If you’re reading this, chances are you’ve done the hard part—built your income, climbed the ladder, maybe even created your first real wealth event. You’re no longer hustling to get in the room. You’re in it.

But that visibility comes with a shadow side: attention from people who want what you’ve earned, and will use sophisticated, deeply personal methods to take it.

This isn’t about paranoia. It’s about fluency. Because the same traits that make you successful—urgency, optimism, ambition—can also make you vulnerable if you’re not prepared.

This week, we unpack how scams are evolving to target HENRYs like you (High Earners, Not Rich Yet), why even the sharpest minds fall for them, and exactly what you can do to stay ten steps ahead.

💸 Why Smart People Still Get Scammed

Let’s kill the myth: scams aren’t about being stupid. They’re about being unprepared—especially when you’re new to wealth. Our Digital Hygiene Checklist keeps you ahead—because the moment you’re unprepared is the moment they strike.

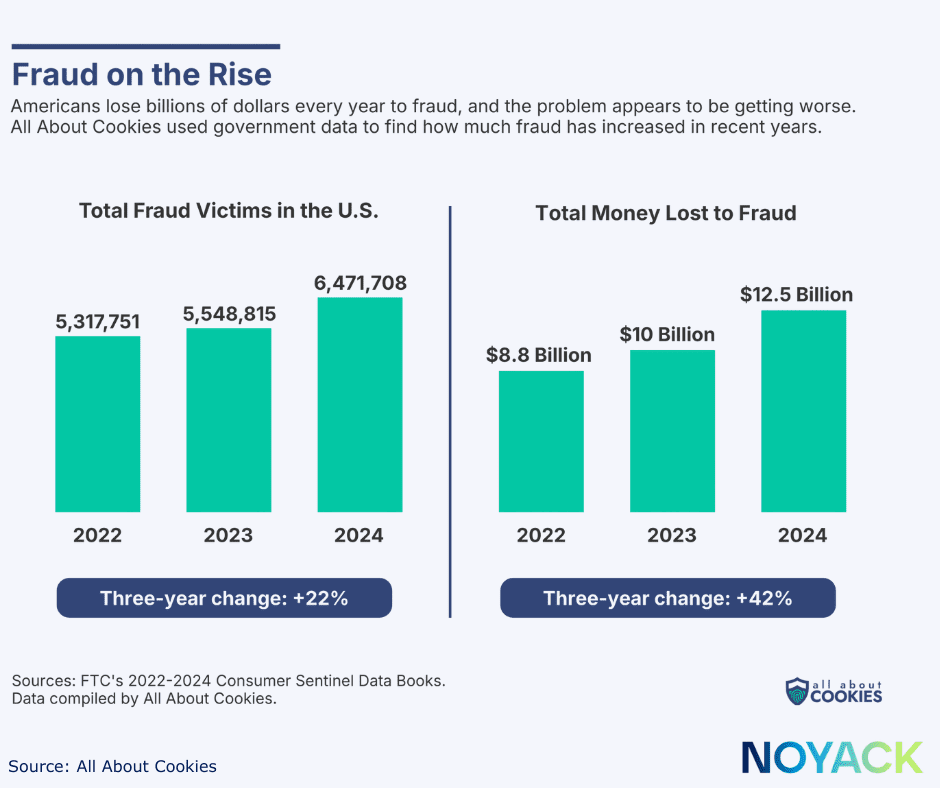

In 2024, Americans lost $12.5 billion to fraud. Investment scams alone hit $5.7 billion, a 24% spike from the year before.

And the victims? Not who you’d expect.

A 35-year-old entrepreneur in Miami sent $87K in crypto to a woman he met on WhatsApp. She spoke his language—tech investor, startup founder, Singapore-based, impressive screenshots. He wasn’t naïve. He was busy. Ambitious. And, at the time, lonely.

Another victim? A managing director at a Fortune 500 firm who wired $1.2 million to a “boutique wealth manager” introduced through a golf buddy. The advisor didn’t exist. The returns were fabricated. And the friend who “recommended” him was also conned.

These are people with MBAs, high-level clearances, Ivy League degrees, and multi-million-dollar net worths. They weren’t gullible. They were human—and moving fast.

That’s the playbook scammers use: they don’t chase ignorance. They chase aspiration, reputation, and emotion. Keeping track of your online presence can help you get ahead. Use our Scam Exposure Map to see where you stand.

If you’re first-gen wealthy, navigating new money without old-money instincts, you’re especially at risk. Not because you’re dumb—but because you’re on the move. And while you’re moving, they’re watching.

