If you’re a Millennial HENRY—High Earner, Not Rich Yet—you know the frustration all too well.

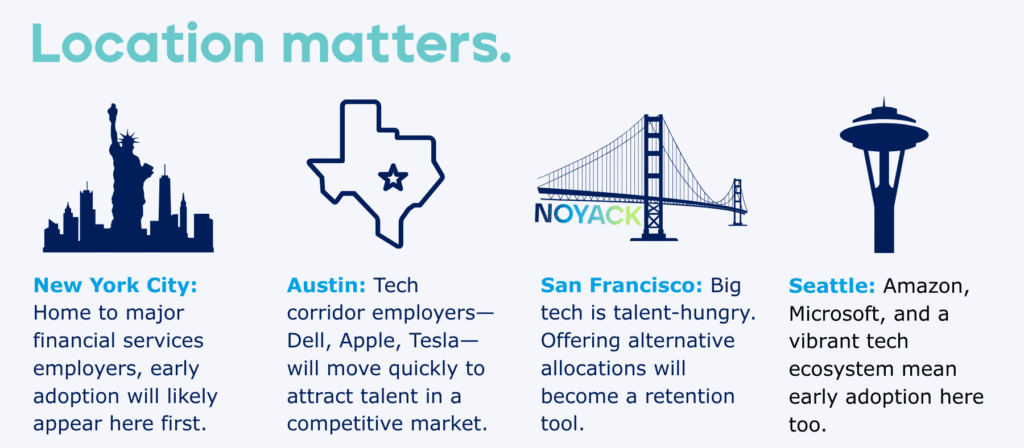

You’re working hard, pulling down $150K to $300K, maybe at a growth-stage tech company in Austin, a consulting giant in Manhattan, or a fintech firm in San Francisco. Your 401(k) balance has finally crossed six figures. You log in, expecting to feel a sense of victory.

Instead, you stare at the same prehistoric menu: Large Cap Growth Fund. Bond Index. Target Date 2055.

Meanwhile, your side portfolio is thriving. Your Fundrise real estate stake is up double digits. The private credit fund you accessed through YieldStreet is paying 12%. Your friend who scored pre-IPO shares through Forge just cashed out at 3x.

Your biggest, most tax-advantaged account—the one that will actually determine whether you retire free or dependent—is still locked in the 1990s.

That’s about to change.

On August 7, 2025, the White House signed an Executive Order that could fundamentally reshape retirement savings. For the first time since the 401(k) was created in 1978, regulators are being told: unlock institutional-grade alternatives for ordinary savers.

Translation: Yale’s endowment strategy is finally coming to your 401(k).

A Quick History: How We Got Stuck

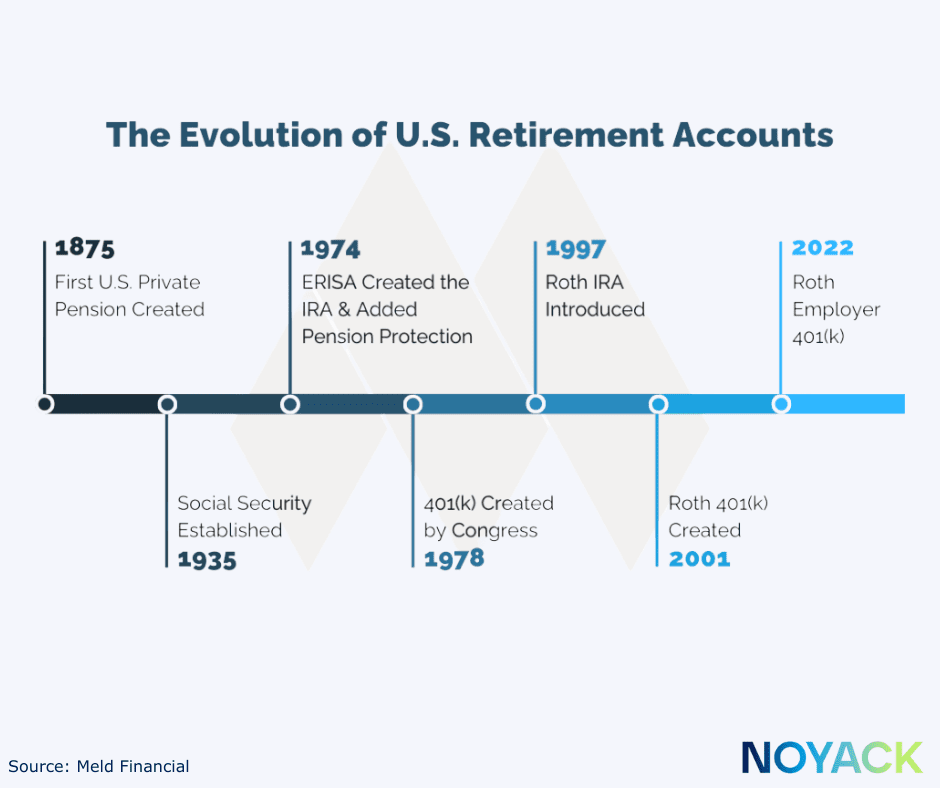

The 401(k) wasn’t born as a master plan. It was a quirky byproduct of the 1978 Revenue Act, a tiny provision allowing workers to defer part of their salary before taxes. No one predicted it would replace pensions and become America’s $8.9 trillion retirement engine.

