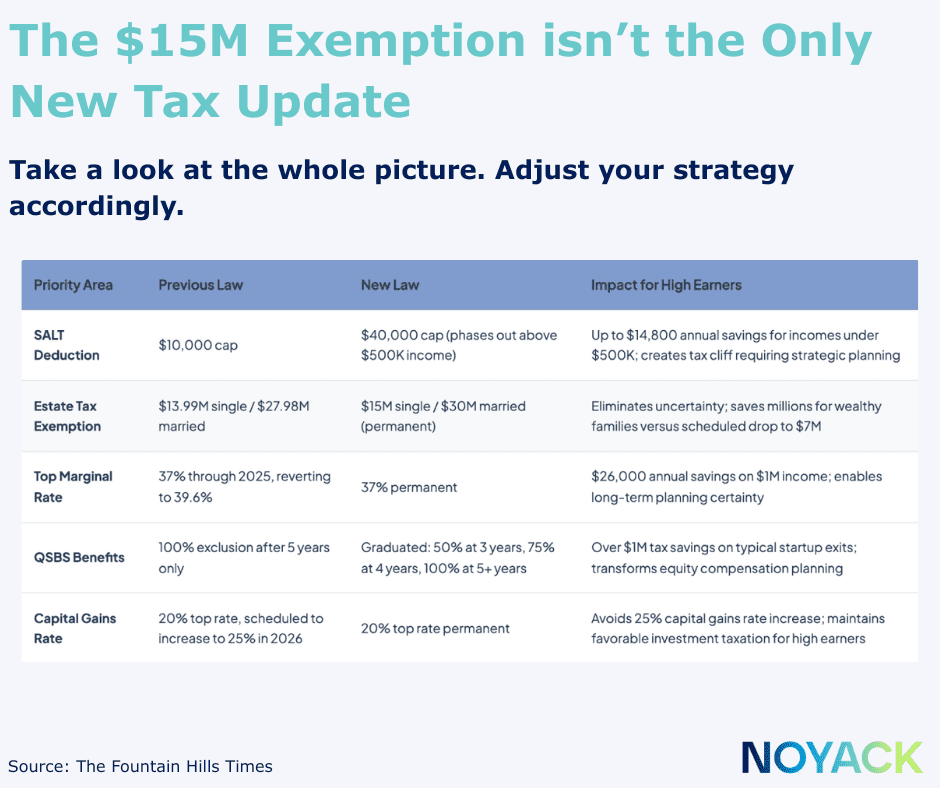

Most young professionals think estate planning is something you do in your 60s—maybe after the second house and just before retirement. But the One Big Beautiful Bill Act (OBBBA), passed on July 4, 2025, quietly rewrote that timeline. Effective January 1, 2026, the federal lifetime gift and estate tax exemption will jump to $15 million per person. That’s $30 million for married couples—and, for the first time, it’s indexed for inflation.

