TL;DR – What You’ll Learn Today

- The Reality Check: Why “Investment Risk” is a distraction for HENRYs (High Earners, Not Rich Yet) living paycheck to paycheck.

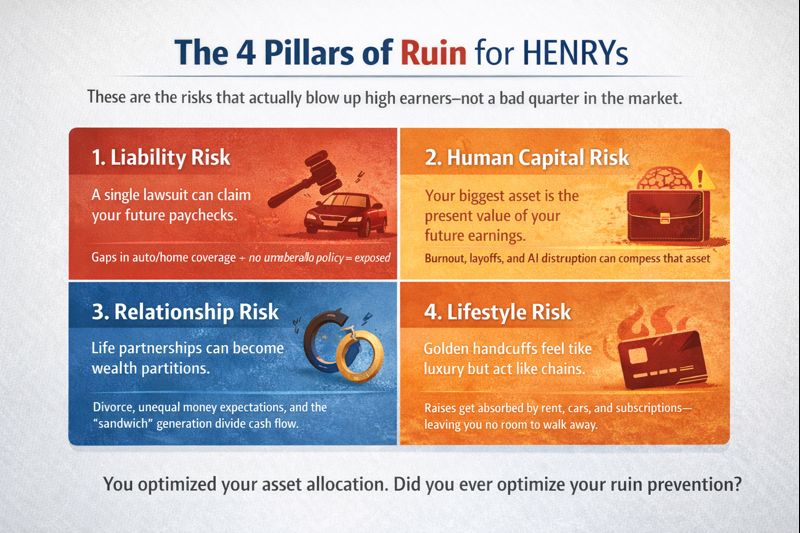

- The 4 Pillars of Ruin: How Liability, Human Capital, Relationship, and Lifestyle risks threaten your solvency more than a market crash.

- The Shield: Why Umbrella Insurance is the cheapest “Sleep Insurance” you can buy.

- The Engine: How to burnout-proof and AI-proof your primary income source.

- The Fix: A 90-Day “Fortress of Solitude” Roadmap to secure your financial foundation.

The Story: Meet “Jason,” The Paper Millionaire

Picture Jason. He’s 34, a Director of Product earning $325,000. He maxes out his 401(k), dabbles in crypto, and checks his Robinhood account daily. He feels wealthy. He feels smart.

One rainy Tuesday, Jason is driving his Tesla to a client meeting. He looks down at a text message for two seconds. Traffic stops. He doesn’t.

The resulting pileup injures a neurosurgeon in the car ahead. The lawsuit demands $2.5 million in damages.

Jason’s auto insurance policy caps at $500,000. He has no Umbrella Policy.

The court garnishes his wages for the next decade. His 401(k) is safe (ERISA protection), but his life is over. He is working for the plaintiff now. His high income is no longer his.

Jason spent years optimizing his asset allocation but zero minutes optimizing his Defense. He built a penthouse on a foundation of sand. Don’t be Jason.

Context: Why This Matters for Millennials in 2026

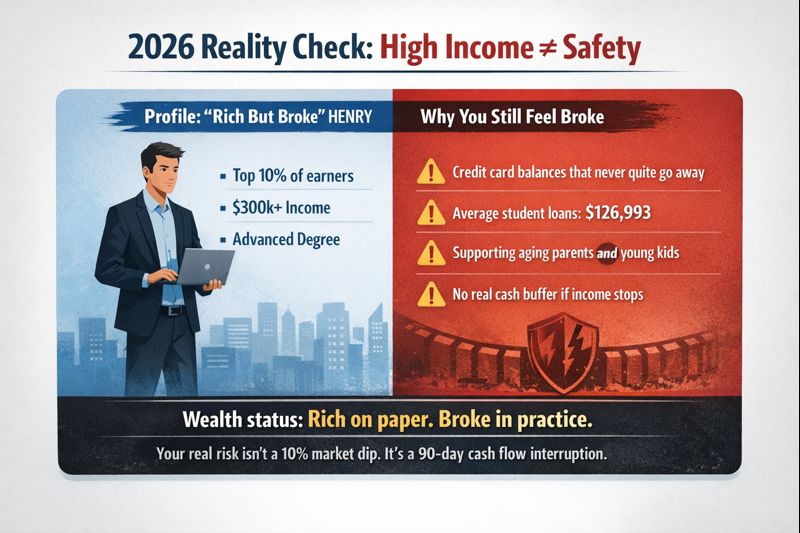

If you are a HENRY in 2026, you are likely living in a paradox. You are in the top 10% of earners, yet you likely feel broke. You are not imagining it.

- The “Rich but Broke” Reality: 60% of earners making over $300,000 annually struggle with credit card debt or living paycheck to paycheck.

- The Debt Drag: Advanced degree holders in our cohort carry an average of $126,993 in student loans.

- The “Sandwich” Squeeze: Nearly half of Millennials (46%) are now supporting both aging parents and young children, a “generational tax” that drains cash flow during prime compounding years.

Your greatest risk isn’t a 10% drop in the S&P 500. Your greatest risk is Cash Flow Interruption. If you stop working tomorrow—due to burnout, a layoff, or a lawsuit—how long do you last? For most, the answer is “90 days.” That is not wealth. That is precariousness.

