What You’ll Learn Today

Most people judge progress by their paycheck. Earning power asks a better question: What’s the total value of your future paychecks, in today’s dollars? When you see that number, you can make clearer choices about work, savings, insurance, and investing.

Key takeaways at a glance

- Earning power = the present-day value of your future after-tax income. Treat it like an asset you already own.

- Use it to compare choices. Promotions, job switches, degrees, and moves are easier to judge when you can estimate how much they add to lifetime income.

- Protect it and grow it. Right-size insurance, build buffers, and pick one skill move each quarter that nudges income up.

- Where it lives: the Framework layer of Your Wealth Blueprint (between Foundation and Growth).

You’ll leave with a baseline method, a 90-day roadmap, and a 5-point checklist. Let’s get into it.

Why Earning Power (Not Just Income) Matters in 2025

Millennials and HENRYs live in a world of shifting roles, remote options, equity comp, and rising living costs in big metros. In that world, focusing on one year’s pay is like judging your fitness by yesterday’s steps; useful, but incomplete.

Five reasons to make earning power your headline metric

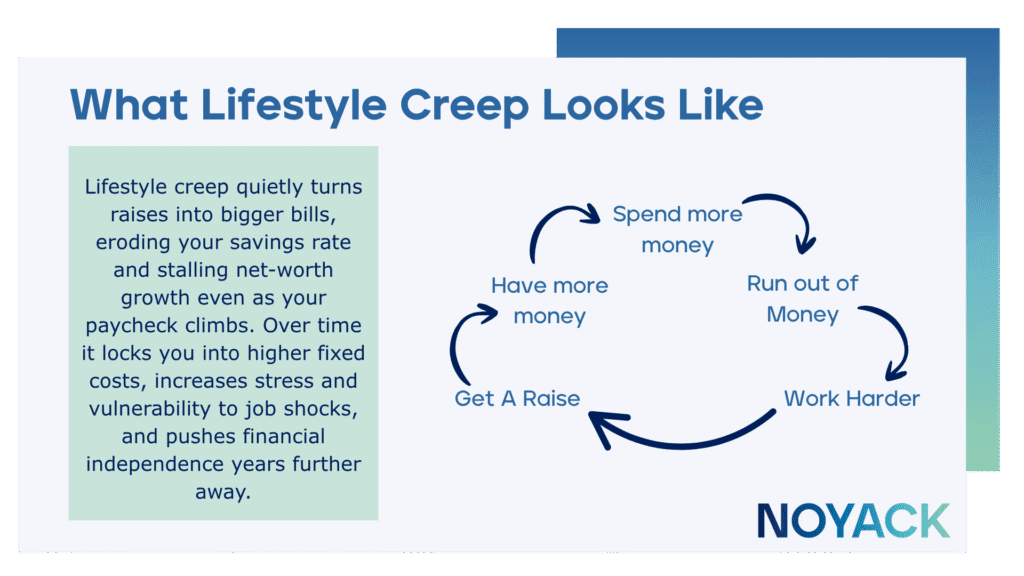

- Paychecks aren’t plans. A bigger salary can still lead to poor outcomes if raises become lifestyle upgrades instead of assets.

- Small skill bumps compound. One credential or project that lifts your pay a little each year can add six figures to lifetime income.

- Resilience through planning. Seeing your career as a multi-million-dollar asset pushes you to insure it and keep a real cash runway.

- Better trade-offs. Big decisions (school vs. cert, move vs. stay, startup vs. stable) become comparisons instead of guesses.

- What gets measured improves. Updating your estimate yearly anchors habits that actually grow wealth.

What Is Earning Power? How Does It Work?

Definition. Earning power is a simple estimate of the value today of all the money you’re likely to earn in the future (after taxes).

If income is the river feeding your finances, earning power is the map that tells you where that river can take you—and how to steer.

