You’re a senior product manager in Austin making $185K. Your 401(k) just crossed the $140K mark—solid. But your statements look eerily similar to your neighbor’s, even though your financial life is anything but.

RSU cliffs. ISO exercises. A side LLC. You’ve got complexity. Meanwhile, your advisor calls every quarter to talk “rebalancing”—but never about your vesting schedule, AMT exposure, or the relocation kicker baked into your next promo.

Your “small” bets in private credit or real estate are doing real work. Your biggest, most tax-advantaged account? Just… exists.

You deserve better than generic.

The Big Shift: Advisors have evolved. Have you?

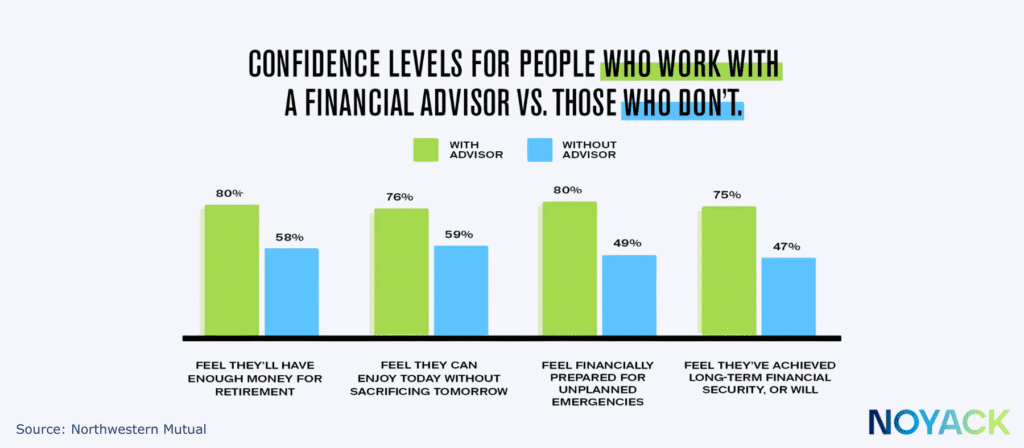

The wealth management industry has split. On one side: legacy firms offering templated portfolios and quarterly check-ins. On the other: modern teams of specialists running coordinated playbooks—tax-aware, equity-smart, and built for real lives.

If you’re a Millennial HENRY (High Earner, Not Rich Yet), this isn’t about “upgrading” to something fancier—it’s about aligning your financial complexity with the right operating system. Because you’re not just managing assets; you’re managing velocity, tax drag, equity comp timing, state moves, side ventures, and career transitions.

Here’s what matters most right now:

- 64% of high-net-worth investors say their advice isn’t personalized.

- Teams outperform solos: $100M vs. $72M in median AUM, and $1.6M vs. $1.0M in average client size.

- 37% of advisors plan to retire within the next 10 years—your plan needs backup.

- Women now make up 23.8% of CFP® pros—reshaping how firms serve actual household dynamics.

- $84.4 trillion is transferring hands by 2045—and the firms winning this era are designed for depth and continuity.

If your advisor’s plan feels like it’s built for someone else, that’s not coincidence. That’s the sign.

Red Flags: Signs Your Advisor Isn’t Built for Your Life

Let’s simplify the test. If two or more of these apply, it’s time to explore alternatives:

- They’ve never proactively mapped your equity comp—no 83(b), no AMT modeling, no 10b5-1 planning.

- Your “financial plan” feels like it belongs to someone prepping for retirement.

- They can’t explain the tax impact of moving from California to Texas—or New York to Florida.

- Fund selection eats up 80% of your meeting. Life planning? Barely a topic.

- They’ve never asked about your next promotion, side income stream, or entrepreneurial ambitions.

Case Study: Sarah, Product Manager in Seattle ($160K)

Sarah moved from a solo advisor to a multi-specialist team. Her first month with the team looked like this:

- A one-page plan aligning short- and long-term goals to accounts: taxable, Roth, HSA, 529.

- A full equity comp playbook: RSU vesting map, ISO timing, AMT guardrails, and a smart diversification ladder.

- A 10b5-1 plan built around blackout windows and key income years.

- A quarterly tax calendar that included real-time market and life-event triggers.

- Clearly defined roles: lead planner, tax strategist, investments lead, and backup.

Within 12 weeks, her team had helped her avoid an AMT surprise, lock in better open enrollment options, and redirect side income into a Solo 401(k) for her consulting work.

