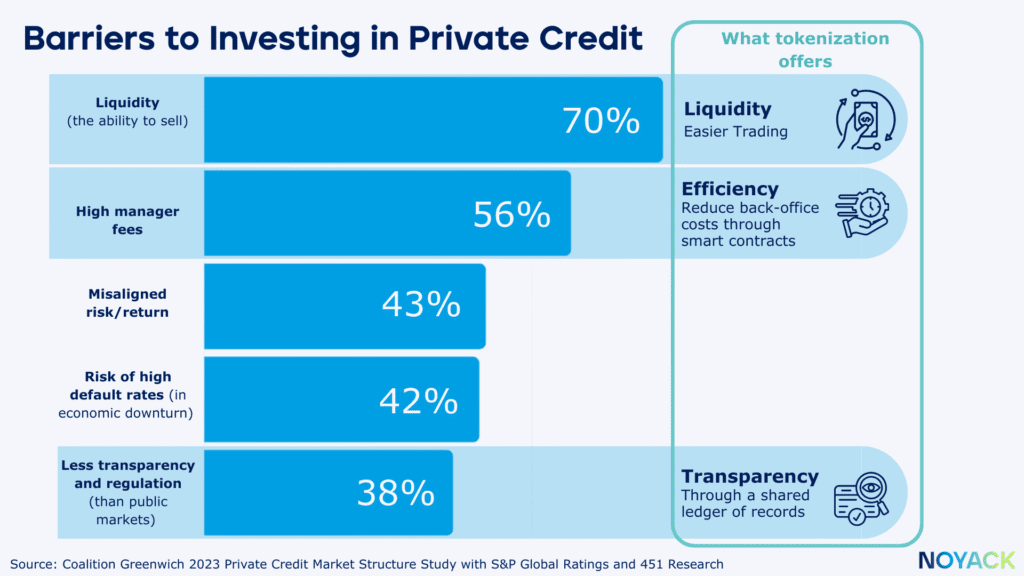

For decades, private credit was the locked room of finance—reserved for pensions, hedge funds, and the top of the capital food chain. Now, the lock is being picked by technology. Tokenization isn’t a headline gimmick—it’s a structural rebuild of how investors access, track, and manage real-world assets.

Here’s what matters: minimums are dropping from six figures to as little as $25, settlement windows are shrinking from months to T+2 days, and recordkeeping is finally moving out of email chains into auditable digital ledgers. The loans themselves haven’t changed—but the rails they run on just did.

This edition breaks down what tokenized private credit means for high earners and wealth builders:

- How blockchain is lowering barriers to entry.

- Why 2025 marks the turning point from pilot projects to live retail products.

- Where tokenized credit fits inside your portfolio—and what guardrails you need before diving in.

By the end, you’ll see that this isn’t about chasing hype. It’s about gaining access, yield, and control in ways that were impossible five years ago—without abandoning the fundamentals of sound credit investing.

TL;DR Tokenized private credit is moving from pilot to practical. You can now start with tiny minimums (as low as $25), see faster processing (often T+2 redemption windows), and enjoy cleaner records—all without changing the underlying loan economics. Treat it as a small alternative-income sleeve inside your portfolio. Respect the risks (liquidity, credit, fees, tech, rules), run a small sandbox test, and scale only if reality matches the brochure.

Private Credit, in Plain English (Before You Tokenize It)

