TL;DR — What You’ll Learn Today

Most people confuse a big paycheck with real wealth. Income is a stream that flows through your life; net worth is the reservoir you’re building. In this edition, you’ll learn how to calculate net worth, why it’s the most honest metric of progress, and how to turn each raise into assets that compound instead of expenses that expand.

Key takeaways at a glance

- Net worth = assets – liabilities. Track it monthly (not daily) to watch your real wealth grow.

- Build net worth using three levers: pay yourself first (raise your savings rate), own productive assets, and reduce expensive debt.

- Biggest threats to wealth: lifestyle creep, tax drag, and over-concentration in a single employer or industry.

- This concept is foundational. It lives in the Foundation and Framework layers of Your Wealth Blueprint, setting you up for growth. You’ll leave with a baseline method, a 90-day roadmap, and a one-page checklist to use every month. Let’s dive in!

You’ll leave with a simple baseline method, a four‑phase roadmap, and a one‑page checklist you can use every month. Let’s dive in.

Why Net Worth (Not Income) Matters in 2025

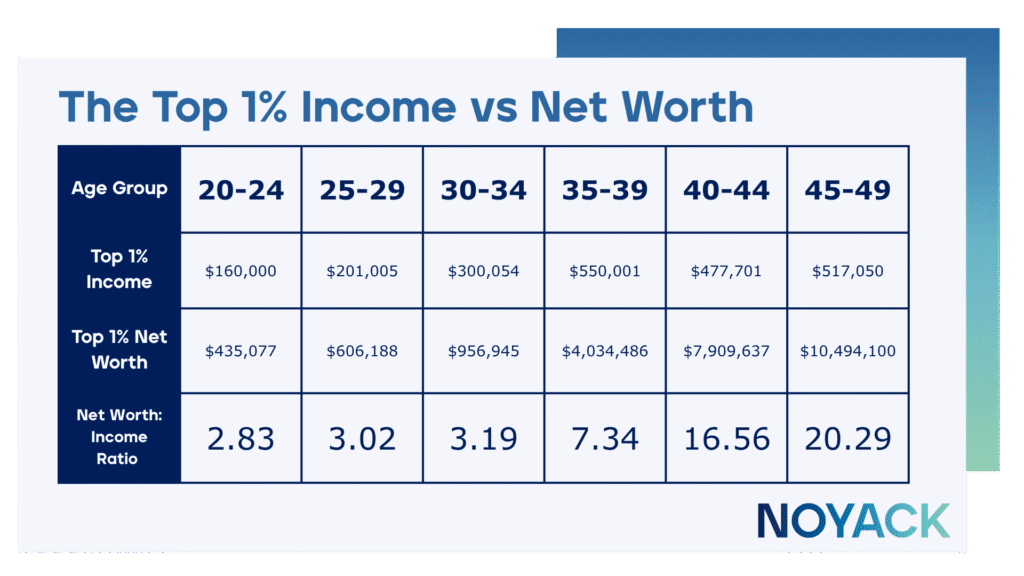

The word Millennials and HENRYs (High Earners, Not Rich Yet) navigate is defined by high costs in major metros, frequent job changes, equity compensation that’s powerful yet complex, and interest‑rate regimes that reward the prepared and punish the unplanned. In that environment, measuring progress with your paycheck alone is like judging fitness by the number of steps you took yesterday—directionally useful, but incomplete.

Five reasons to make net worth your headline metric

- Paychecks are not portfolios. A high salary can coexist with a flat or negative net worth if cash is consumed rather than converted into assets.

- Taxes and debt cause “leakage.” A raise without a plan often just raises your tax bill and expands liabilities, leaving net worth unchanged.

- Volatility happens. Markets swing and companies restructure. A stronger balance sheet (higher net worth) keeps your life steady when surprises hit.

- Goals compete for resources. Housing, kids, caregiving, career pivots – these require trade‑offs that only a net-worth view makes visible.

- What gets measured grows. Tracking your net worth monthly nudges you to make better money choices far more than any income-only focus would.

What Is Net Worth? How Does It Work?

Definition. Net worth is the difference between what you own (assets) and what you owe (liabilities). If income is the river that feeds your finances, net worth is the lake that stores your progress. Your aim is a deeper, clearer lake each quarter.

Start with a straightforward inventory. For assets, list the accounts and properties you could reasonably value today. For liabilities, list every balance you’re obligated to repay. Be conservative; over‑estimating assets or ignoring debts just blurs the picture you need to steer by.

