Picture this: You log into your financial app in 2027. Instead of static balances and generic advice, you’re greeted by your own financial agent. It’s not just summarizing your transactions — it’s monitoring global markets, reallocating your portfolio overnight, negotiating a better interest rate with your bank, and even suggesting you fund your child’s 529 with surplus cash flow this month.

You didn’t prompt it. You didn’t “ask” it. It’s doing this autonomously, like a trusted advisor who never sleeps.

This isn’t sci-fi. This is Agentic AI — the next generation of artificial intelligence in financial services.

What Is Agentic AI (In Plain English)?

Generative AI creates content based on prompts. ChatGPT writes emails. DALL-E generates images. These tools are reactive—you ask, they respond, and the interaction ends. They’re powerful for analysis and recommendations but require constant human direction.

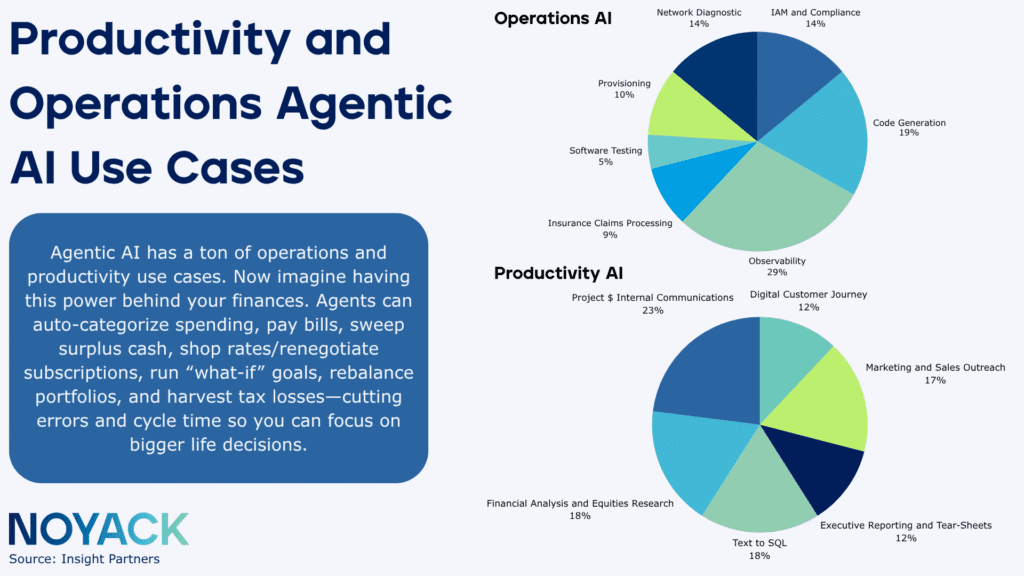

Agentic AI pursues goals autonomously across multiple steps and systems. You set an objective like “maximize my after-tax returns within my risk tolerance,” and the agent plans a multi-step approach, accesses necessary tools and APIs, executes transactions, monitors results, and adjusts strategies without constant supervision.

- Autonomy – Operates independently once goals are set, chaining actions without constant instructions.

- Tool Use – Connects to APIs, brokers, and banks to execute transactions, not just recommend them.

- Planning – Maps multi-step strategies (e.g., cutting insurance costs by analyzing, comparing, negotiating, and switching).

- Continuous Learning – Adapts based on results, refining methods when past approaches underperform.

Think of generative AI as a highly knowledgeable consultant who answers questions. Agentic AI is an employee who executes complex projects independently, checking in only when human judgment is truly required.