Education: What Is Holistic Risk?

Most financial advice obsessively focuses on Investment Risk (market volatility). But for a high earner, investment risk is secondary. Real wealth defense requires managing Holistic Risk.

Holistic Risk is defined as the sum of existential threats that can wipe out your net worth regardless of investment performance.

Investment Risk vs. Holistic Risk: What’s the Difference?

| Feature | Investment Risk | Holistic (Life) Risk |

| Primary Threat | Stock market volatility, inflation. | Lawsuits, burnout, divorce, spending. |

| Potential Loss | 10% – 30% of portfolio value. | 100% of assets + future wages. |

| Probability | High frequency, low impact. | Low frequency, catastrophic impact. |

| Mitigation | Diversification (ETFs). | Insurance, Legal Structure, Savings. |

Here is the breakdown of the risks you are actually facing:

1. Liability Risk: The Deep Pocket Target

As you build wealth, you put a target on your back. In a litigious society, high income equals “high payout potential.”

- The Gap: Standard auto/home policies often cap at $300k or $500k.

- The Threat: A single lawsuit can exceed these limits, putting your future wages at risk through garnishment.

2. Human Capital Risk: The AI & Burnout Collision

Your biggest asset isn’t your portfolio; it’s the present value of your future earnings.

- The AI Threat: Generative AI is targeting “knowledge work”—finance, law, coding—threatening income compression.

- The Burnout Tax: 74% of Gen Z and Millennials report moderate to high burnout. Burnout isn’t just a feeling; it’s a financial liability that causes career gaps and income loss.

3. Relationship Risk: The Wealth Divider

- Divorce Economics: Divorce often reduces women’s household income by 41% and men’s by 23%.

- The Sandwich: Supporting parents and kids simultaneously is the new normal, yet 75% of the “sandwich generation” report it harms their financial goals.

4. Lifestyle Risk: The Golden Handcuffs

Lifestyle Creep occurs when discretionary consumption rises in proportion to income increases, preventing wealth accumulation.

- The Trap: You get a raise, so you lease a better car. You move to a “luxury” building.

- The Result: You make $400k but have a “burn rate” of $20k/month. You cannot quit your job. You are a prisoner of your own comfort.

Opportunities: The Benefits of a Fortress

When you address these risks, you don’t just get safety; you get Freedom.

- The “Soft Life” Paradox: True “Soft Life” isn’t about luxury goods; it’s about autonomy.

- Sleep Insurance: An Umbrella Policy costs ~$150–$300/year for $1M in coverage. For the price of one nice dinner, you become invincible to most liability claims.

- Antifragility: By diversifying your skills and lowering your burn rate, you become immune to toxic bosses and economic downturns.

Risks: The Mentor’s Guardrails

Is it safe to ignore these pillars? Absolutely not.

- Is Umbrella Insurance necessary for me? If your net worth + future earnings > $500k, yes. You are underinsured without it.

- Can’t I just save my way out of liability? No. A $2M lawsuit wipes out 20 years of saving in one gavel strike. Insurance transfers that risk for pennies on the dollar.

Blueprint Placement: The Framework Layer

This strategy sits squarely in the Framework Layer of your Millennial Wealth Blueprint.

Just as NOYACK’s REIT strategy mitigates market risk through diversification, your personal Risk Fortress mitigates life risk through structure. You cannot build the “Growth” layer (Investments) until this “Framework” layer is secure.

Roadmap: Your 90-Day “Fortress” Plan

Stop worrying about the Fed. Control your perimeter.

Weeks 1–2: The Shield (Liability)

- Call your insurance broker. Ask for a quote on a $1 Million (or $2M) Umbrella Policy.

- Requirement: You may need to raise your auto/home liability limits to $300k/$500k first.

- Cost: ~$300/year. Value: Priceless.

Weeks 3–6: The Moat (Liquidity)

- Audit your “Burn Rate.” Identify one recurring “Lifestyle Creep” expense. Kill it.

- Redirect that cash to your Freedom Fund (High-Yield Savings).

- Goal: 6 months of lean expenses. This is your “Walk Away” money.

Weeks 7–12: The Engine (Human Capital)

- Assess your job security. Is your role AI-vulnerable?

- Start one “Upskilling” initiative (AI certification, leadership course).

- Goal: Make your skills transferable and diversified.

Is Your Wealth Fortress Built on Sand?

At NOYACK, we don’t just teach you how to pick private equity winners. We teach you how to keep what you earn. From tax strategies to asset protection, the Noyack Investing Club is your architect for a bulletproof financial life.

Closing Reflection

Risk isn’t just a number in a spreadsheet. It’s the gap between what you expect to happen and what actually happens.

The investment industry wants you to focus on the stock market because that’s where they make their fees. But as a Mentor, I’m telling you: the market isn’t your biggest enemy. Life is.

Building a Fortress isn’t pessimistic. It’s the ultimate act of optimism. It says, “I value my future freedom enough to defend it today.”

Once you have your Shield (Insurance), your Moat (Savings), and your Engine (Skills) secured, then you can go out and take massive investment risks with the Liberator’s confidence.

You don’t build wealth by accident. You build it by removing the possibility of ruin.