You’re not here to get rich overnight. You’re here to build wealth that lasts—for yourself, your family, and your future freedom. That means looking beyond the hype cycles and headline chasers and identifying investments with staying power.

While everyone obsesses over ChatGPT and AI girlfriends, the lasting wealth is being created in the unsexy, essential backbone—the servers, chips, cables, and cooling systems that make every AI interaction possible.

McKinsey projects $5.2-7.9 trillion in global AI infrastructure investment by 2030. To put that in perspective, that’s larger than Japan’s GDP. Unlike the dot-com bubble, this isn’t built on “eyeballs” and “potential”—this is physical infrastructure generating immediate cash flow.

The world’s most profitable companies are placing the biggest infrastructure bets in history:

- OpenAI’s Stargate Initiative: $500 billion

- Microsoft: $80 billion for 2025 alone

- Meta: $65 billion this year

- Amazon: $75 billion in AI infrastructure

- Google: $50 billion, plus nuclear power investments

Combined, the “Magnificent 7” tech companies will deploy over $315 billion in 2025 alone. This isn’t venture capital fairy dust—it’s concrete, copper, and computing power.

But here’s what mainstream financial media isn’t telling you: every AI query—every ChatGPT response, every AI-generated image, every autonomous vehicle decision—requires massive physical infrastructure. OpenAI’s GPT-4 training alone consumed enough electricity to power 50,000 homes for a year. And we’re just getting started.

This creates what I call the “Infrastructure Inevitability”—as AI adoption accelerates, the physical backbone must expand exponentially. It’s not a question of if, but how fast and who profits.

What Is “AI Infrastructure,” Really?

If AI is the brain, infrastructure is the skeleton, bloodstream, and muscle. Here’s what we mean when we say AI infrastructure:

Compute Hardware: This is the silicon beating heart. Think GPUs (graphics processing units), TPUs, ASICs—chips engineered for AI model training and inference.

Storage & Data Centers: All that data has to live somewhere. From sprawling physical data centers to cloud-native storage solutions, this is the real estate of the digital age.

Networking: High-speed fiber optics, 5G backbones, and low-latency internet infrastructure are the equivalent of arteries—moving data, fast.

Power & Cooling: AI training doesn’t sip electricity; it guzzles it. Power grid upgrades, water-cooled servers, and thermal management systems are critical.

Digital Plumbing: Middleware, orchestration software, and cloud platforms make it all work together. Think of it as the nervous system connecting every AI nerve ending.

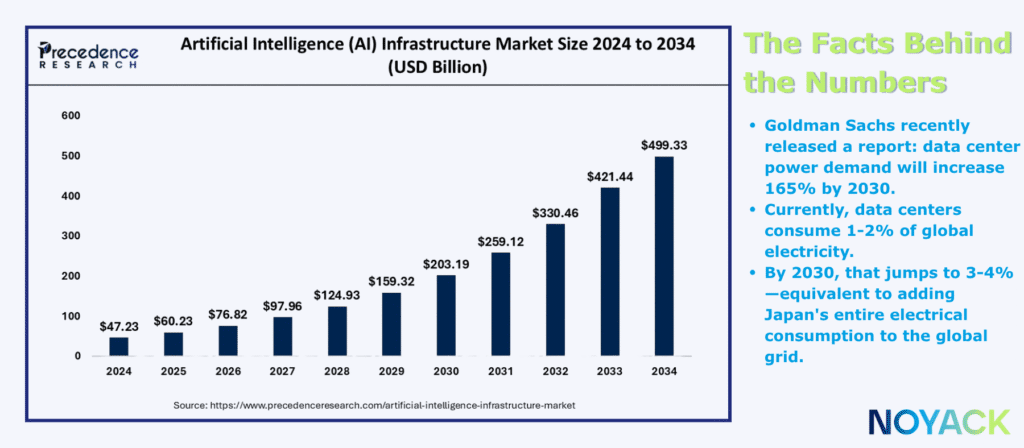

Global AI infrastructure market size is exploding from $135.8 billion in 2024 to an estimated $394-521 billion by 2030, representing 20-30% annual growth. But here’s the critical insight: power infrastructure represents the ultimate bottleneck. Goldman Sachs projects a 165% increase in data center power demand by 2030, while current data centers consume only 1-2% of global electricity. By 2030, this will grow to 3-4% of global consumption—equivalent to adding Japan’s entire electrical grid to worldwide demand.

Why Infrastructure, Why Now, Why You?

