The One Big Beautiful Bill, signed into law on July 4, 2025, isn’t just another tax reform—it’s a full-blown strategy guide for anyone living the remote work lifestyle. If you’re a Millennial HENRY (High Earner, Not Rich Yet) juggling a freelance business, consulting gig, side hustle, or full-time remote job, this bill could mean thousands in your pocket—if you play it smart.

The legislation rewrites the tax playbook for the self-employed and location-independent. With simplified rules for 1099 reporting, boosted home office deductions, and powerful write-offs for equipment, remote workers now have more opportunity—and less paperwork—than ever before. And it gets better: a permanent 20% QBI deduction (rising to 23% in 2026), new tip and overtime income exclusions, and expanded Foreign Earned Income Exclusions (FEIE) all point to one thing:

Your “non-traditional” lifestyle is officially a financial edge.

The Biggest Change (And Why It Matters)

The centerpiece is the Qualified Business Income deduction—the QBI. You may have used it before, but here’s what’s new: it’s now permanent, and it’s been enhanced.

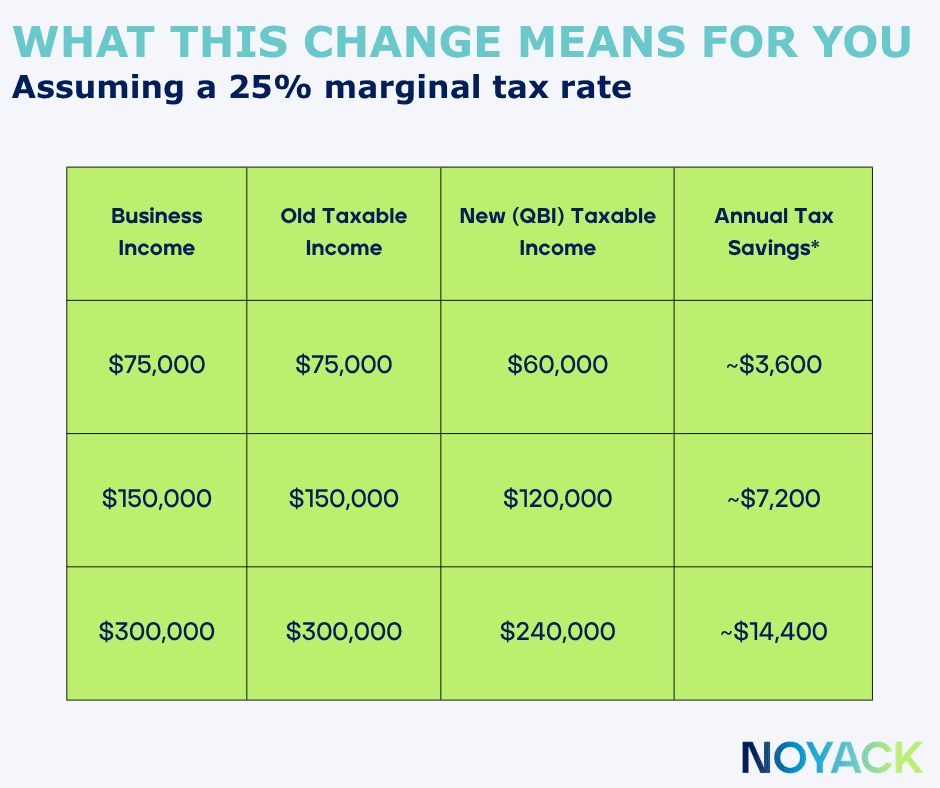

If you earn income through a sole proprietorship, LLC, partnership, or S-Corp, you can deduct 20% of your qualified business income from your taxable income. So if you net $100,000 from your business, the IRS only sees $80,000 of it for tax purposes.

But the new law goes further. Even if you’re just starting out—earning $1,000 from a side project, freelance work, or small business—you’ll get a minimum deduction of $400. No income too modest. No operation too scrappy.

And starting in 2026? That 20% jumps to 23%.

This isn’t just tax relief. This is the federal government acknowledging that your way of working—diversified, location-independent, entrepreneurial—isn’t alternative anymore. It’s foundational to how the economy actually works.

The legislation also simplified the administrative burden that’s been weighing down independent workers. Starting in 2026, you’ll only need to issue 1099-NEC forms if you pay someone $2,000 or more (up from $600). Payment platforms will only send you 1099-K forms if you exceed $20,000 and 200 transactions—rolling back the widely despised $600 threshold.

Less paperwork. Fewer forms. More time to focus on what actually matters: building your business and your wealth.

The New Contractor Reality: Less Paperwork, More Profit

One of the biggest updates: The threshold for issuing 1099-NEC forms rises to $2,000 (up from $600), and 1099-Ks now only apply once you hit $20,000 and 200+ transactions. This is a game-changer for freelancers, consultants, and digital creators who work with multiple small clients or platforms.