The old binder plan? Out. The new model? A living strategy.

The Three Shifts

There have been three major shifts in recent years in the financial advising world. Make sure your strategy keeps up.

Shift #1: Women-Led and Women-Forward Firms Win on Design

This isn’t about checking a box. It’s about designing around reality.

Firms led or shaped by women increasingly start with the full household view—income, caregiving, career transitions, mental load—and work from there. That’s a radically different starting point than traditional firms still anchored in product push or “the market will bounce back” conversations.

Why it matters:

- Women-led firms are 40% more likely to collaborate proactively with your CPA.

- They’re 60% more likely to surface and plan around career transitions.

- They ask about caregiving. About burnout. About what’s changing—not just what’s compounding.

What to ask when interviewing an advisor:

- “Can I see a household-level plan with equity comp, taxes, and a funding schedule?”

- “How do you build flexibility for life shifts—like relocations or caregiving?”

- “If my lead advisor is out, who steps in and how is that documented?”

- For more guidance, check out our First Meeting Template.

Modern firms don’t just pitch values. They operate differently.

Shift #2: Complexity Wins—And Teams Win Complexity

Solo advisors aren’t necessarily bad. They’re just outmatched when life gets layered.

If you’ve got RSUs vesting quarterly, an upcoming promotion, income across states, and a consulting gig with 1099 income, a solo simply doesn’t have the bench. Even if they’re brilliant, they’re one person.

By the numbers:

- Median AUM per team advisor: $100M

- Median AUM per solo: $72M

- Over 1 in 3 advisors will retire this decade

Ask yourself: if your entire financial plan depends on one person—and they go dark, get sick, or retire—what happens?

A solo might be fine if:

- You’re W-2 only

- Living in one state

- No equity comp or side income

You absolutely need a team if:

- You have RSUs, ISOs, or options

- You move states

- You file K-1s or run a business

- You’re coordinating a trust, estate, or donor-advised fund

Ask for a service calendar. Ask who owns what. Ask what happens if your lead leaves. If there’s no answer in writing, that is your answer.

Check out our full comparison guide to see if a solo or team fits your situation best.

Shift #3: Personalization = Deliverables, Not Vibes

Personalization isn’t a warm intro and a friendly Zoom. It’s process.

You’ll know your advice is truly personalized when it comes with:

- A one-page plan linking goals to account types (taxable, Roth, Solo 401(k), HSA, etc.)

- A mapped vesting schedule with equity comp strategy: exercise windows, AMT thresholds, 10b5-1 timing

- A quarterly tax calendar with “if this, then that” logic

- Real-time updates based on market shifts or life events

- A clear breakdown of roles: you, your advisor, your CPA—and their backups

If that’s not happening, you’re not getting bespoke planning. You’re getting tiered service with a custom font.

What to Expect (and Why It Matters)

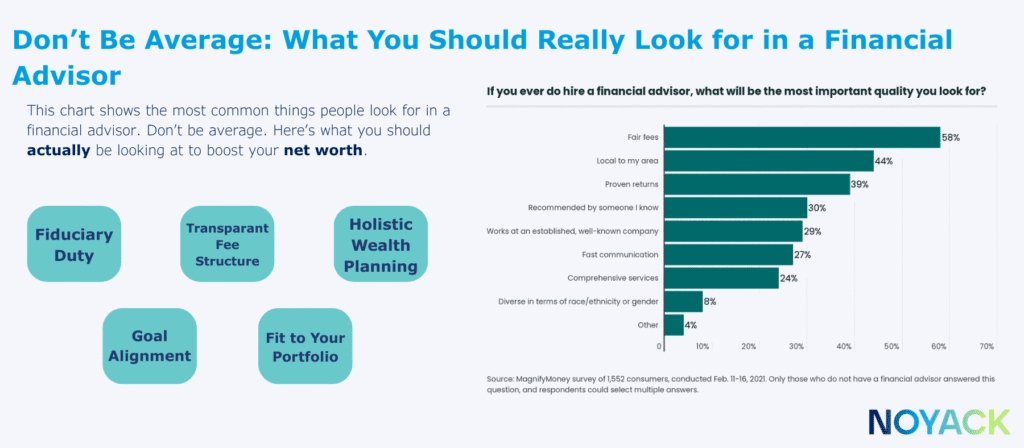

Fee Transparency

There’s no one “right” way to price planning—but there is a wrong way: fuzzy fees with unclear deliverables.