Goldman Sachs recently released a report that should have been front-page news: data center power demand will increase 165% by 2030. Currently, data centers consume 1-2% of global electricity. By 2030, that jumps to 3-4%—equivalent to adding Japan’s entire electrical consumption to the global grid.

This isn’t just an American phenomenon. Global AI infrastructure market size is exploding from $135.8 billion in 2024 to an estimated $394-521 billion by 2030, representing 20-30% annual growth. The power infrastructure represents the ultimate bottleneck—and the ultimate opportunity.

This mismatch between demand and supply creates what economists call “scarcity value”—and what investors call “opportunity.”

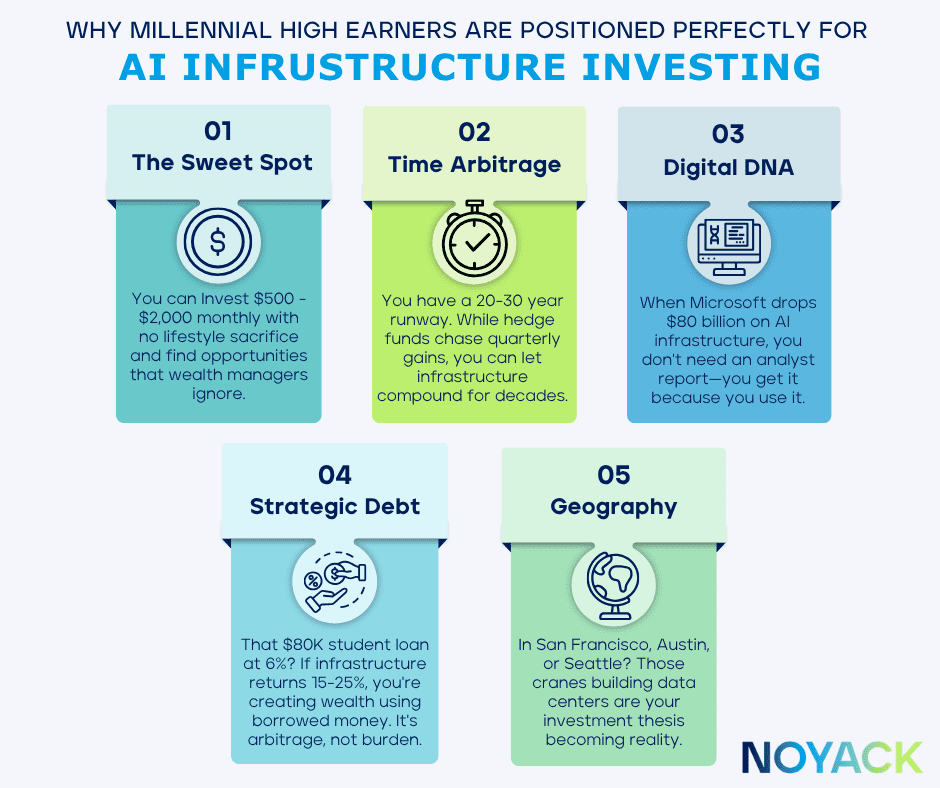

In other words, you’re positioned to benefit: high income, solid liquidity, but still early in the compounding game. The key is converting your earnings into ownership of the “digital rails” that will move future data. Unlike previous infrastructure buildouts dominated by institutions, today’s AI revolution offers unprecedented access through liquid, accessible investment vehicles. Millennial high earners are set up perfectly for the coming boom.