Common asset categories

- Cash and high‑yield savings (your emergency runway)

- Retirement accounts (401(k), IRA, Roth variants)

- Taxable brokerage accounts and diversified alternatives (index funds, REITs, private credit funds sized to risk)

- Real estate equity (principal residence and any investment properties)

- Business equity, RSUs, and stock options

Common liability categories

- Credit cards and personal loans

- Student loans

- Auto loans

- Mortgages and HELOCs

- Taxes owed and payment plans

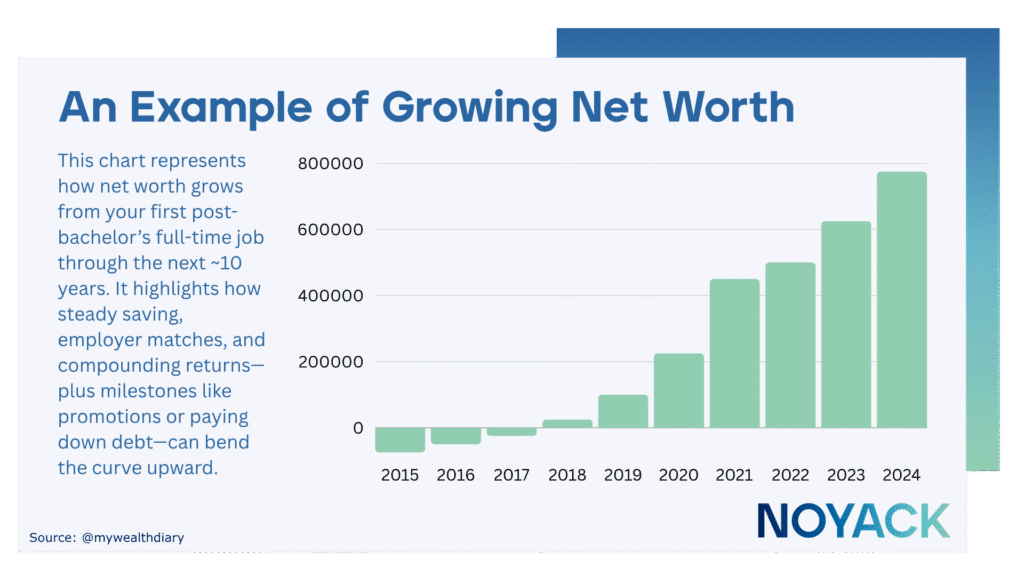

How net worth grows in practice

Start by routing a slice of every paycheck into assets before it can be spent. Then lower the cost of your liabilities by attacking high-interest debt and refinancing when it’s sensible. Focus on owning productive, compounding assets—broad index funds, real assets, and, where appropriate, diversified alternatives. Keep lifestyle creep in check so your savings rate rises with your income. And always trim drag from fees, idle cash, and tax surprises.

The Upside of a Net‑Worth‑First Approach

Focusing on net worth changes your decision‑making. Instead of asking, “Can I afford this payment?” you ask, “Does this choice raise or lower my net worth in six months?” That single reframing improves thousands of micro‑decisions across a year.

Benefits you’ll feel quickly

- Clarity: One number summarizes your financial reality and direction.

- Compounding: Dollars move into assets that work while you sleep.

- Resilience: Larger buffers turn emergencies into inconveniences.

- Alignment: Spending maps to goals you actually care about.

- Momentum: Monthly updates create a feedback loop that sticks.

The Risks of an Income‑Only Strategy

Relying on income as your primary metric invites hidden risks. Without intention, lifestyle tends to expand until it absorbs every raise; taxes increase in step; and liabilities quietly accumulate. Concentrating too much of your life in one employer or industry adds fragility you don’t see until a downturn.

Watch‑outs and common mistakes

- Lifestyle creep: Spending rises with paychecks; savings rate stalls.

- Concentration risk: Employer stock, bonus dependency, or single‑industry exposure.

- Debt traps: Low‑APR teasers become long‑term balances; high interest compounds against you.

- Illiquidity and mismatch: Locking funds you’ll need within 6–18 months.

- Tax drag: Equity comp and bonuses without proactive withholding or planning.

Edge cases to handle deliberately

- Counting speculative or illiquid items as core net worth.

- Investing aggressively without a 3–6 month emergency fund.

- Ignoring vesting schedules and tax impacts of RSUs/options.

- Underinsuring income while carrying dependents or fixed obligations.

Where This Fits in Your Blueprint

This topic spans two layers of Your Wealth Blueprint. In the Foundation layer, you establish your cash runway, create a debt payoff plan, and adopt a monthly net-worth tracking habit. In the Framework layer, you design your asset mix, automate contributions, and put tax and insurance protections in place so your growth is durable. Once those pieces are set, the Growth layer – index funds, real assets, and carefully sized alternatives – can do its job without jeopardy.