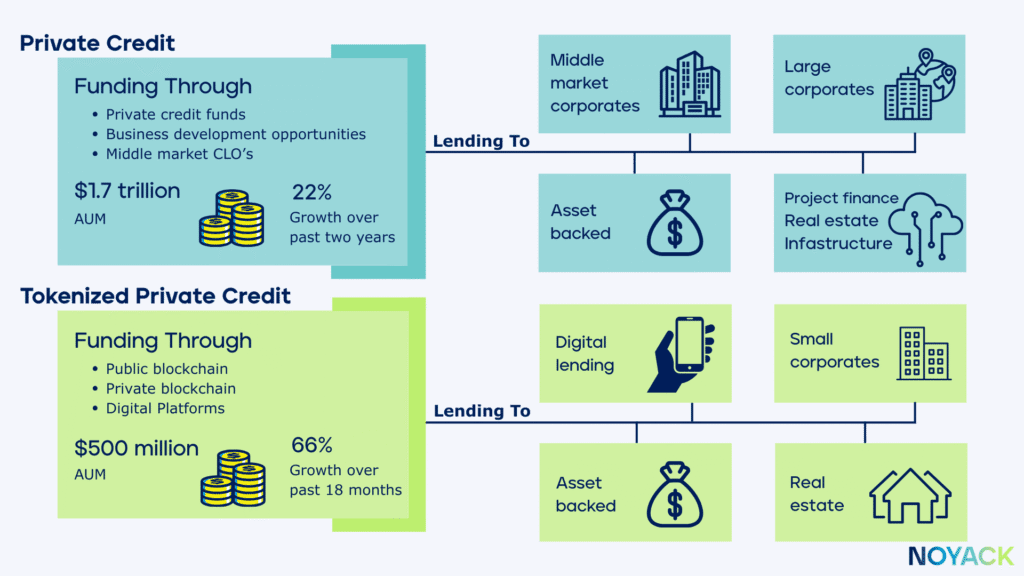

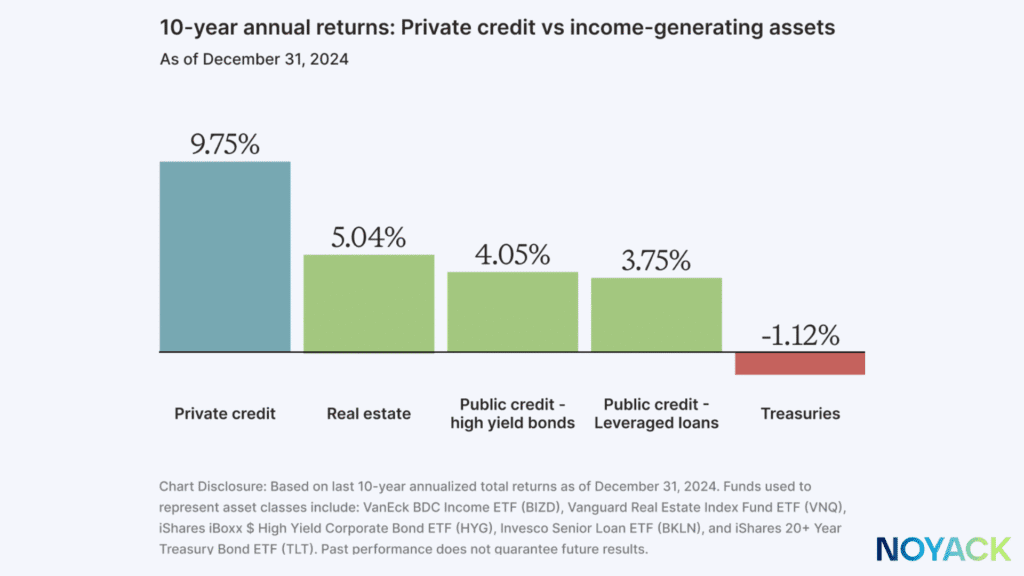

Private credit is non-bank lending: investors (via a professional manager) fund loans to mid-market businesses, real-estate projects, or specialty finance companies that want flexible terms and fast decisions. It often pays more than public bonds because you accept less liquidity and more underwriting complexity.