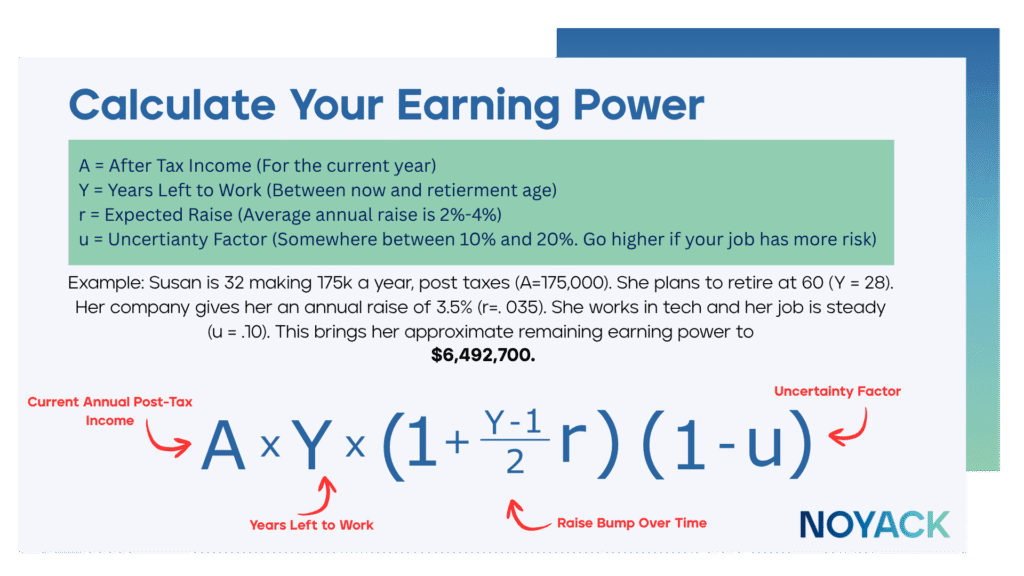

How to make a clean, beginner-friendly estimate

- Start with after-tax income. Use what lands in your bank account.

- Pick years left to work. Be conservative and choose a realistic number.

- Adjust up a bit for likely raises. Keep it gentle, not aggressive.

- Adjust down a bit for uncertainty. If your pay is bumpy, trim the estimate.

Quick baseline method (no fancy math):

- After-tax income × years left = rough total.

- Add a little for small, steady raises; subtract a little for risk.

- You now have a ballpark value of your earning power.

The Upside of an Earning-Power-First Approach

Switching from “salary-first” to “earning-power-first” changes how you decide.

Benefits you’ll feel quickly

- Clarity: One number pulls your career, savings, and investing into the same conversation.

- Confidence: You’ll know when a move likely adds real value—so you can say yes with less second-guessing.

- Resilience: Right-sized insurance and a proper cash buffer reduce panic when surprises hit.

- Momentum: A yearly update creates a feedback loop—you’ll see progress and keep building.

Everyday examples

- A $3,000 certification that reliably adds $3,000/year to pay can pay for itself within a year, then compound for decades.

- A job switch that bumps pay 8% and resets your growth path can be worth far more than a one-time signing bonus.

- A clearer sense of value helps you negotiate—you’ll speak to trajectory, not only title.

The Risks of an Income-Only Strategy

Relying on today’s pay alone hides risk. Without intention, lifestyle creep eats raises, taxes creep up, and you may concentrate too much on one employer or industry.

Watch-outs and common mistakes

- Counting on “maybe” money. Treat unvested equity and options as a bonus, not the plan.

- Over-optimism. Round down on raises and up on uncertainty.

- Illiquidity. Don’t lock up money you’ll need in the next 6–18 months.

- Underinsuring. If others depend on your income, term life and long-term disability are basics—not luxuries.

- Forgetting taxes. Use IRS brackets to sanity-check your after-tax estimate and avoid unwanted surprises.

Where This Fits in Your Blueprint

This brick lives in Framework—the bridge between your basics and your investing.

When you size your earning power, you get the number that sets your savings rate, tells you how much income protection you need, and guides how much investment risk you can actually hold. It also creates simple rules—automation, a target mix, and a review cadence—so good decisions happen by default. In short: Foundation supports today, Growth compounds for tomorrow, and earning power is the Framework signal that connects the two.

How to Get Started with Earning Power: A 90-Day Roadmap

Use this four-phase plan. Each phase includes a short goal and a checklist.

Weeks 1–2 — Establish Your Baseline and Cash Map

You’re building a clear picture. Accuracy beats perfection.

Do this

- Write down after-tax income and years left to work. Make your first earning-power estimate (range is fine).

- List debts with balances and APRs; circle anything above 8–10%.

- Download 90 days of transactions; tag them into 6–8 categories to see where cash actually goes.

- Open a dedicated high-yield savings account for your emergency fund.

- Pick a recurring automation day (e.g., two days after payday).