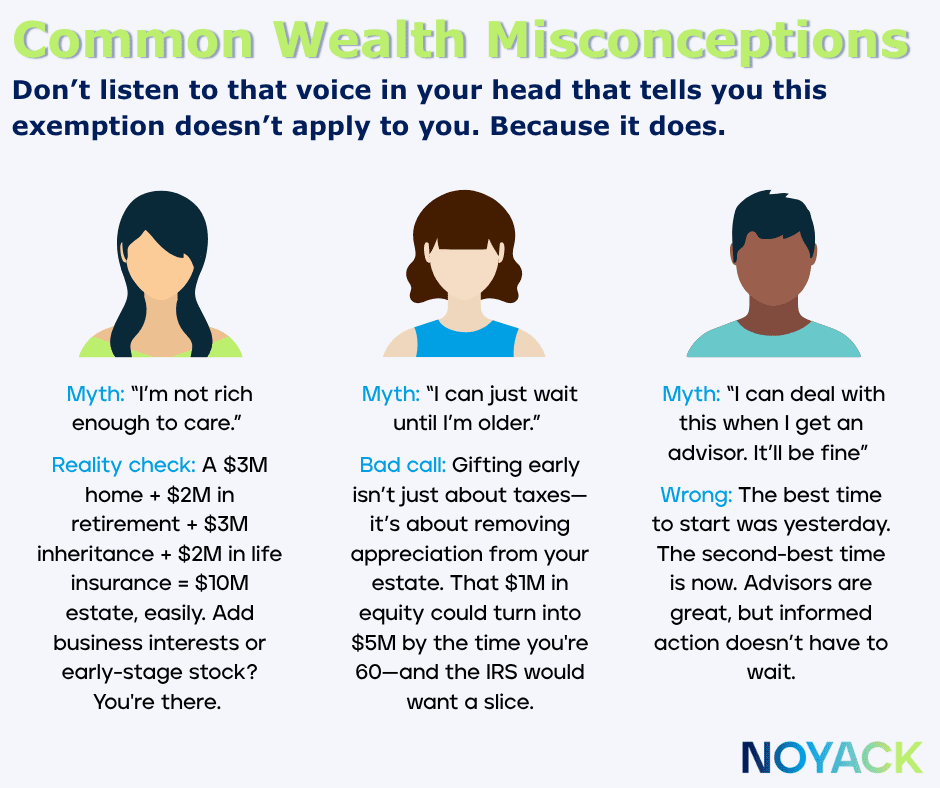

This isn’t just about trust fund families and billionaires in Boca Raton. It’s about you. This exemption changes the math on when, why, and how you should be planning your financial legacy. Let’s unpack what it really means for young high earners—and how to use it strategically.

Join us as we continue to dive into the OBBBA and what it means for you:

- Edition 1: We dove into the basics of the OBBBA and what it means for high earners on a macro level.

- Edition 2: We unlocked “Trump Accounts,” the new $1,000 head start for kids and how early, tax-free compounding can permanently alter a family tree.

- Today: Estate planning is no longer a retirement fantasy or a billionaire’s worry. It’s a concrete, actionable strategy for every Millennial and HENRY who plans to be rich—not just someday, but soon.

- Coming Up: Advanced Tax Playbook—business entities, solo 401(k)s, and side-hustle strategies to turn “not rich yet” into “future legend.”

💡 What’s Really Changed

The short version:

- The lifetime exemption was about to drop to $7 million in 2026. Now it’s locked at $15 million per person and indexed for inflation.

- GST (Generation Skipping Transfer) exemptions are now aligned, making multi-generational planning easier than ever.

- No more sunsets: the exemption doesn’t expire (unless Congress acts).

Who wins?

- Millennial HENRYs with high growth assets—equity, crypto, real estate, businesses.

- Families with future inheritances on the horizon.

- Young professionals who understand that “not rich yet” is a matter of time and compounding.

🏗️ Not Just for Billionaires: The Real-World Scenarios

There’s a compound advantage to using the exemption now. Estate planning is not just for retirement. With new asset classes (crypto, startups, IP), younger investors can amass substantial wealth quickly—and must plan accordingly.

Who should care?

Not just the ultra-rich. If you’ve quietly built any amount of wealth, or plan on starting your growth, you need to keep this policy in mind. Let’s take a look at three situations that could very well mirror your own one day.

1. Tech Exec with Early Equity

- Assets: $2.5M in pre-IPO shares (likely to 5X post-IPO). Any liquidity event could increase the value to $15M+.

- Threat: Asset growth pushes you into taxable estate territory

- Action: Transfer a chunk into an IDGT (Intentionally Defective Grantor Trust) now

- Result: All appreciation post-transfer is outside your taxable estate. The IRS only gets to tax what you gift today, not the future upside.

2. Crypto Founder in Volatile Markets

- Assets: $6M in Ethereum, Bitcoin, NFTs

- Threat: Value swings and illiquidity create tax and legacy headaches

- Action: Transfer $4M into a family LLC, gift discounted interests to heirs

- Result: Valuation discounts help you use less of your $15M exemption, and future volatility stays off your estate’s balance sheet.