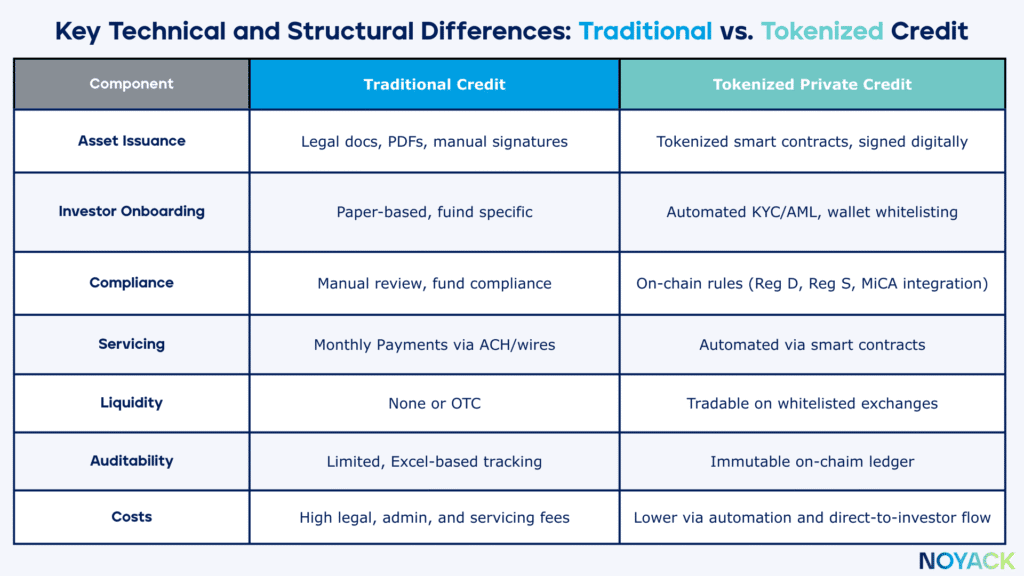

Tokenization doesn’t change the loans; it changes how you own and administer your slice. Think cleaner ledger, fewer manual emails, faster processing windows, and eligibility rules enforced by code.

How Private Credit Tokenization Works

Private credit just got a new passport: blockchain. That doesn’t mean the rules of credit disappear—it means access, efficiency, and transparency are finally catching up to demand. Here’s what you need to know before testing the waters.

- Digitized ownership: Your fund interest is represented as a token on a reputable chain. That token is your auditable, tamper-resistant receipt.

- Automated workflows: Smart contracts can enforce eligibility, route distributions, and process transfers/redemptions within set rules and windows.

- Cleaner records: On-chain ledgers reduce reconciliation headaches and make audits/cap tables easier.

- Optional liquidity: Some programs offer faster processing (e.g., T+2 redemptions) and controlled secondary venues. It’s improved liquidity—not the click-to-sell liquidity of public stocks.

