The Cloud Isn’t Vapor — It’s Infrastructure. AI doesn’t run on magic. It runs on concrete, copper, cooling, power contracts, and fiber.

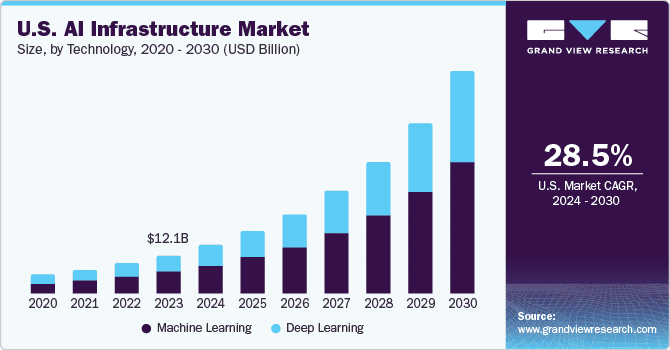

The old data center model is fading. Capital is chasing AI-ready facilities and powered land. As AI shifts from chat to action, compute is moving closer to cities — toward the edge.

You don’t have to bet on the next breakout app or chip stock. You can invest in the factory floor of AI.

But first, there are two non-negotiables:

1. Verifiable metrics. 2. Audited reporting.

If a manager can’t provide both, it’s a hard pass.

This edition gives you:

• A 20-minute AI infra whitepaper reading stack

• A hard line on transparency

• A 10-point fund scorecard

• A suitability guide (growth, income, blend)

Because real infrastructure deserves real diligence.

The Story: The “Invisible” Landlord

Meet Sarah. She’s a smart HENRY (high earner, not rich yet). In 2023, she bought a big AI stock because she saw the wave early. It worked—until it didn’t feel as clean anymore. Valuations got loud. Competition got crowded. The “easy money” vibe faded.

Then she realized something important: the biggest winners in the AI buildout aren’t only the companies building models. They’re the people buying the physical layer underneath the models.

While everyone watched the chatbot, institutional capital quietly bought:

- the powered land

- the cooling infrastructure

- the industrial shells

- the connectivity corridors

- the contracts

Sarah owns the race car. Now she wants to own the racetrack. That’s the Concrete Cloud.

What “AI Infrastructure” Actually Means (Plain English)

AI doesn’t run on dreams. It runs on four physical inputs — and together, they’re what make up real infrastructure. Think of it like a factory. If an AI fund can’t explain how it controls or solves for these, it’s not an infrastructure play. It’s just a story.

1. Power — the Gatekeeper

Power isn’t just a line item. It’s the single biggest determinant of AI capacity.

- Example: NVIDIA H100 chips need ~700 watts each. Multiply that by tens of thousands and you’re looking at industrial-scale demand.

- Real Infra Play: A data center with a long-term, fixed-rate power contract near a substation or renewable source.

2. Cooling — the Constraint

AI chips run hot. Without cooling, compute throttles or fails.

- Example: High-performance liquid cooling (vs traditional air cooling) is now essential for dense compute clusters.

- Real Infra Play: Facilities with proprietary liquid cooling or direct-to-chip systems — and optimized water usage rights.

3. Connectivity — the Lifeline

Low-latency fiber routes and interconnects enable real-time inference and data transfer.

- Example: A GPU cluster is only as fast as its weakest link — slow fiber kills performance.

- Real Infra Play: Edge data centers sitting directly on major fiber backbones or with private dark fiber networks.

4. Space — the Canvas

Not just any warehouse will do. AI facilities require zoning, high ceilings, power-dense floorplans, and future expansion potential.

- Example: “Powered land” with entitlements in place can command premiums.

- Real Infra Play: Developers who control land near metro cores and have scalable designs ready to go.

If you’re evaluating an AI fund, start here. If they can’t walk you through how they’re solving for all four — power, cooling, connectivity, and space — you’re not looking at infrastructure. You’re looking at narrative risk.

The 3 Pillars of AI Real Estate

The term “cloud computing” might be the most profitable metaphor in tech history — because it sounds light, limitless, and clean.

