

For HENRYs juggling student loans, credit cards, and investment accounts, this trend-based view can be both a risk and an opportunity.

Real-Life Examples

Let’s take a look at how this all can apply to you.

Case Study #1: Alyssa’s Middle Score Problem

Alyssa, a Millennial tech consultant in Seattle, pulls her scores:

- Experian: 730

- Equifax: 678

- TransUnion: 685

Her lender uses the middle score—685. Suddenly her interest rate jumps from 6.5% to 6.9%, she’s forced to pay PMI because her score is below 700, and her maximum loan amount is reduced.

The difference? A servicing error on her student loan that only Equifax captured. If her lender uses VantageScore 4.0, verifiable rent history could help. She can also fix the Equifax error to lift her representative score or start to pre‑pay card balances before statement cut to get lower reported utilization.

Case Study #2: Brandon & Joel’s Co-Borrower Dilemma

Brandon and Joel, a couple in Chicago, apply together. Brandon’s middle score: 762. Joel’s middle score: 670.

The lender uses Joel’s 670 to price the loan. Their rate is higher, they’re charged PMI, and their loan options shrink. T

They decide Brandon should apply solo—limiting their borrowing power but saving them $25,000 in interest over the life of the loan. Their other choice is to wait until Joel fixes disputes, lowers utilization trends, and perhaps benefits from VantageScore 4.0 with reported utilities—if their lender is using it

The High Earner playbook: Now vs. Later

If you’re buying in the next 3–9 months (today’s rulebook)

- Pull all three credit reports free at AnnualCreditReport.com (yes, free weekly—permanently). Dispute bureau‑specific errors that are dragging your representative score.

- Engineer your utilization trend. Pay cards down before statements cut; target <30% on each card (and lower if feasible) to reduce reported balances that feed both legacy and trended models.

- Time your inquiries. Avoid new credit lines ~90 days pre‑application so you don’t introduce fresh pulls right before underwriting.

- Model co‑borrower impact. Ask your lender to run rep score scenarios and price quotes both ways. (Many HENRY couples leave thousands on the table by assuming “two incomes are always better.”)

If you’re 9–24 months out (the next rulebook is coming into view)

- Turn your rent into data. Ask your property manager if they report. If not, consider a compliant rent‑reporting service so on‑time rent shows up on your file; that can help if your lender uses VantageScore 4.0.

- Make your trended story obvious. FICO 10T cares about the direction of balances. Set up recurring extra payments that lower utilization a little each month rather than one big lump right before you apply.

- Track two numbers. Keep an eye on the score your lender will likely use (Classic FICO today) and the VantageScore many consumer apps show—this gives you a feel for how rent/utility data and trended behavior are landing.

Stay updated. The GSEs’ pages will post model and timeline updates; we’ll link the latest inside the post.

FAQ

Is the “dual score” (FICO 10T + VantageScore 4.0 on every loan) a done deal by 2026?

No. FHFA validated both models in 2022, but current 2025 guidance says lenders may use VantageScore 4.0 or Classic FICO under tri‑merge; bi‑merge and 10T incorporation timing are TBD. Always check the date on any article you read. We’ll keep our post updated.

Will VantageScore 4.0 help me if I’ve paid rent on time for years?

It can—if those on‑time payments appear in your file. Ask your landlord/manager or use a reporting service; not all rents are reported by default.

Which model is “better”?

Both companies published 2025 studies. VantageScore cites gains over Classic FICO; FICO says FICO 10T is more predictive than VantageScore 4.0. You don’t control which the lender uses, but you do control the behaviors both models reward: on‑time payments, falling utilization, no “phantom” BNPL debt, and clean files at all three bureaus.

Does a 700 score remove PMI?

Not by itself. PMI is usually required on conventional loans when down payment < 20%; your score affects how much PMI costs.