Want to test your scam vulnerability? Check out our Scam Simulation Quiz.

🧠 The Psychology Behind Modern Scams

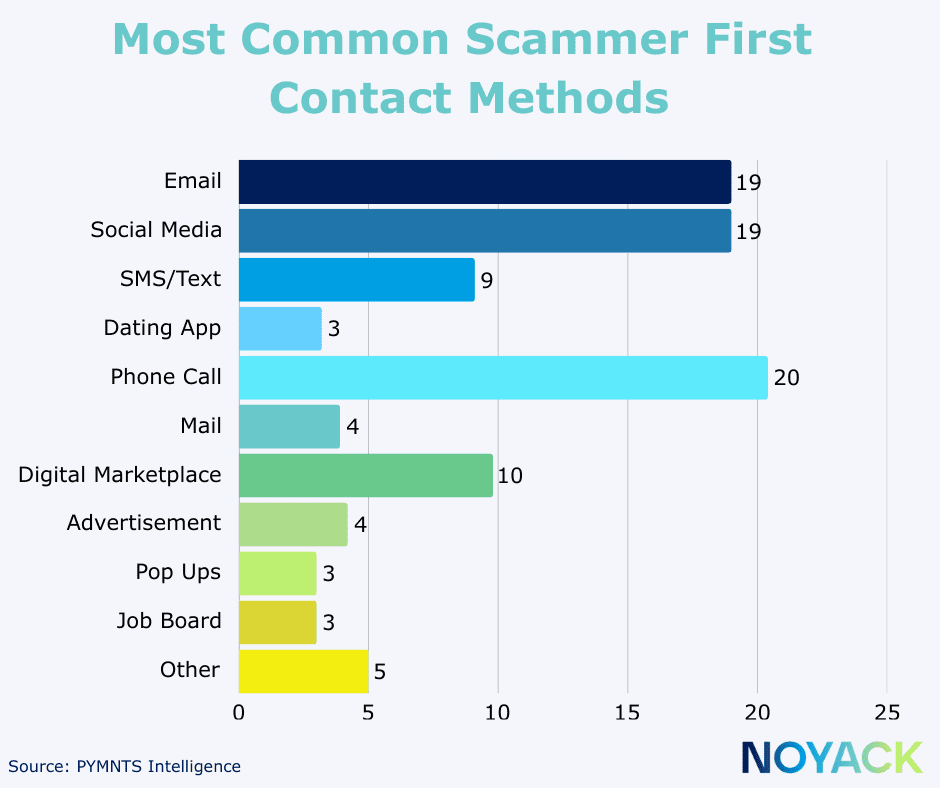

Scammers today aren’t hacking passwords—they’re hacking behavior. Their biggest tools aren’t malware or phishing kits (though those help); they’re empathy, mimicry, and timing.

These scams work not because they’re obvious, but because they’re subtle. They don’t provoke suspicion—they provoke action. They create urgency, rapport, and emotional logic that feels right in the moment.

Let’s break down the most commonly exploited instincts:

🎓 Authority Bias

Whether it’s a “Senior Analyst at the SEC” or a “CFA-certified advisor from Morgan Stanley,” scammers know that name-dropping real institutions and credentials lowers your guard. In many cases, they reference actual people and real firms, tweaking just enough details to avoid legal detection.

⏱️ Urgency Triggers

Every scam has a countdown clock. The artificial scarcity—“only a few slots left,” “offer closes today,” “last round of funding”—triggers your FOMO and bypasses deliberation. This is especially effective with professionals used to solving problems quickly and independently.

🪞 Identity Mirroring

They’ll research your college, company, values, industry lingo, and Twitter likes. If you’re a fintech exec, they’ll talk about DeFi trends. If you’re a DTC founder, they’ll reference Shopify, ad CAC, and retention metrics. This isn’t a coincidence—it’s a customized persona, built to reflect you.

💔 Emotional Exploitation

Many HENRYs feel professionally successful but personally isolated. Whether it’s due to relocation, burnout, or the emotional cost of ambition, scammers offer what feels like connection. They don’t push right away. They build a sense of trust, comfort, even affection—before pivoting to the financial ask.

🔒 Platform Trust

We tend to lower our defenses in familiar digital environments. A message on LinkedIn feels professional. A conversation on Telegram feels private. But these platforms aren’t vetting who’s on the other side of the screen. Scammers know the environment matters more than the message.