3. Dual-Income Couple Building Fast

- Assets: $3.5M and growing via aggressive saving, investing, and RSUs

- Threat: Slow but steady appreciation creeps over the exemption threshold in 15–20 years

- Action: Automate $38K/year in exclusion gifts to kids, layer on SLATs (Spousal Lifetime Access Trusts) for flexibility

- Result: Decades of compounding and gifting keep the estate under the limit and your family in control.

Picture yourself 15 years from now. Your home could easily be worth $2M (Brooklyn, Austin, LA—take your pick). Thanks to early startup equity, your RSUs value at $1.5M. By investing smart your accounts have grown to $1M in brokerage funds and $250K in crypto. Maybe you receive a $1M inheritance from parents or grandparents. Your life insurance has a $2M death benefit.

You’re already at $7.75M — and that’s before another decade of growth. The average Millennial HENRY who executes on today’s opportunities will outgrow the “safe” zone by their mid-40s.

The IRS won’t wait for you to catch up.

🛠️ What Tools Do Modern Wealth-Builders Actually Use?

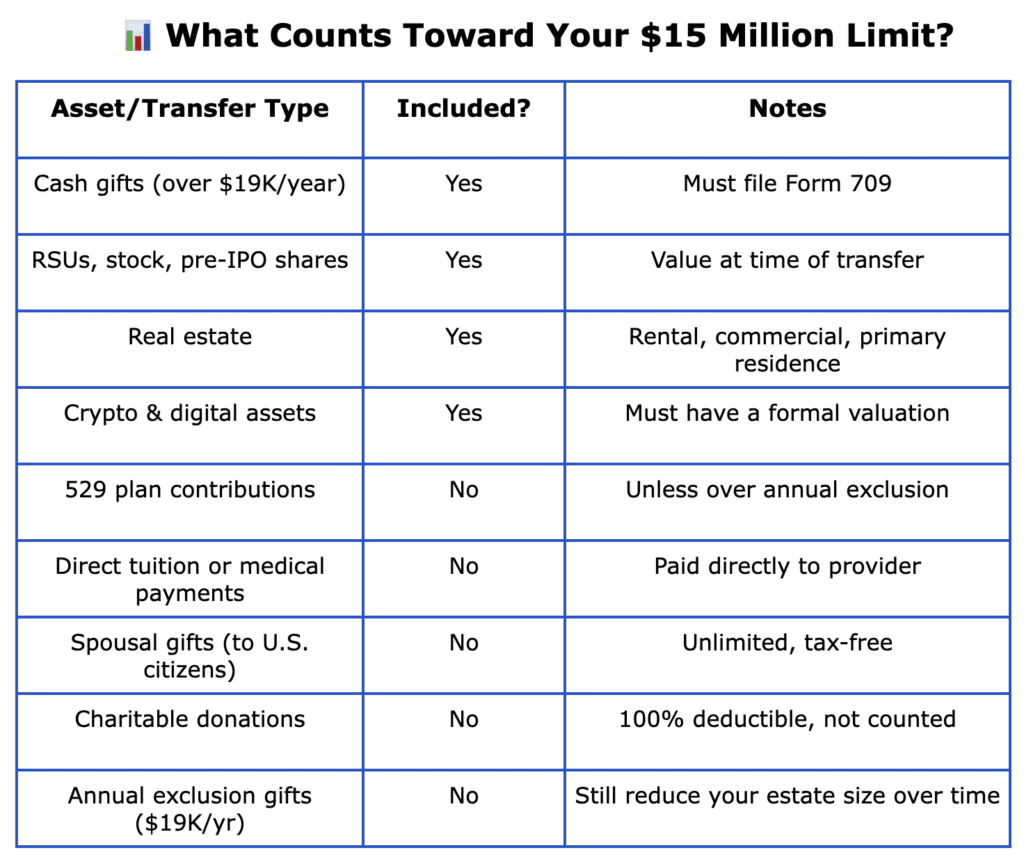

To keep your assets within the exemption limit, it’s imperative that you utilize all the tools at your disposal. Here are some major ones to keep on your radar.