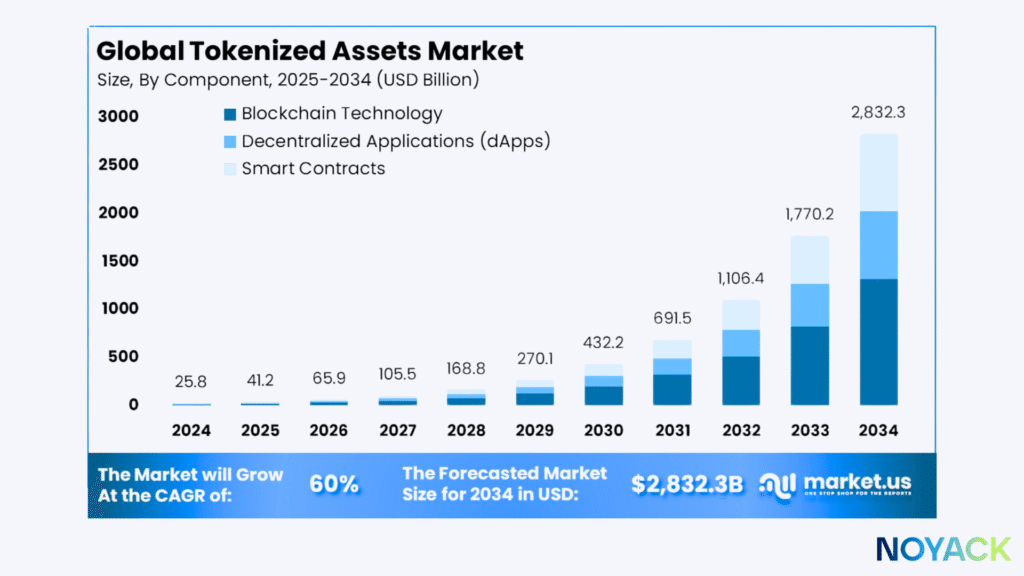

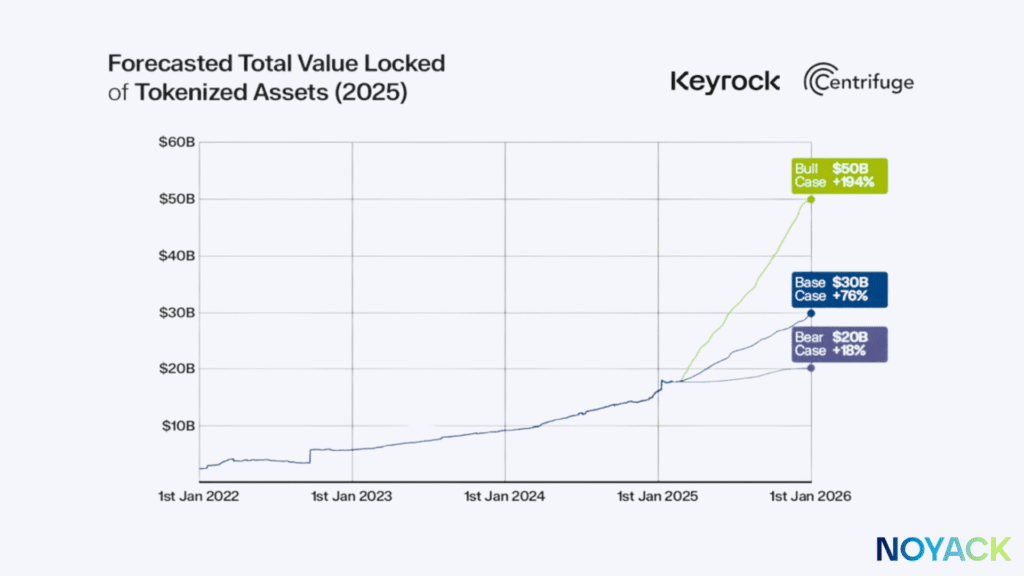

So why is 2025 the turning point? Three forces are converging at once—access, infrastructure, and investor behavior. Together, they make tokenized private credit less of a theory and more of a usable tool.

- Live retail options: Some tokenized private-credit funds publish clear, low minimums and predictable subscription/redemption windows.

- Operational maturity: Public-chain rails and compliance tooling make onboarding and record-keeping feel like a modern investing app.

- Investor fit: HENRYs value time efficiency, transparent workflows, and evidence-based decisions. Tokenization finally lets you run a small, controlled pilot instead of leaping based on a PDF.

Benefits of Tokenized Private Credit (and Their Limits)

So what does tokenization actually deliver for you as an investor? Four advantages stand out—each one practical, measurable, and already showing up in live funds:

- Access you can actually use: Minimums that start at $25–$250 let you run a live pilot with tuition-sized dollars.

- Operational clarity: Automated record-keeping and scheduled windows reduce back-and-forth, errors, and “where’s that PDF?” stress.

- Income potential: Diversified private-credit strategies often target upper single-digit to low-teens yields before fees. Your net depends on manager skill, defaults, and total costs.

- Composability: As tokenized Treasuries and other real-world assets snap into custody and payment rails, private-credit tokens inherit better on/off-ramps and cleaner workflows.

Tokenization can improve access and efficiency, but it can’t repeal the laws of credit, liquidity, or regulation. The guardrails still matter—and here are the ones to check first:

- Liquidity illusion: “Daily” usually means daily processing, not a standing buyer at your price. Plan to hold through a full cycle.

- It’s still credit: Borrowers can miss payments; managers can misjudge. Diversify managers, strategies, and rails.

- Fee stack matters: Fund expenses + platform fees + any transaction/network costs can erode returns—evaluate the net number you keep.

- Tech risk is real: Code can have bugs; platforms can change policies; keys can be lost. Keep your setup simple and your provider list reputable.

- Rules still apply: Tokenized shares are securities. Eligibility, disclosures, and transfer rules matter—read them.