🧨 Scam Type #1: Business Email Compromise (BEC)

🔧 The Mechanics

BEC scams begin with quiet surveillance. Scammers scrape employee lists, download org charts, and study Slack screenshots on social media. They use breached email databases to see how executives sign off messages and what vendors you regularly work with.

Then they strike—often on Friday afternoons, during earnings week, or when key staff are traveling. They spoof a domain, impersonate an executive, and request a transfer.

Some even insert themselves mid-thread, replying to ongoing vendor conversations with “updated instructions.”

📉 Real Example

Jordan, a COO at a fast-scaling CPG company in NYC, received an email from her CEO:

“Wire $540K to the new supplier we discussed—urgent. Closing logistics window.”

The email matched prior tone, timing, and signature lines. The invoice looked real. But the wire instructions routed the funds to a shell LLC in the Caymans.

🤯 Why It Works

High-trust environments. Internal emails. Hierarchical requests. It’s a potent combination—especially when time is tight and responsibilities are decentralized. These scams thrive in environments where protocol takes a backseat to execution.

🛡️ How to Prevent It

- Implement “call-before-cash” protocols for transfers above $5K

- Configure DMARC, SPF, and DKIM on your domain

- Lock down executive calendars and org charts from public view

- Hold quarterly social engineering drills for finance teams

💘 Scam Type #2: Romance Investment Scams (“Pig Butchering”)

🔧 The Mechanics

These scams begin innocently: a misdirected text, a compliment on your LinkedIn post, a follow on Instagram. The person is attractive, polite, and curiously aligned with your values. Their profession sounds impressive but vague: “private equity consultant,” “blockchain analyst,” “tech investor based in Singapore.”

Over days or weeks, the relationship deepens. They message daily. You exchange stories, goals, and even family histories. Then comes the casual mention:

“I made 30% last month using this crypto exchange. Want me to show you?”

They never ask immediately. They suggest. You test it with $3K. They cheer you on. You withdraw $300 profit. You reinvest. Then you’re in for $50K or more. Then the site stops working. Then they disappear.

Behind the scenes, this scam is a workflow. There’s a team: one building rapport, one managing the fake trading platform, another tracking targets and prepping documentation. Some even use deepfake videos to simulate Zoom calls.

💔 Real Example

Taylor, a 34-year-old tech consultant in LA, met “Lina” on Instagram. She reacted to a story he posted about Bitcoin. They started messaging. Her profile was filled with lifestyle pics, finance quotes, and screenshots of “trades.” She was charming, consistent, and sounded just like someone from his startup circle. After a month of daily communication, she pitched a platform. He lost $87,000.

The platform, it turned out, was hosted in Hong Kong and used pooled wallets. Funds were moved through a chain of mixers and off-ramps the moment he hit “send.”

🤯 Why It Works

This isn’t an investment scam. It’s an emotional engineering campaign with an investment hook. You’re not investing in crypto. You’re investing in trust. And scammers know that once emotional trust is established, logical skepticism takes a backseat.

These scams don’t trigger fight-or-flight. They trigger bonding and belonging—until it’s too late.

🛡️ How to Prevent It

- Set a hard rule: No financial moves with online-only relationships

- Use reverse image searches and tools like PimEyes or Google Lens to test profile photos

- Ask yourself: Have they ever sent me a selfie in the moment? Are they willing to meet in public?

- Verify any platform independently via regulatory databases or reputable financial media

🧑💼 Scam Type #3: Fake Wealth Advisors

🔧 The Mechanics

These scammers target first-time wealth builders—people too successful for robo-advisors but not connected to old-money advisory circles. You’re likely to get an outreach via LinkedIn, a referral from a loose contact, or a post-event follow-up. Their credentials? Impressive. Their website? Beautiful. Their pitch? Flawless.

They start with strategy: “Let me analyze your tax exposure.” Then they talk sophistication: “Have you explored structured notes or tax-deferred yield swaps?” They’ll mention compliance, but offer flexibility: “We operate in the UHNW space and use client-first discretion to move fast.”

Then they pitch a fund or instrument that requires wiring money directly to a custodian they control. Sometimes they delay the ask. Other times they incentivize speed: “Only 5 seats left in this tranche.”

💸 Real Example

Jordan, a 40-year-old consultant in Chicago, was approached by “Elena,” a CFA who claimed to work with rising execs at Bain and McKinsey. She offered to run a free audit of his portfolio. Her language was precise. Her onboarding kit was professional. The site featured glowing client testimonials (later found to be AI-generated).