Here’s how to benchmark:

- Team-based model (comprehensive): 0.75%–1.25% AUM

- Solo advisors: Often 1.0%–1.5% AUM

- Flat/Retainer: $2,000–$7,500 per year

- Hourly: $200–$400 per hour

What this looks like in dollars: If you earn $200K and have $300K in assets, a team-based comprehensive fee may run $2,400–$3,600/year.

That’s not about access to an app. It’s about:

- A tax strategist pre-wiring your CPA

- A planner coordinating your open enrollment

- A team recalibrating your plan after a market drop

- And someone calling you before the equity event—not after

What a Great Team Feels Like

Not like a committee. Like a pit crew.

You’re not chasing them. They’re pre-empting you. When your RSUs vest, your tax person already knows. When markets drop, your planner calls you before panic sets in.

They’ll:

- Send your CPA a clean, annotated tax packet quarterly

- Run multi-state analysis before you accept a relocation

- Flag blackout window changes for your 10b5-1 plan

- Re-prioritize savings goals if bonuses or rates shift

This is what modern advice feels like: proactive, coordinated, continuous.

Myth vs. Reality: Clearing Up Common Advisor Myths

Myth: “I’m too young to need all this.”

Reality: Equity comp, tax exposure, and mobility make your plan harder—not easier.

Myth: “My advisor is nice and calls me back.”

Reality: That’s the minimum. You need a system, not a friendship.

Myth: “Teams are more expensive.”

Reality: Team pricing often lands at or below solo pricing—and value per dollar is almost always higher.

What to Do Right Now

Edge Cases

Your specific situation indicates your next step.

- DIY and spreadsheets? Keep going—but schedule a biannual CFP check-in, especially around equity and taxes.

- Love your solo advisor? Ask for a named backup, a written succession plan, and a deliverables calendar.

- Likely inheritance in 3–7 years? Start estate and tax coordination now. Families who plan early keep more compounding.

- Multi-state income? Choose a team that’s done this. Ask for real CA→TX or NY→FL case studies.

- Equity-heavy and under 40? Prioritize tax-aware sequencing and blackout-aware planning over fund picks.

How to Interview an Advisor Like a Pro

You don’t need to “catch” them. You just need to ask the right questions.

Ask these five:

- Who, exactly, is on my team? Name my lead, tax strategist, investments point, and backup.

- Show me your service calendar. What’s getting done this quarter, next quarter, and annually?

- How do you personalize? What tools do you use, what data do you track, and how often do you update?

- Fees—in English. What am I paying for planning, investments, and extras? Break it down.

- If my lead leaves tomorrow, what happens to my plan—and where does it live?

Any advisor worth your time will have crisp, documented answers.

The right advisor changes everything. Use our Advisor Fit Checklist to find yours.

5 Things Great Firms Volunteer Upfront

- ✅ 12-month client service calendar

- ✅ Redacted one-pager tailored to your life

- ✅ Clear team roles—lead, backup, tax, investments

- ✅ Fee breakdown in dollars and %

- ✅ Continuity and succession plan

Your 3-Week Upgrade Plan

Week 1 – Define Your “Job to Be Done”

- Take your Money Score at NOYACK

- Write your top three goals (next 5–10 years)

- Map your complexity: tax, equity, estate

- Make a “stop doing” list: no more DIY tax projections or inbox chaos

Week 2 – Run the Team Test

- Ask the five questions above

- Request a redacted one-page plan and a sample service calendar

- Complete a side-by-side evaluation of 2–3 firms

Week 3 – Demand the Actual One-Page Plan

- Net worth snapshot and 12-month funding plan

- Equity comp roadmap: dates, thresholds, who calls whom

- Quarterly tax actions with built-in triggers

- If/Then logic

- Roles named (planner, tax, investments, you, your CPA)

- Create a living doc that updates as life does. Our First Advisor Meeting Template gives you the perfect place to start.

The Next Best Step Is the One You Take

You’ve already done what most people don’t: you’ve paused to ask if your current setup actually fits your life. That alone puts you ahead of the curve.

Now it’s time to act on that insight.

Modern financial lives are layered—equity, taxes, relocations, multiple income streams, complex goals. If your advisor isn’t built for that, it’s not a personal failing. It’s just a mismatch. And mismatches are fixable.

Whether you’re ready to make a switch or simply want to pressure-test your current plan, you now have the playbook. Because the next decade of your financial life will be shaped by the systems you choose—or the ones you outgrow.