But as it grew, it ossified. Liability fears and regulatory gray zones kept employers from adding alternative investments. In 2021, the Department of Labor even issued guidance essentially warning plan sponsors: “If you touch alternatives, you’ll get sued.”

So your menu never evolved. Public equities. Bonds. Maybe a target-date fund. Simple? Yes. Optimized for long-term wealth building? Not even close.

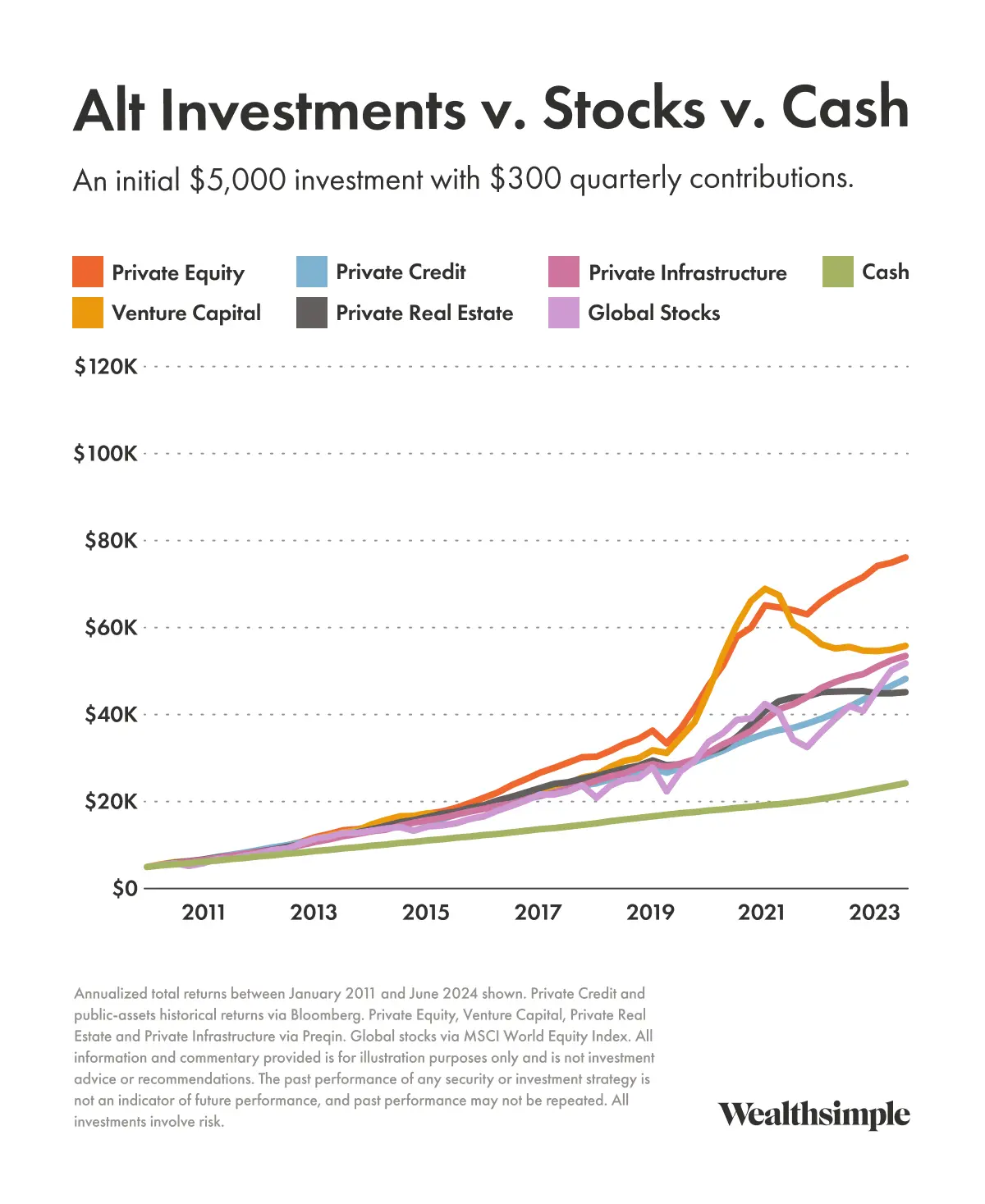

Meanwhile, institutions played a different game. Yale’s endowment, under David Swensen, routinely generated 10%+ annualized returns by allocating heavily to alternatives: private equity, venture capital, real estate, commodities, hedge funds. Harvard, Stanford, and major pensions followed suit.

The results were staggering. While your 401(k) slogged through two decades of volatility, endowments built generational wealth. The secret wasn’t luck—it was access.