Why it matters: Less paperwork. More flexibility. Lower audit risk. If you’re earning side income, you’ll still need to report it, but without the flood of forms that used to bog down January.

Pro tip: Use this administrative “quiet time” to restructure your side hustle or business. Set up the LLC. Build a legit brand. Now’s your chance to scale without drowning in tax prep.

Home Office Deduction 2.0: Maximize Your Remote Work ROI

Your home isn’t just your office—it’s a tax-saving machine. Under the new law:

- The simplified deduction increases to $6/sq ft, up to 300 sq ft ($1,800 max).

- Bonus depreciation is back at 100% for 2025 purchases.

- Section 179 limits double to $2.5M, allowing for massive equipment write-offs.

Whether you’re upgrading your video setup, buying a standing desk, or turning the guest room into a studio, those expenses are now fully deductible in the same tax year. Remote workers with flexible income streams can now structure smarter—and keep more.

Remote Work Abroad: The Digital Nomad Tax Trifecta

With the Foreign Earned Income Exclusion (FEIE) increasing to $130,000, working abroad isn’t just a lifestyle upgrade—it’s a tax advantage. Qualify via:

- Physical Presence Test (330+ days outside the U.S.)

- Bona Fide Residency (establish tax home in another country)

Combine this with the $40,000 SALT deduction cap (up from $10K), and you’ve got serious incentive to base yourself in a low-tax country—or to strategically move within the U.S.

Caution for state-taxed nomads: Some states, like New York and Pennsylvania, may still tax you based on your employer’s location. Know your nexus rules before you bounce.

The Complete Implementation Framework

Rather than rushing into changes, let’s build a thoughtful approach that respects the complexity of your existing financial life. You don’t need to implement everything at once. The QBI deduction is permanent—that’s the gift. But your opportunity to use it strategically this year requires some decisions.

If you’ve been operating as a sole proprietor and earning significant income, schedule a consultation with a CPA who understands business entity elections. The S-Corp decision alone could save you thousands annually. If you’ve been treating your home office casually, get serious about the space and expense tracking. The simplified deduction is easier, but actual expense tracking might save you more.

If you’ve been putting off business purchases, this is your year. The combination of bonus depreciation and the QBI deduction creates powerful incentives to invest in your business infrastructure. Most importantly, start thinking of yourself as a business owner, not just someone with multiple income streams. That mindset shift—backed by the right structure and strategy—is what turns high earning into wealth building.

Phase One: Foundation (Weeks 1-2)

Week 1: Assessment

- Measure your home office space—whether you’re using the simplified deduction ($6 per square foot, up to 300 square feet) or tracking actual expenses, you need baseline numbers

- List all equipment and technology purchased since January 2025

- Review your income streams: W-2, 1099, direct client payments, platform earnings

Week 2: Organization

- Open a dedicated business checking account if you haven’t already—this creates clean records that support your deductions

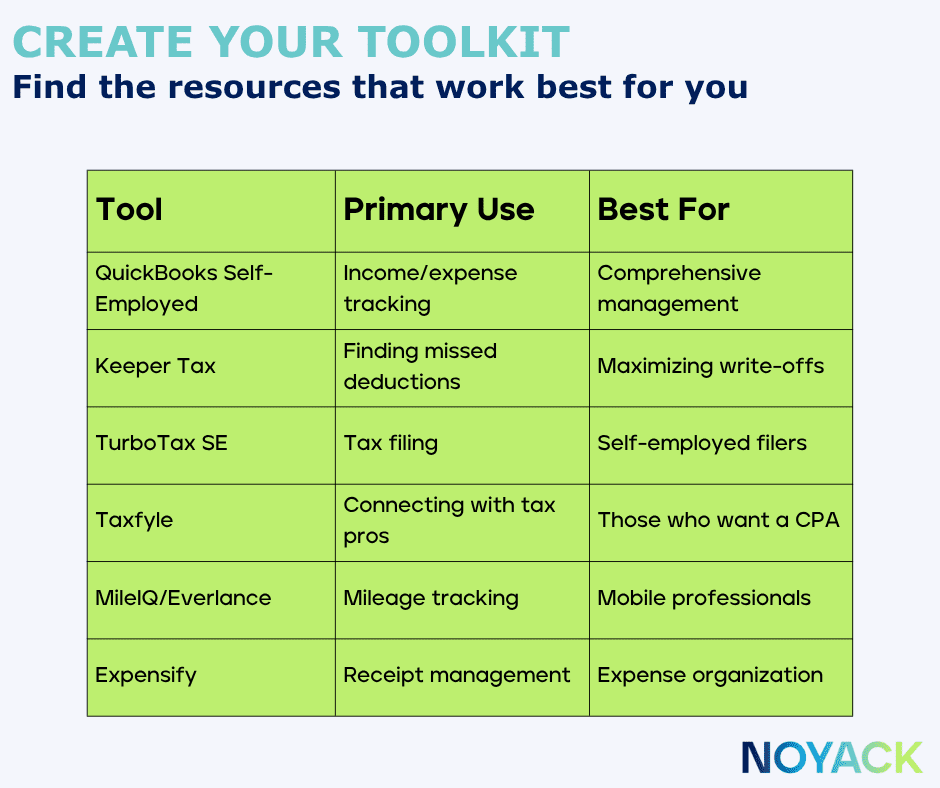

- Choose accounting software: QuickBooks Self-Employed for comprehensive tracking, Keeper for finding overlooked deductions, or Xero for growing businesses