Weeks 3–4 — Automate the Wins

Turn intentions into defaults you can’t forget.

Do this

- Auto-transfer a target of 15–25% of net pay into investing, emergency fund, and near-term goals.

- Turn on 401(k)/IRA contributions; always capture the full employer match first.

- Create a simple debt plan: minimums on all, extra to highest APR until gone; keep credit utilization under 30%.

- Kill or renegotiate three recurring bills this month.

Weeks 5–8 — Build the Engine

Give your dollars a job and protect the engine that earns them.

Do this

- Draft a one-page Investment Policy Statement (IPS): your target mix, when you rebalance, and what you’ll avoid.

- Implement a core portfolio of broad index funds; consider NOYACK REIT strategy and other NOYACK alternative investments later as diversifiers (education first, size modestly).

- Set rules for RSUs/options (e.g., sell a portion at vest to diversify; plan withholding).

- Complete an insurance review: long-term disability and term life (if someone depends on your income), renters/home, umbrella liability.

Weeks 9–12 — Optimize and Grow

Remove friction. Aim new income at savings before lifestyle expands.

Do this

- Decide Roth vs. Traditional for new contributions; consider HSA/FSA and (if eligible) backdoor Roth.

- Create sinking funds for 6–18 month goals (travel, wedding, down payment) separate from investments.

- Plan an income upgrade: negotiate comp, add one skill, or test a small side project. Pre-commit any raise to automation.

- Set a quarterly review: update earning power, celebrate progress, and refine your IPS.

5-Point HENRY Wealth Checklist

Keep this front and center:

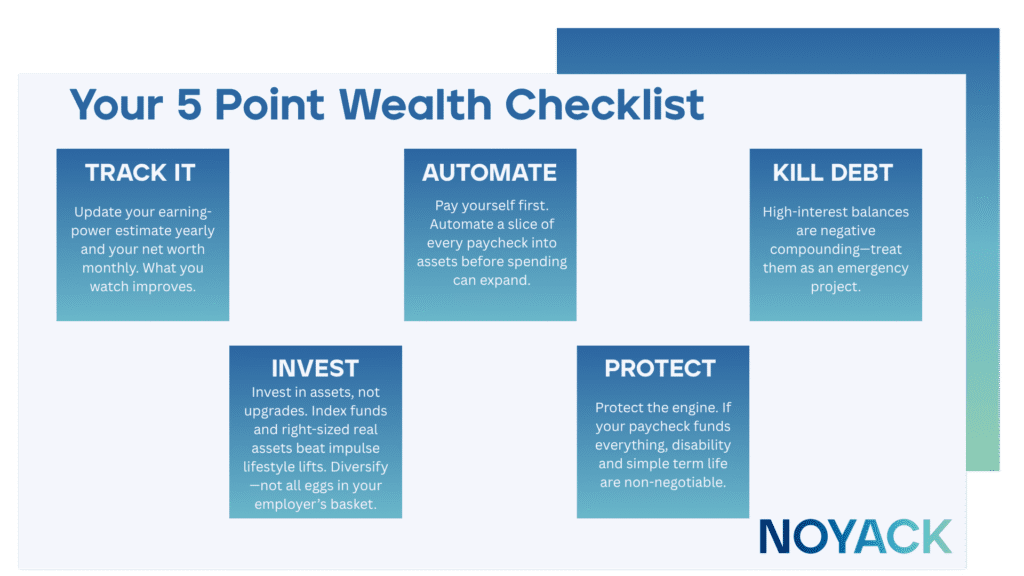

- Track it to grow it. Update your earning-power estimate yearly and your net worth monthly. What you watch improves.

- Pay yourself first. Automate a slice of every paycheck into assets before spending can expand.

- Kill “toxic” debt fast. High-interest balances are negative compounding—treat them as an emergency project.

- Invest in assets, not upgrades. Index funds and right-sized real assets beat impulse lifestyle lifts. Diversify—not all eggs in your employer’s basket.

- Protect the engine. If your paycheck funds everything, disability and simple term life are non-negotiable.

Final Note

A strong salary is the fuel; earning power is the vehicle—the whole journey mapped out. When you start measuring the right thing, you naturally build systems that support it: automation, buffers, insurance, and a sensible portfolio. The goal isn’t just more pay—it’s a life with options, flexibility, and calm.

Ready to put a number on your career and use it well? Start by making the 10-minute estimate today.