She pitched a $250K investment into a “structured income sleeve.” After wiring the funds, he was locked out of the client portal. The phone numbers stopped working. The domain was taken down.

🤯 Why It Works

Scammers know you’re not an amateur—but you’re still learning. They leverage your desire to “speak the language” of serious money without questioning the syntax.

They also prey on the fact that many HENRYs feel behind when it comes to investing. You’re earning fast, but not sure how to scale it without making rookie mistakes. These scammers position themselves as the shortcut to sophistication.

🛡️ How to Prevent It

- Confirm every advisor’s license with FINRA and SEC IAPD

- Look for red flags: Gmail addresses, WhatsApp-only communication, no physical office, or resistance to legal review

- Ask to speak with 3 real clients—and verify their identities

- No licensed advisor will rush you. Ever.

🏛️ Scam Type #4: Government Impersonation

🔧 The Mechanics

You get a call. Or an email. Or a mailed letter with a government seal. The message is urgent:

“You owe back taxes and risk wage garnishment.

A case is being prepared against you.

You must resolve this within 2 hours.”

The call sounds official. The language matches IRS scripts. They even know your previous address or last 4 digits of your SSN—thanks to breached databases.

They direct you to a local Bitcoin ATM, tell you exactly what to enter, and walk you through the transaction as if they’re your “case officer.” By the time you realize it’s a scam, the funds are gone, laundered through crypto mixers.

🎯 Real Example

Raj, a Houston-based sales exec, got a call from “Agent Dawson from the IRS.” Caller ID matched. The agent cited legal code, tax form references, and threatened criminal charges. Raj was told to make immediate payment via a Bitcoin ATM at a local gas station. He sent $6,200. The call ended. His money was gone.

🤯 Why It Works

Scammers manipulate two things: urgency and authority. These scams don’t just scare you—they isolate you. They often say: “Don’t speak to anyone else. This is confidential.” That’s a classic tactic to shut down your support system.

They also count on your status anxiety. Professionals with reputations to protect—lawyers, doctors, execs—are more likely to pay to avoid scandal, even if the threat feels slightly off.

🛡️ How to Prevent It

- The IRS does not initiate legal action by phone

- Government agencies never accept Bitcoin, Zelle, or gift cards

- Call the IRS directly: 1-800-829-1040

- Alert your assistant, family, and team to never act on these requests without independent verification

🚀 Scam Type #5: Pre-IPO / Friends & Family Investment Scams

🔧 The Mechanics

These are often affinity scams—executed inside your professional, cultural, or alumni network. You meet someone at a startup mixer, mastermind, or exclusive event. They follow up later with:

“We’re raising a quiet pre-IPO round for insiders only.

You’d be a great fit. But the window is closing soon.”

They send you a stunning deck. The company sounds like the next Palantir. They offer access to a term sheet, a “founder call,” and even connect you to other “investors” (who are part of the scam).

The moment you wire the funds—usually to a crypto wallet or offshore LLC—the site, contact info, and pitch materials vanish.

🧨 Real Example

Priya, a 39-year-old engineer, was invited to a VIP dinner during a tech conference. A month later, one of the attendees pitched her on a pre-IPO deal for a “quantum AI” startup with supposed backing from Andreessen Horowitz. The founder Zoom was slick. The deck was polished. She wired $100K. It was all fake.

No such company was registered. The “founder” was a composite of AI-generated photos and a LinkedIn profile created 30 days earlier.

🤯 Why It Works

This scam weaponizes your ambition. It dangles access to the inner circle—the deals you assume you missed because you didn’t grow up with the right people. It flatters your intelligence while preying on your desire to multiply capital fast.

Scammers know that scarcity, status, and speed are intoxicating when bundled together.

🛡️ How to Prevent It

- Always vet investment opportunities with your own legal counsel

- Search the company in the SEC’s EDGAR database and your state’s business registry

- Don’t be afraid to ask uncomfortable questions—real founders are used to diligence

- Slow down: if someone rushes you to wire money, it’s a pitch, not an opportunity

Final Word: The HENRY Firewall

Scammers are evolving. You have to evolve faster.

Here’s your HENRY-grade firewall:

✅ Pause on pressure

✅ Verify independently

✅ Use real-time voice confirmation for transfers

✅ Always use regulated advisors and platforms

✅ Cross-check all social proof

✅ Train your team, not just yourself

Scam fluency is a wealth skill. Treat it like one.