The Three-Tier Wealth Strategy: From Foundation to Acceleration

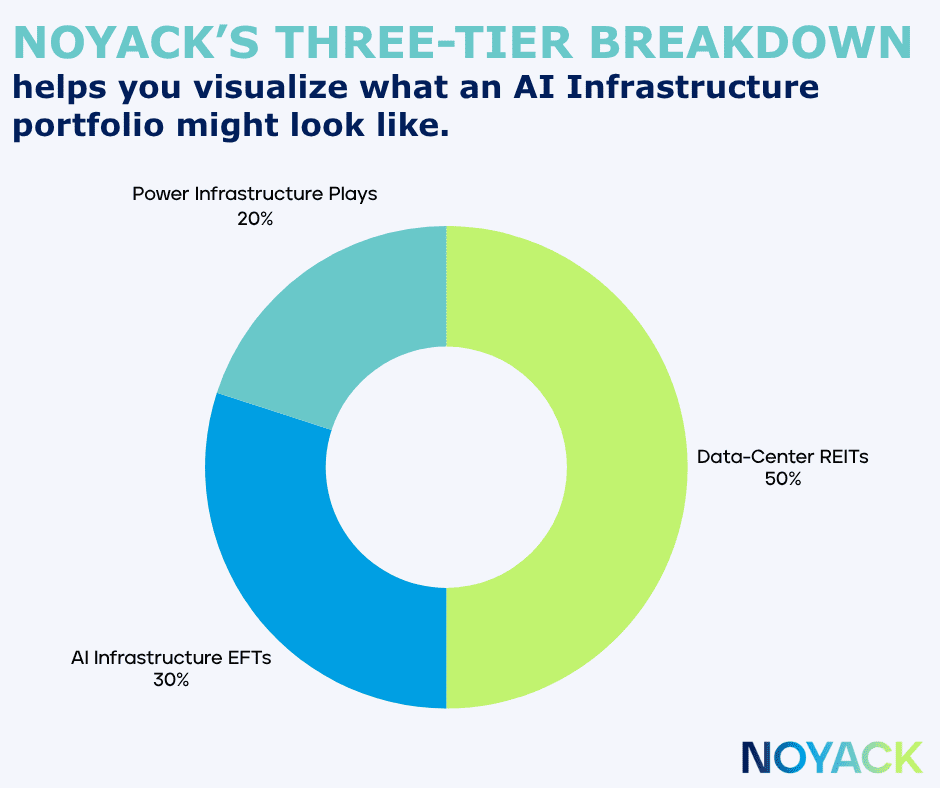

Rather than trying to pick individual winners in a rapidly evolving sector, smart AI infrastructure investing requires a balanced approach. Here is our three tier guide to help you bring infrastructure investing back to the basics

Tier 1: Data-Center REITs – The Foundation Layer (40–50%)

Data-center REITs lease power and cooling capacity, not square footage, creating utility-like cash flow These aren’t your uncle’s strip mall REITs. Data center REITs are the landlords of the digital age, and their tenants are the most creditworthy companies on Earth.

Why REITs First? They offer immediate income (dividends), long-term appreciation, and exposure to the entire AI ecosystem without betting on individual winners.

Digital Realty Trust (DLR) – The Berkshire of Bytes

- The Business: 300+ data centers across 50 metros globally

- The Numbers: $5.6 billion revenue, targeting $6 billion by 2026

- The Income: 3.3% dividend yield, raised for 17 consecutive years

- The Growth: Just acquired 166 new customers in Q4 2024

- Why HENRYs Love It: It’s like owning apartment buildings where Microsoft, Google, and Amazon pay rent—except they sign 10-year leases and never miss payments

Equinix (EQIX) – The Switzerland of Data

- The Moat: 260,000+ interconnections making it indispensable

- The Track Record: 87 consecutive quarters of revenue growth

- The Expansion: Targeting $9 billion annual revenue by 2027

- The Network Effect: Each new customer makes the platform more valuable

- Why HENRYs Love It: It’s the digital equivalent of owning the best real estate in Manhattan—location, location, location

American Tower (AMT) – The 5G-to-AI Play

- The Twist: Known for cell towers, but their data center division is exploding

- The Synergy: 5G + Edge Computing + AI = Triple demand drivers

- The Geography: Present in markets where latency matters most

- Why HENRYs Love It: Multiple ways to win as data demand explodes

🚀 Your AI Infrastructure Play With NOYACK: The Urban Edge Advantage

Don’t just watch AI transform cities—own the infrastructure making it happen.

NOYACK REIT 2 has cracked the code that even Wall Street missed: converting urban parking garages into distributed AI computing nodes. This breakthrough strategy brings compute power directly to where demand is highest—minutes from users, not miles.

Claim Your Spot in the Urban AI Revolution →

Why HENRYs Are Moving Fast

- $500 minimum: No million-dollar barriers

- 18-20% target IRR: Institutional returns, accessible entry

- 6% annual dividends: Income while you grow

- Management skin in the game: $10M+ co-investment

This isn’t another data center play—it’s the next evolution. While others build expensive facilities in remote locations, NOYACK transforms existing urban structures into AI powerhouses.

The result? Lower costs, faster deployment, premium valuations, and first-mover advantage in the hottest real estate trend of the decade.

Ready to own the grid instead of just using it?

Tier 2: AI-Infrastructure ETFs – The Diversification Layer (30–40%)

ETFs are your “smart lazy” solution. Professional management, automatic rebalancing, and instant diversification across dozens of companies. Perfect for busy professionals who want exposure without becoming full-time analysts.