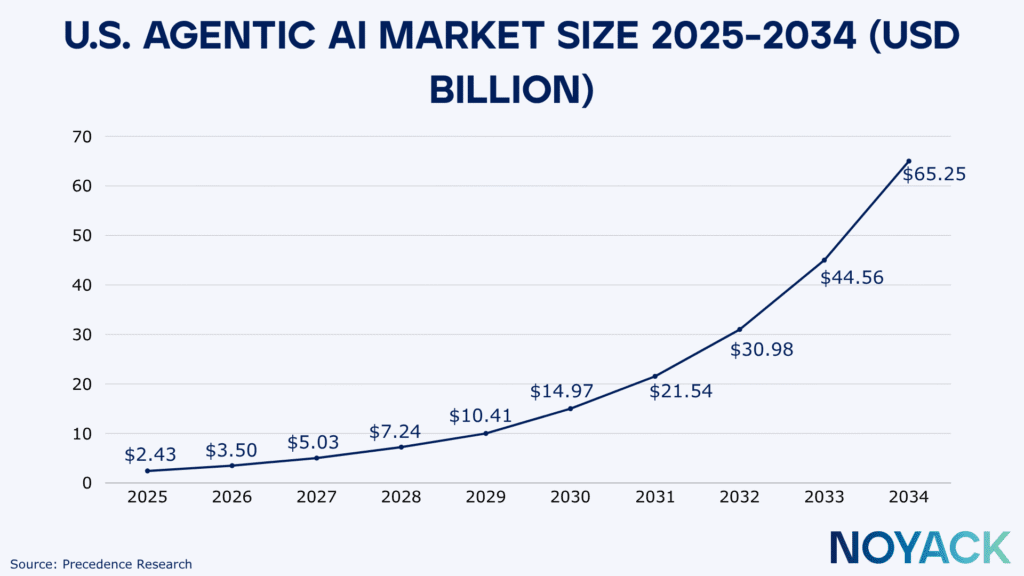

Why Agentic AI in Finance Is Exploding in 2025

The rise of agentic AI in 2025 isn’t just another fintech headline—it’s the tipping point where financial automation becomes a true wealth-building partner. For years, AI tools were stuck in pilot projects and proof-of-concepts. They could summarize, analyze, and recommend, but lacked the rails, access, and legitimacy to actually manage money at scale. This year, that changed.

Four forces converged to turn agentic AI from an experiment into everyday wealth infrastructure:

- Real-time rails: FedNow and RTP now move money instantly, letting AI sweep cash into high-yield accounts within minutes instead of days.

- Standardized access: The FDX standard opened secure, universal APIs across banks and brokers—no more fragile screen-scraping.

- Regulatory clarity: In March 2025 the SEC confirmed AI agents fit within robo-advisor rules, with Europe following under MiFID II.

- Institutional validation: When Morgan Stanley and peers put billions under AI-powered management, retail platforms raced to match.

Together, these shifts removed the friction, risk, and doubt that once held AI back—paving the way for autonomous agents to become a core Blueprint tool for higher-earning millennials.

The Benefits: Why HENRYs Should Pay Attention

Beyond the novelty factor, agentic AI delivers concrete advantages for millennial wealth builders, particularly those in high-earning but time-constrained situations.

Time Reclamation

The average HENRY spends 6-8 hours monthly on financial maintenance—reviewing accounts, paying bills, rebalancing portfolios, researching investment options, and handling financial admin. Agentic AI handles these tasks continuously, freeing this time for career advancement, skill development, or simply life enjoyment. At a $75/hour opportunity cost, that’s $450-600 monthly in reclaimed time value.

Emotional Optimization

Humans make predictable financial mistakes under stress. We panic-sell during market drops, chase performance in hot sectors, and delay rebalancing because change feels risky. Agentic AI executes predetermined strategies without emotional interference. During March 2025 market volatility, Wealthfront’s AI continued systematic rebalancing and tax-loss harvesting while many investors froze or sold at lows.

Continuous Optimization

Traditional financial planning happens quarterly if you’re diligent, annually if you’re typical. Agentic AI monitors continuously, capturing opportunities that appear and disappear within days. When rates on high-yield savings increased 50 basis points in August 2025, AI-managed cash swept to higher-yielding options within hours. Manual managers took weeks to notice and act, if at all.

Sophisticated Tax Management

Tax-loss harvesting delivered 1-2% annual return improvements for Wealthfront users during 2025’s volatile market. Most individual investors can’t monitor portfolios daily for harvesting opportunities, and human advisors charge 1%+ annual fees for this service. Agentic AI provides institutional-grade tax management at fraction of traditional advisory costs.

Reduced Decision Fatigue

Every financial decision consumes mental energy. Should I rebalance now or wait? Is this subscription still valuable? Should I negotiate this bill? Agentic AI eliminates hundreds of micro-decisions annually, reducing the cognitive load that leads to financial procrastination.