But in reality, the internet is heavy, hot, and hungry. AI only works because physical infrastructure supports it — and investors who understand that physical layer will own the long-term upside.

Here’s how real estate is being redefined in the AI era:

1. The AI Factory

Modern AI chips (like NVIDIA H100s) generate intense heat and require specialized environments. These aren’t just “data centers with AC” — they’re industrial-grade compute factories.

Why it matters:

- AI facilities now require liquid cooling, not just fans.

- Power density is 5–10x that of older data centers.

- Operational tolerances are tight — downtime or thermal throttling ruins model performance.

- Many legacy data centers are functionally obsolete without major retrofits.

Investor takeaway:

Capital is flowing into new, purpose-built facilities — AI factories — that meet these standards. Older buildings risk becoming a digital rust belt.

2. Powered Land

In many regions, the bottleneck isn’t servers or chips — it’s grid access. “Powered land” means real estate with a clear, contracted path to large-scale electricity. That’s what enables scale.

Why it matters:

- Power queues can take 2–5 years.

- Grid upgrades are slow and political.

- Without power, even the best-located data center can’t grow.

Investor takeaway:

Owning land with locked-in megawatts is now a massive competitive advantage. Power isn’t boring — it’s the toll booth on the AI superhighway.

3. The Edge

Training large models happens in giant campuses — often in rural areas. But inference — when AI responds in real-time — is a different story. It needs to happen fast and close to users.

Why it matters:

- Agentic AI (AI that acts, not just chats) is latency-sensitive.

- Tasks like fraud detection, smart logistics, and real-time personalization can’t wait for roundtrips to Iowa.

- That’s why edge data centers are popping up inside metro areas — to enable AI that works in real time.

Investor takeaway:

The edge is where AI becomes operational. Proximity becomes performance — and that makes urban infrastructure a core growth asset class.

AI real estate isn’t just about buildings. It’s about control over bottlenecks: power, cooling, latency, and land. The winners will be those who understand that compute is physical — and capital flows to those who solve its constraints.

How You Can Play the Biggest Trend in Tech

You don’t need $50M and a CIO to invest in the future of AI. You need a clear allocation strategy.

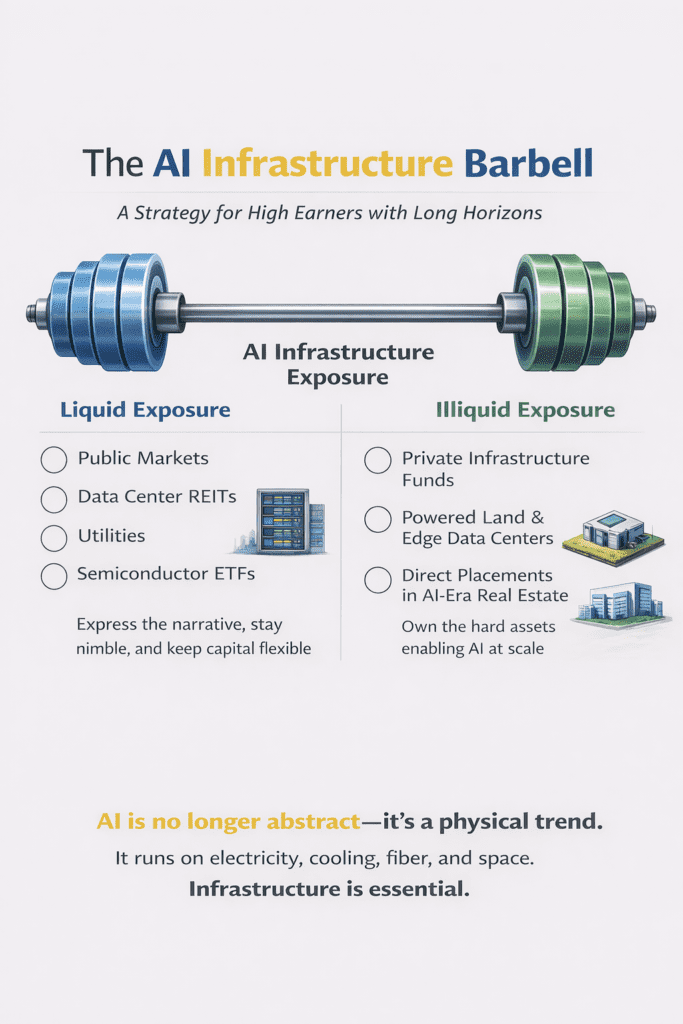

One framework that works — especially for high earners with long horizons — is the barbell.