Your 40 Minute Access Roadmap

Tokenized private credit access means you can now start with as little as $25 instead of six figures, using platforms that handle custody, eligibility, and distributions for you. The loans themselves haven’t changed—but the rails have, making it possible to run small, low-stakes pilots that teach you the process without risking real damage.

1) Set Your Entry Point (10 minutes)

Decide how much you’re willing to risk on a first test. For tokenized private credit, that might mean $25–$250—small enough to learn, large enough to feel real. Write down a maximum you won’t exceed in the first six months.

2) Choose the On-Ramp (10 minutes)

Pick 2–3 tokenized platforms or funds that state their terms in plain English. Focus on clear minimums, redemption windows, and fee structures. If eligibility or liquidity language feels vague, move on.

3) Test the Rails (10 minutes)

Fund a pilot amount. Receive your token (platform custody is fine for beginners). Note your expected distribution date and redemption options. Treat it like tuition: you’re paying to understand the process.

4) Record & Reflect (10 minutes)

Write down what you expect to happen—when money leaves, when it returns, and what fees apply. Schedule a 90-day review titled, “Did this match the brochure?” If the answer is yes, you’ve built a foundation to scale responsibly.

Personal Note from CJ

When I first stepped into a CIO role in the late ’90s, we didn’t pick private credit because it sounded clever. We picked it because a third-generation family business needed a bridge and the bank said no. Equity would have cost them control; a well-structured mezz loan could buy them time. We wrote a modest deal with real collateral, real covenants, and a small equity kicker so interests aligned. It wasn’t flashy. It paid on time. The family kept the company. Lesson one: done right, private credit is the adult in the room—steady cash in, clear rules, and a plan for bad weather.

Fast-forward to 2008. Markets screamed; pressure to do something heroic was everywhere. We did the opposite. We redirected new dollars into senior-secured, first-lien loans with tighter covenants and bigger cushions. We sized positions as if liquidity might vanish—because it did. Checks still came in. We didn’t feel brave. We felt prepared. Through the 2010s and the pandemic, we used asset-backed and specialty finance to smooth cash flows for real families: receivables lines, equipment loans, real-estate debt tied to durable income. Same objective every time: get paid to be patient, and make sure both the business and our recourse were real.

Three rules endured. (1) Never confuse yield with safety. If we couldn’t explain—in one paragraph—how we get repaid in a normal year and a rough patch, we passed. (2) Paperwork is the strategy. Covenants, collateral, and information rights aren’t decoration; they’re the levers that protect the downside. (3) Position sizing is a risk tool. Start small, let it grow when underwriting is strong, and trim when standards get sloppy. Today’s tokenized wrappers don’t change those fundamentals; they simply lower the step-in cost and clean up the plumbing. Families still want the same thing they wanted in 1999: income you can plan around, risk you can describe plainly, and terms you can live with on a bad day.

FAQ: Tokenized Private Credit

Do I need to be “into crypto” to do this?

No. Think of blockchain as the recordkeeper under the hood. Many platforms custody tokens for you. If you self-custody later, keep the setup simple and your recovery phrase backed up (twice).

Is this safe for a first alternative investment?

Safer than chasing speculative coins, but not risk-free. You’re taking credit, liquidity, fee, and platform/tech risks. That’s why we advocate a tiny first step and a full end-to-end test.

Does “daily liquidity” mean I can exit any day at my price?

Treat “daily” as daily processing windows, not a guaranteed buyer at NAV. Secondary markets can be thin. Plan to hold through a full cycle.

What kind of return should I expect?

Strategy-dependent, but many diversified approaches aim for upper single-digit to low-teens before fees. Focus on your net after all expenses and compare to public options with similar risk.

Where should I hold this for taxes?

If you can, use tax-advantaged accounts (IRA/401(k)/HSA where appropriate). In taxable accounts, track all distributions and any token sales for gains/losses.

How do I judge platform credibility?

Look for plain-English disclosures, transparent fees, clear eligibility and liquidity rules, reputable partners, and responsive support. If the vibe is “just trust us,” don’t.