Global X Data Center & Digital Infrastructure (DTCR)

- What It Owns: 35+ pure-play data center and digital infrastructure companies

- Global Reach: US, Europe, and Asia exposure

- The Beauty: Rebalanced quarterly to capture momentum

- Cost: 0.50% expense ratio (worth it for professional management)

- Why HENRYs Love It: One-click diversification across the entire data center ecosystem

VanEck Semiconductor (SMH)

- The Brain Trust: Taiwan Semi, NVIDIA, ASML—the chip royalty

- The Leverage: Semiconductors are the ultimate AI pick-and-shovel play

- The Volatility: Higher risk, higher reward (perfect for your aggressive sleeve)

- Why HENRYs Love It: Captures the entire chip value chain without single-stock risk

First Trust Clean Energy Grid (GRID)

- Why HENRYs Love It: Profits from the “boring” infrastructure everyone needs

- The Thesis: Every data center needs massive grid upgrades

- The Holdings: Transmission, smart grid, and energy storage leaders

- The Catalyst: Biden’s Infrastructure Act + AI power demand

Tier 3: Power Infrastructure Plays – The Acceleration Layer (10–20%)

This is your growth kicker—smaller allocation, bigger potential. Think of it as the hot sauce on your portfolio burrito.

The Nuclear Renaissance The most fascinating subplot in AI infrastructure is nuclear power’s comeback. After decades of decline, nuclear is suddenly the belle of the ball. Why? It’s the only carbon-free, reliable, scalable power source that can meet AI’s 24/7 demands.

VanEck Uranium & Nuclear (NLR)

- Broad exposure to the entire nuclear value chain

- Benefits from both new reactors and life extensions

- Includes uranium miners, reactor builders, and utilities

Sprott Uranium Miners (URNM)

- Pure-play uranium exposure for the risk-tolerant

- Massive leverage to uranium price increases

- Small position can generate outsized returns

- The Natural Gas Bridge While we wait for nuclear’s renaissance, natural gas is filling the gap:

Alerian Energy Infrastructure (ENFR)

- 4.65% dividend yield plus growth potential

- Pipeline companies feeding gas plants powering data centers

- Pennsylvania’s Marcellus Shale proximity to East Coast data centers is key

The HENRY Implementation Strategy: Practical Wealth Building

Tax-Advantaged Account Priority

Max your Roth IRA and 401(k) before placing high-growth assets in taxable accounts; tax-free compounding is a super-power. The 20-30% annual growth potential from AI infrastructure makes tax-free compounding extremely valuable for long-term wealth building.

Use IRAs for ETF and REIT positions to shelter dividends from ordinary income rates. The required REIT distributions create regular income streams that compound tax-free in retirement accounts.

Dollar-Cost Averaging Blueprint

Automate $500–$1,500 monthly into DLR + DTCR based on your cash flow capacity. Add a quarterly drip to NLR or URNM for power exposure. Review allocation drift every January to maintain target percentages.

Most brokerages offer automatic investment plans that can be set up once and forgotten, making systematic investing effortless. This approach provides steady exposure while averaging out the significant volatility that can occur in infrastructure investments.

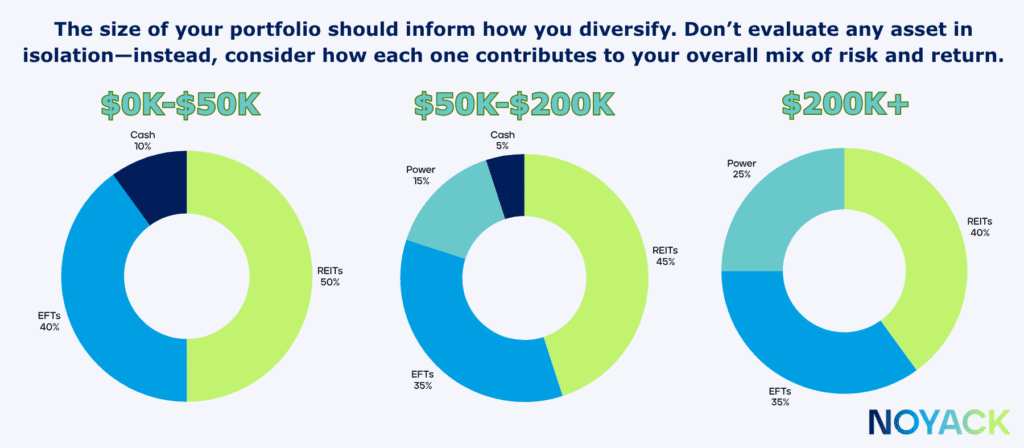

Progressive Allocation Milestones

This progressive approach allows you to build conviction gradually while maintaining appropriate risk management for your overall portfolio size. Early-stage investors focus on stability, while larger portfolios can handle more aggressive power infrastructure exposure.