Here’s how it applies to AI infrastructure:

- On one side:

Liquid exposure — public markets, data center REITs, utilities, semiconductor ETFs. These let you stay nimble and express a thesis without locking up capital. - On the other side:

Illiquid exposure — private infrastructure funds, powered land, edge data centers, and direct placements in AI-era real estate. These give you access to the hard assets enabling AI at scale.

Think of it this way: one side rides the narrative, the other owns the picks, shovels, and power.

Why this matters now:

AI is no longer abstract — it’s a physical trend. It runs on electricity, cooling, fiber, and space. Infrastructure is the bottleneck. That makes it investable.

But this market is still early. Not every opportunity will be priced right — or structured well. That’s why the barbell works:

- It helps you manage liquidity

- It gives you optionality

- And it still lets you participate in the structural AI buildout

This is a framework, not a recommendation. Your job is to size each side based on your risk budget, time horizon, and income needs. Don’t try to be Blackstone. Just be intentional.

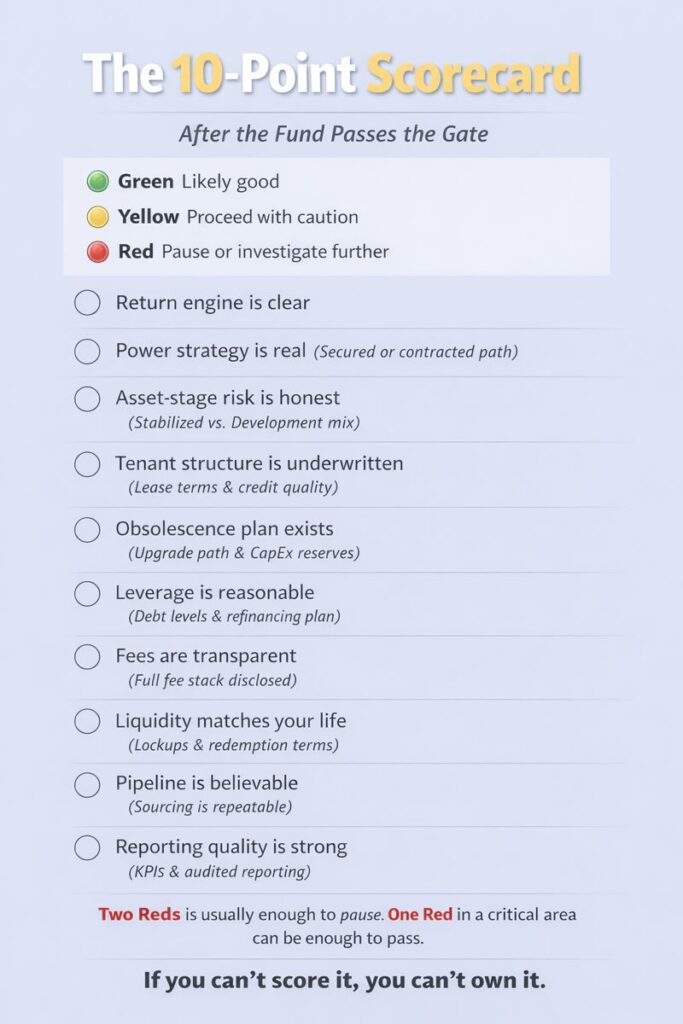

Decoding the Deck in 20 Minutes

A whitepaper explains what a fund does, how it makes money, and what risks you’re taking. It’s part strategy doc, part sales pitch. For private deals like AI infrastructure, it’s often your only deep dive before investing. Read it to cut through the polish and find the truth.

Most whitepapers are built to create confidence. You need a decision. Instead of reading top-to-bottom, read in this order:

Step 1 — Find the return engine (1 minute)

You’re looking for one sentence:

- “We generate returns by…”

- “The strategy is…”

- “We target returns through…”

If you can’t explain the return engine in one sentence, stop.