The Risks: What Could Go Wrong

Technology optimism must be balanced with clear-eyed risk assessment. Agentic AI introduces both familiar financial risks and novel technology-specific challenges.

Technology and Security Risks

Software bugs could cause incorrect transactions—overdrafts, incorrect transfers, or unintended trades. Platform outages might prevent access during critical moments. API failures could disrupt automation workflows. While major platforms carry insurance and have rollback capabilities, these events create frustration and potential financial impact.

Mitigation: Start with read-only monitoring before granting transaction authority. Use platforms with established security track records and clear insurance coverage. Set conservative automation limits initially.

Data Privacy and Consent

Agentic AI requires extensive access to financial accounts, transaction histories, and personal information. This data concentration creates attractive targets for breaches. Terms of service may permit data usage for platform improvement in ways users don’t fully understand.

Mitigation: Review privacy policies carefully. Understand exactly what data is shared and how it’s used. Prefer platforms with clear data minimization principles and strong encryption standards. Avoid platforms with vague language about data sharing with “partners.”

Loss of Financial Awareness

Excessive automation can reduce financial mindfulness. When bills pay themselves and portfolios rebalance automatically, losing touch with spending patterns and investment performance becomes easy. This disconnection might cause delayed responses to life changes requiring strategy adjustments.

Mitigation: Schedule monthly reviews of automated actions. Review transaction logs and decision rationale. Maintain awareness even when delegating execution.

Algorithm Lock-In and Bias

Agentic AI makes decisions based on programmed objectives and learned patterns. These algorithms might optimize for objectives that diverge from user intentions or incorporate biases from training data. Over-reliance on automation might prevent questioning whether the AI’s interpretation of your goals truly matches your values.

Mitigation: Periodically reassess whether automated outcomes align with evolving goals. Maintain ability to override or pause automation. Understand the optimization criteria your AI uses.

Regulatory and Legal Uncertainty

Despite 2025 guidance, the regulatory framework continues evolving. Rule changes could affect platform operations, potentially requiring service adjustments or discontinuation of certain features. Legal liability for AI decisions remains partially untested—who’s responsible when an autonomous agent makes a costly mistake?

Mitigation: Choose platforms with strong legal and compliance teams. Understand terms of service regarding liability. Don’t deploy AI for financial decisions beyond your risk tolerance for potential reversals or losses.

Platform Viability Risk

Many agentic AI platforms are venture-funded startups with uncertain long-term viability. Platform failure could disrupt automated workflows and potentially strand assets during transitions. Even established platforms might pivot strategies or be acquired, changing service quality.

Mitigation: Diversify across multiple platforms rather than concentrating all automation with one provider. Maintain ability to manually manage finances if platforms fail. Favor platforms with established parent companies or clear paths to profitability.

When Not to Deploy Agentic AI

Agentic AI is powerful, but like any Blueprint brick, timing matters. If your financial house isn’t ready, automation can amplify cracks instead of strengthening the structure. Hold off on deploying until these conditions are addressed:

- Foundation Gaps – If your emergency fund isn’t fully established, you don’t yet have the resilience to withstand shocks. Automating money without a buffer is like installing smart wiring in a house with no roof.

- Unclear Cash Flow – If you can’t articulate where your income goes each month, start with awareness first. Automation works best on a map it understands.

- High-Interest Debt Outstanding – Paying 18% on credit card debt while optimizing cash sweeps at 5% is financial backwardness. Prioritize eliminating expensive liabilities before turning on new tools.

- Weak Account Security – Without strong passwords, two-factor authentication, and secure devices, you’re handing the keys to an AI in an unlocked house. Secure first, then automate.

- No Audit Trail – If a platform can’t show you clear logs of every action it takes, walk away. Transparency is non-negotiable for trust.

- No Pause Button – Automation should empower, not trap. If you can’t pause or reverse actions easily, you’re not in control—the system is.