- Start logging business miles and expenses immediately

Phase Two: Structure (Weeks 3-4)

Week 3: Strategic Investment

This is where business entity decisions become important. If you’re earning under $75,000 in business income, a single-member LLC likely serves you well—simple, flexible, and QBI-eligible.

But if you’re consistently above $80,000 in business income, an S-Corporation election becomes compelling. You’ll pay yourself a reasonable salary (subject to payroll taxes), but the remaining profit can be distributed to you without self-employment tax—while still qualifying for the QBI deduction.

The new law also brought back 100% bonus depreciation through 2029. That laptop you’ve been eyeing? The ergonomic desk setup? The professional camera for your content business? All of it can be deducted immediately rather than depreciated over several years.

Week 4: Professional Guidance

Book a session with a CPA who understands remote work and hybrid income. This isn’t about compliance—it’s about strategy. Review your state tax exposure, plan quarterly payments based on your new lower taxable income, and get clarity on entity structure decisions.

Integration with Your Existing Financial Life

Here’s where most tax advice falls short: it treats these deductions in isolation rather than as part of your broader financial picture.

If you’re already maxing out a 401(k), the QBI deduction creates additional tax-advantaged space. Consider a solo 401(k) for your business income—you can contribute as both employee and employer, potentially sheltering significant additional income.

If you’re holding stock options or restricted stock, the timing of your business income becomes more important. The QBI deduction can help offset the tax impact of exercising options or vesting events.

If you’re planning to buy real estate, the additional tax savings from QBI can improve your debt-to-income ratios and available cash for down payments. But coordinate the timing—you don’t want to trigger AMT or push yourself into higher tax brackets inadvertently.

Risk Management: What to Watch

Every powerful tax strategy comes with compliance requirements and potential pitfalls.

The IRS has been increasingly focused on QBI deduction claims, particularly around what constitutes “reasonable compensation” for S-Corp owners. If you’re paying yourself $30,000 as an S-Corp owner but distributing $150,000, expect scrutiny.

Documentation becomes critical. Your home office needs to be used regularly and exclusively for business. Mixed-use spaces can trigger challenges. Keep photos, measurements, and expense records organized.

State tax authorities are also paying attention to remote workers. If you’re claiming residency in a no-tax state while working for a company based in a high-tax state, make sure you understand the rules and can document your position.

The Quarterly Review Process

Since many of these strategies require ongoing attention, build a quarterly review framework:

Q1: Assess prior year performance, adjust withholding or estimated payments, plan major purchases or entity changes

Q2: Mid-year income projection, adjust business structure if needed, review state tax exposure for any location changes

Q3: Final planning opportunities, equipment purchases for bonus depreciation, retirement contribution planning

Q4: Year-end tax moves, documentation organization, planning for next year’s strategies

This systematic approach turns overwhelming complexity into manageable progress. The key is building systems that work consistently rather than scrambling each April.

Building Your Wealth Beyond the Deductions

The QBI deduction is powerful, but it’s most valuable when it’s part of a broader wealth-building strategy rather than an isolated tax move.

Use the money you’re saving to build assets that compound over time. That might mean investing in index funds, real estate, or even your own business infrastructure. The key is not letting tax savings leak into lifestyle inflation.

Consider the stability this permanent deduction provides for long-term planning. You can now build a business knowing that this tax advantage will be there year after year. That predictability lets you invest more confidently in growth, equipment, and even hiring help.

For many HENRYs, the path from high earner to actually wealthy requires building multiple income streams and optimizing the tax treatment of each. The enhanced QBI deduction, combined with the simplified reporting requirements, makes this more achievable than it’s ever been.

The Longer View

This legislation represents something larger than tax policy. It’s recognition that the future of work is already here—distributed, flexible, entrepreneurial. The government isn’t just accommodating this reality; it’s actively encouraging it.

You’re not just adapting to changing times. You’re part of defining what professional success looks like for your generation and beyond. The tax code now explicitly supports that vision.

Wealth doesn’t arrive all at once. It builds slowly, through decisions that compound over time. The permanent QBI deduction is one of those decisions—not flashy, but foundational.

Use it thoughtfully. Build with it strategically. And remember that the goal isn’t just to save on taxes this year, but to create the kind of financial foundation that supports the life and work you actually want.

That’s what this is really about: not just keeping more of what you earn, but having the freedom and security to keep earning on your own terms.