Step 2 — Identify what they actually buy (3 minutes)

You’re looking for: assets + stage + geography

- data centers vs powered land vs edge facilities vs “infra-adjacent” real estate

- stabilized vs development vs redevelopment

- where, and why

Step 3 — Go straight to the real risks (5 minutes)

Ignore generic risk language. Extract the drivers:

- power timing and access

- cooling/water constraints

- obsolescence (specs change)

- tenant concentration and contract length

- capex overruns / construction risk

- leverage/refinancing risk

- community/zoning pushback

Step 4 — Fees + liquidity (6 minutes)

This is where performance quietly disappears.

- management fee

- performance fee/carry

- fund expenses

- acquisition/disposition/financing fees

- lock-up/redemption rules

- hold period assumptions

Step 5 — Who executes (5 minutes)

Data centers are operationally intense. Powered land is process-heavy. Edge strategies require creative execution.

- name the people

- show the track record

- show the operating partners

- show how they’ve handled a problem deal

Suitability: Growth vs Income vs Blend (and the trade-offs)

Even if a fund is “good,” it might be wrong for you. For HENRYs, this usually comes down to return shape:

Growth-focused

You’re optimizing for upside and long-term net worth acceleration.

Trade-offs: less current cash flow, longer hold, more uncertainty.

Income-focused

You’re optimizing for distributions and stability.

Trade-offs: typically lower upside, and income strategies still have risk.

Blend (often the best fit for HENRYs)

You want solid income plus modest-to-above-average growth.

Trade-offs: you won’t maximize either extreme, but you’re building stability and compounding at the same time.

A simple rule:

- If your cash flow feels fragile, income matters more.

- If your cash flow is stable and you’re compounding hard, you can tilt growth.

- If you want the most practical balance, blend usually wins.

Here’s the key line:

The right fund isn’t the one with the best deck. It’s the one whose return shape matches your life.

Where NOYACK fits (a practical on-ramp that doesn’t require data-center engineering)

AI infrastructure can be an excellent theme—but it’s complex. And complexity demands transparency.

For many Millennial HENRYs, the smartest progression is:

- start with real assets you can underwrite more easily

- build confidence in private-market evaluation

- then graduate into higher-complexity themes like AI infrastructure

That’s why we talk about logistics real estate as a “physical layer” strategy that’s simpler to understand than liquid-cooled compute facilities. Goods still move. Warehouses still lease. Contracts still matter. It’s real assets without pretending you’re an electrical engineer.

If you want a real-assets option inside the NOYACK ecosystem that leans more conservative and income-aware, NREIT I is built to be that kind of exposure: stabilized, cash-flowing logistics and industrial real estate tied to the backbone of modern commerce.

And if you want more growth-tilted real-asset strategy that’s closer to the “edge” concept—urban infrastructure that can benefit from changing mobility and last-mile patterns—there’s NREIT II.

Same category (real assets). Different return shapes and complexity profiles.

If you’re exploring AI infrastructure funds, reading our logistics strategy is a good comparison point for:

- how returns are generated

- what the risks actually are

- what reporting and transparency should look like

- whether your goals are growth, income, or blend

Start with the fund overview here: https://wearenoyack.com/funds/nreit2/

(Not advice. Just a smart way to build your frameMost people get distracted by shiny objects: apps, avatars, stock tickers that move 10% a day.

Infrastructure is quieter. And that’s the point.

When you own the physical assets the economy must use to function, you stop chasing returns and start collecting rent on the future.

But don’t outsource your judgment to a deck.

Use the method:

- find the return engine

- identify what they buy

- isolate the real risks

- total the fees

- demand transparency (metrics + audited reporting)

- and match the fund to your goal (growth, income, or blend)

Do you own the cloud—or just the vapor?

— CJ

Educational disclaimer: This is for educational purposes only and does not constitute financial, tax, or legal advice. All investments involve risk, including the loss of principal. Consider your personal circumstances and consult professionals where appropriate.work and compare real-world strategies.)