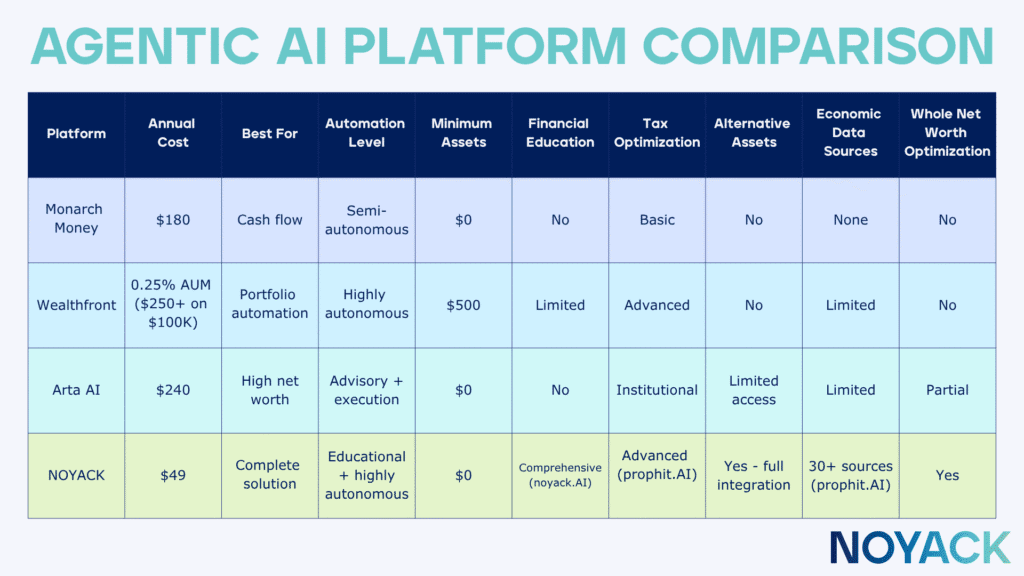

- Costs > Benefits – A $240 subscription that only saves $150 a year is negative ROI. Run the math before you commit.

- Feeling Rushed – If you feel pressured to automate before you understand, stop. Literacy must precede leverage.

- Regulatory Gray Zone – Avoid platforms without clear compliance, insurance, or custodial protections. A strong Blueprint is built on lawful, insured foundations.

How to Get Started with Agentic AI: A 90-Day Roadmap

Just as NOYACK brings structured access to alternatives with discipline and transparency, agentic AI in finance brings structure to your day-to-day money ops. Adopting agentic AI works best in stages—starting small, earning trust, and scaling up as confidence grows.

Days 1–30: Education & Read-Only Monitoring

- Build a knowledge base: review your current workflows, calculate time spent, and clarify your risk tolerance.

- Explore literacy tools like noyack.AI to fill gaps before automation.

- Research 2–3 platforms, connect accounts in read-only mode, and observe recommendations without execution.

Milestone: By Day 30, you’ll understand agentic AI’s capabilities and have one platform monitoring your finances safely.

Days 31–60: Low-Stakes Automation

- Start with simple wins: subscription cleanup, small bill negotiations, and modest savings rules ($50–100).

- Activate cash sweeps between checking and high-yield savings, and set minimum balance thresholds.

- Monitor activity daily at first to build trust.

Milestone: By Day 60, cash flow automation should be running smoothly, saving hours monthly and producing measurable gains.

Days 61–90: Portfolio-Level Automation

- Enable rebalancing, dividend reinvestment, and tax-loss harvesting in taxable accounts.

- Review two months of automated decisions, fine-tune parameters, and expand scope if results are positive.

- Consider joining the prophit.AI beta (Q4 2025) for alternatives integration.

Milestone: By Day 90, automation is handling routine tasks, freeing 5–8 hours each month while boosting efficiency and tax outcomes.

Closing Reflection

Agentic AI isn’t here to replace your judgment; it’s here to make it easier to act on. You set outcomes and guardrails, and the system handles the repeatable work—drafting disputes, sweeping idle cash, pulling statements, tidying portfolio chores—while leaving a clean audit trail. The key is discipline: start read-only → simulate → small & reversible, with cash floors, daily caps, and approval thresholds. That turns an agent from a black box into a reliable teammate.

Agentic AI in finance isn’t a fad. For higher-earning millennials, it’s a practical layer in the Millennial Wealth Blueprint—a way to reclaim time, reduce friction, and widen access without surrendering control. Start narrow, ship safely, measure honestly, and let autonomy compound where it’s earned.