What Just Changed

The August 7 Executive Order is the first serious crack in the wall. Here’s what it does:

- Department of Labor (DOL) guidance: Plan sponsors will now be told how to add alternatives responsibly, instead of being warned not to.

- SEC coordination: Disclosure, pricing, and investor protection standards will apply, ensuring institutional-quality oversight.

- A hard deadline: Within 180 days (by February 2026), both agencies must deliver frameworks.

That timeline is key. This isn’t a wish list. It’s a mandate.

By late 2026, large employers—think Google in Mountain View, JPMorgan in New York, and Dell in Austin—could begin offering alternative allocations in their retirement menus. By 2027, smaller employers will follow.

The door is opening. The question is whether you’re ready to walk through.

What Counts as “Alternatives” (and What Doesn’t)

Forget the headlines about “Bitcoin in your 401(k).” That’s not what’s happening. The changes are about measured access to institutional strategies, not gambling.

Here’s what you could see:

- Private Real Estate: Professionally managed funds owning warehouses in Dallas, data centers in Ashburn, or apartment complexes in Brooklyn. Target returns: 7–10% with steady cash flow. Curious what this might look like? Check out NOYACK’s REITs.

- Private Credit: Direct lending to middle-market businesses—loans that used to come from banks. Target yields: 8–14%, with institutional risk management.

- Growth Equity: Late-stage private companies 1–2 years before IPO. Not moonshot venture bets, but mature firms with clear revenue paths.

- Infrastructure & Real Assets: Toll roads in Florida, renewable energy projects in California, telecom towers in Seattle. Inflation-protected, income-generating.

- Commodities & Natural Resources: Timber, farmland, energy. Diversifiers that move differently from the S&P 500.

- Digital-Asset Funds (selective): Professionally managed crypto exposure, capped and structured for retirement accounts

The principle is simple: access without chaos.

Why It Hits Different for Millennials

If you’re 32, making $180K in San Francisco, you’re sophisticated enough to know diversification matters. But you’re stuck. Your 401(k) is 100% public equities and bonds.

Here’s the math that should keep you up at night:

- Max contributions of $23,500/year at 7% growth = ~$2.2M at retirement.

- The same contributions at 8.5% growth = ~$3.1M.

- That’s $900,000 in extra wealth.

For a Brooklyn consultant paying $5,000/month rent or a Seattle engineer juggling daycare costs, that’s not a luxury—it’s the difference between financial independence and lifestyle downgrade.

Institutions have known this for decades. Now, for the first time, you get a seat at the table.

The Trade-Offs (Read This Twice)

Alternatives aren’t free money. They come with very real considerations:

- Liquidity: Quarterly redemption, not daily. Fine for retirement, but requires patience.

- Fees: 1–2% management fees, sometimes performance fees. Net return matters most.

- Valuations: Quarterly marks, not real-time stock prices. You’ll need tolerance for opacity.

- Complexity: More moving parts, more disclosure. No autopilot.

Education is non-negotiable. Don’t let fear keep you in a cage.

Your Action Plan

Phase 1: Immediate (30 Days)

- Log into your 401(k). Identify what options you already have (REITs, CITs, multi-asset).

- Ask HR: Will our plan evaluate alternatives under the new EO?

Phase 2: Positioning (6 Months)

- Educate yourself: learn the basics of private equity, credit, and infrastructure.

- Plan your allocation: Start thinking in 5–15% ranges, not wholesale replacement.

- Track industry leaders: Fidelity, Vanguard, and State Street are already developing products. Also pay attention to major cities where adoption is most likely to happen first.

Phase 3: Implementation (2026–2027)

- Start small: 5% to diversified real estate or credit.

- Keep your core: index funds remain your foundation.

- Monitor fees and performance: institutional quality or bust.

The Bigger Picture

This isn’t about speculation. It’s about access.

For decades, the best tools in wealth building were reserved for endowments, pensions, and ultra-high-net-worth families. Institutions compounded wealth while retail investors were told to stick with the S&P 500.

Now, with Millennials inheriting $84 trillion in the Great Wealth Transfer, access is shifting. This is about democratizing the very engines of generational wealth.

Looking Ahead: The Next Decade

By 2030, the 401(k) could look radically different. Imagine:

- Target-date funds with a 10% real estate sleeve.

- Default options that include private credit allocations.

- A generation of Millennials and Gen Z investors compounding 8–9% instead of 6–7%.

That incremental edge—multiplied across 70 million workers—reshapes the wealth landscape of America.

And HENRYs in hubs like New York, Austin, San Francisco, and Seattle will be the first to seize it.

The Takeaway

Your 401(k) prison break is coming.

The wealthy have always understood that access shapes outcomes. The difference between retiring comfortably and retiring wealthy isn’t luck—it’s the investment menu available over your career.

Washington just opened the gates. Institutions proved decades ago that alternatives belong in long-term portfolios.

The question isn’t if. It’s when.

And the real question is whether you’ll be ready.

Stay disciplined. Stay diversified. Stay bold.