The Power of Concentrated Conviction

Once you understand AI infrastructure deeply, consider 15-20% concentrated positions in your highest-conviction plays. This isn’t gambling—it’s educated risk-taking that separates wealth builders from index huggers.

Your 90-Day Implementation Roadmap: From Analysis to Action

Let’s turn strategy into reality. No overwhelm, just systematic progress.

Month 1: Foundation Building (Weeks 1-4)

Week 1-2: Set the Stage

- Open or max out Roth IRA contribution ($7,000 for 2025)

- Compare brokerages for commission-free ETF trading

- Download NOYACK REIT 2 offering documents

- Calculate your monthly investment capacity (aim for 10-15% of gross income)

Week 3-4: First Positions

- Buy initial positions: $500 each in DLR and DTCR

- Set up automatic monthly investments

- Join NOYACK Wealth Club for ongoing education

- Start learning: Read one data center REIT earnings call transcript

- Buy initial positions: $500 each in DLR and DTCR

Month 2: Systematic Expansion (Weeks 5-8)

Week 5-6: Add Growth Layers

- Allocate to power plays: $250 each in NLR or GRID

- Consider NOYACK REIT 2 position (5-10% of infrastructure allocation)

- Don’t panic at volatility—infrastructure is a long game

Week 7-8: Automation and Education

- Automate all monthly contributions

- Read “The Physics of Data Centers” to understand your investments

- Schedule quarterly review dates in your calendar

Month 3: Optimization and Scaling (Weeks 9-12)

Week 9-10: Fine-Tuning

- Rebalance to target weights if any position drifts 5%+

- Evaluate tax-loss harvesting opportunities

- Consider adding individual stocks (only with proper research)

Week 11-12: Forward Planning

- Project next year’s investment capacity

- Plan IRA strategy for following year

- Celebrate progress—seriously, acknowledge your wealth-building journey

Professional Risk Management for Personal Wealth

Let’s have an honest conversation about what could go wrong—and how to protect yourself:

Technology Evolution Risk: AI efficiency improvements could reduce infrastructure needs The Reality: Historically, efficiency increases demand (Jevons Paradox)

Your Protection: Diversify across infrastructure types, not just data centers

Concentration Risk: Big Tech dominates spending The Reality: They’re also the most creditworthy tenants in history

Your Protection: Spread investments across multiple REITs and regions

Regulatory Risk: The Concern: Governments might restrict data center development The Reality: National competitiveness overrides local concerns

Your Protection: Geographic diversification through ETFs

Power Constraint Risk: Grid limitations could cap growth The Reality: This constraint creates scarcity value for solutions

Your Protection: That’s why we invest in power infrastructure too

Interest Rate Risk: Rising rates could hurt REIT valuations The Reality: Infrastructure REITs have pricing power through long-term contracts

Your Protection: Dollar-cost averaging smooths rate impact over time

The Wealth-Building Bottom Line: Your Future Starts Now

Here’s what separates infrastructure investors from speculators: we’re not trying to catch lightning in a bottle. We’re building the power grid that channels the lightning.

The AI infrastructure boom offers something rare in investing: a multi-decade trend that’s just beginning, with accessible entry points for regular investors. You don’t need millions. You don’t need connections. You just need to start.

The infrastructure revolution isn’t coming—it’s here, humming in data centers and flowing through fiber optics. The question isn’t whether AI will transform our economy. The question is whether you’ll rent that future or own a piece of it.

Ready to Act? Start with NOYACK’s Urban Data-Center Strategy

For HENRYs seeking direct exposure to the next generation of AI infrastructure, NOYACK’s REIT 2 represents a unique opportunity to participate in the transformation of urban real estate for AI applications. The innovative parking garage conversion strategy addresses the critical challenge of bringing compute power directly into cities where latency matters most.

Investment Highlights:

- $500 minimum investment accessible to all HENRYs

- 18-20% target IRR with institutional-quality real estate

- Urban edge computing positioning for premium valuations

- Management alignment through significant co-investment

This opportunity bridges traditional real estate stability with cutting-edge AI infrastructure demand, offering HENRYs access to institutional-quality infrastructure investments typically reserved for much larger investors.

NOYACK Wealth Weekly is published by NOYACK Wealth Club, a 501(c)(3) nonprofit dedicated to financial literacy for the next generation. This content is educational, not personal investment advice. Consider your unique circumstances and consult professionals where appropriate. Remember: wealth-building is a marathon, not a sprint. We’re here to run alongside you.