IDGT (Intentionally Defective Grantor Trust)

- Freeze asset value now, transfer growth to heirs tax-free.

- You keep income rights—but future appreciation is shielded.

- Best for: Entrepreneurs, early investors, those with appreciating equity.

SLAT (Spousal Lifetime Access Trust)

- Great for couples: One spouse gifts to a trust benefiting the other.

- Gives flexibility: Allows income and distributions even while removing from estate.

- Best for: Married couples who want to retain access but plan for long-term control.

Dynasty Trust

- Builds a legacy: Assets grow for multiple generations, often GST-exempt.

- Most effective when funded early: Compound over 30+ years.

- Best for: Anyone thinking three generations ahead.

⚠️ What Happens If You Wait?

Delaying estate planning is more costly than you think. As your assets grow, your $15 million exemption shrinks in power. Suddenly, what felt like plenty of room turns into a near miss—with more wealth exposed to 40% estate tax.

State taxes aren’t waiting for you either. In high-tax states, unplanned estates can face a double hit: first from the IRS, then from local tax authorities.

And remember: Congress can—and often does—change the rules overnight. That “permanent” window can close retroactively, with little warning.

Worse yet, if your assets aren’t liquid, your heirs may be forced to sell at the wrong time just to pay the tax bill. What you built over decades could be dismantled in months.

There’s a compound advantage to using the exemption now:

- Remove Appreciation from Your Estate: Gifting early takes not just today’s value out of your estate, but all future growth, too.

- More Control with Less Tax Cost: Structures like family LLCs and IDGTs let you keep income streams or control while locking in gift values.

- No Pressure to “Spend” It All at Once: You can gift incrementally over years, using combinations of exemption, annual exclusions, and tax-free medical/tuition payments.

- Estate Planning ≠ Just for Retirement: With new asset classes (crypto, startups, IP), younger investors can amass substantial wealth quickly—and must plan accordingly.

Bottom line: Strategy isn’t just for the ultra-wealthy. It’s the only way to stay in control of your legacy, before someone else decides for you.

✅ Your 30-Day Action Blueprint

Wealth without a structure is fragile. The $15 million exemption is not just a tax break—it’s a design tool. If you’re a high earner in your 30s or 40s, you have the rare opportunity to:

- Use trusts to pre-fund future generations

- Keep your growing estate below the taxable threshold

- Build a charitable legacy through donor-advised funds

- Transfer control of your business or investments on your terms

Here’s how you can get on track within a single month.

Week 1: Inventory all assets—real estate, startup equity, RSUs, crypto, insurance, inheritance.

Week 2: Forecast the 10- and 20-year value of your estate. (Factor in growth rates. Be aggressive.)

Week 3: Choose the right strategy. Do you need a trust? Is it time to start annual exclusion gifting? Are you ready for a SLAT or IDGT?

Week 4: Engage your estate attorney and CPA. Set up legal structures. Prepare IRS Form 709. Fund your trust or execute the first gift. Schedule annual review points and plan to revisit as assets appreciate.

Remember: Every dollar of estate tax you avoid is another dollar that stays with your family, not with the IRS.

Final Word: The Time to Start Is Long Before You Think You “Need” To

You don’t wait until your portfolio hits $15 million to start estate planning. You use estate planning to avoid hitting the estate tax wall at all. The One Big Beautiful Bill just gave you more space and more time—but the window for strategic action is always closing. Markets change. Congress could change the rules again. Life changes, too.

Don’t let the IRS or Congress define your destiny. This exemption is the most powerful, flexible planning tool you’ll see for a generation. Claim it. Shape your wealth on your terms, not on someone else’s schedule.

Take control now, while the code is in your favor. Your future heirs—and your future peace of mind—will thank you. Stay tuned for next week where we dive deeper into more of the new tax changes coming in 2026.