Related bricks to explore next

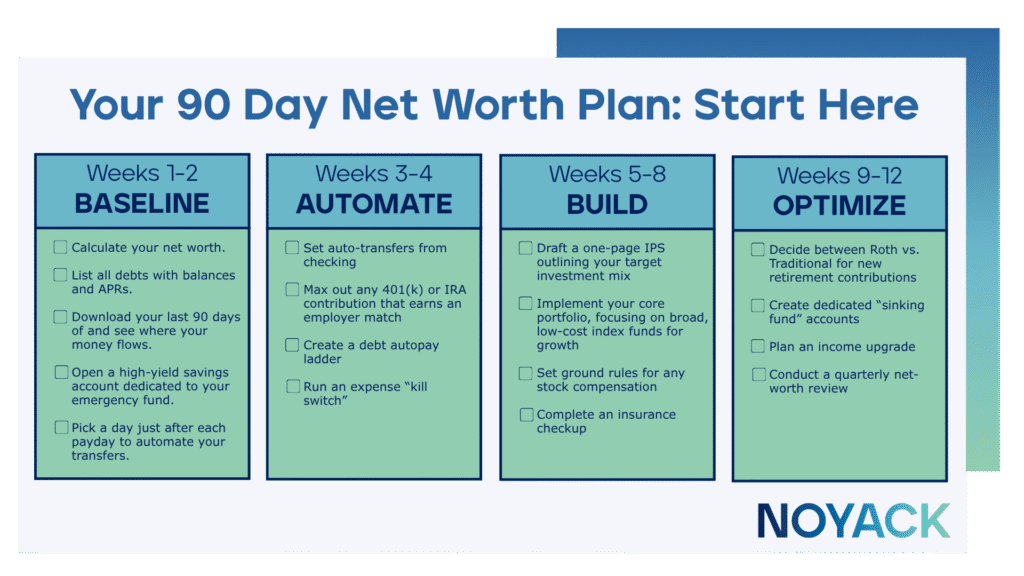

How to Get Started with Net Worth: A 90‑Day Roadmap

The best plan is the one you’ll follow. Use the next three months to lay foundations, automate movement, install engines, and then optimize. Each phase includes a short narrative goal and a checklist to make it concrete.

Weeks 1–2 — Establish Your Baseline and Cash Map

In the first two weeks, you’re building the dashboard. Capture a truthful snapshot of where you stand today and where your money has been going. The point is not perfection; it’s visibility. Once you can see the system, you can change it.

Do this

- Calculate net worth (assets − liabilities) and label it Month 0.

- List liabilities by balance and APR; flag anything above 8–10%.

- Download the last 90 days of transactions and tag them into 6–8 categories.

- Open a high‑yield savings account dedicated to your emergency fund.

- Pick a recurring automation day (e.g., 48 hours after payday).

Weeks 3–4 — Automate the Wins

Automation turns intention into default reality. You’ll pre‑decide where your next paychecks go so progress continues even when life gets busy. Think of this as installing rails that are hard to fall off.

Do this

- Set auto‑transfers from checking: a target of 20% of net pay split into investing, emergency savings, and near‑term goals.

- Turn on 401(k) or IRA contributions and capture the full employer match before anything else.

- Create a debt autopay ladder: minimums on all, extra to the highest APR until it’s gone; aim for <30% credit utilization.

- Run an expense kill‑switch: cancel or renegotiate three subscriptions; lower recurring bills.

Weeks 5–8 — Build the Engine

Now you’ll give your dollars a job description. A basic Investment Policy Statement clarifies risk, allocation, and when you’ll rebalance. You’ll also address equity compensation and insurance so a single event can’t undo your progress.

Do this

- Draft a one‑page IPS with target allocation and rebalancing rules.

- Implement a core portfolio—broad index funds complemented by diversified, appropriately sized alternatives where suitable.

- Set RSU/Options rules (e.g., sell a portion at vest to diversify; plan withholding).

- Complete an insurance review: disability, term life, renters/home, and umbrella liability.

Weeks 9–12 — Optimize and Grow

With systems installed, you’ll look for friction you can remove. Taxes are a lever, not just a bill; near‑term goals need their own buckets; and any fresh income should be routed to savings before lifestyle has a chance to expand.

Do this

- Decide Roth vs. Traditional for new contributions; consider HSA/FSAs and, if eligible, a backdoor Roth process.

- Create sinking funds for 6–18 month goals (wedding, travel, down payment) separate from investments.

- Plan an income upgrade: negotiate comp, add a skill, or test a side‑project; pre‑commit any raise to automation.

- Conduct a quarterly review: update net worth, celebrate progress, and adjust your IPS.

5-Point HENRY Wealth Checklist

For HENRYs who want to start building real wealth, keep this checklist front and center:

- Track it to grow it: Calculate and record your net worth at the end of each month. Watching that number trend up will keep you motivated and informed.

- Pay yourself first: Automate a portion of every paycheck (aim for 15–20%) to go straight into investments and savings before you can spend it.

- Kill “toxic” debt fast: Aggressively pay down high-interest debt (credit cards, personal loans). It’s hard to grow net worth when double-digit interest is dragging you down.

- Invest in assets, not upgrades: Put your money into things that appreciate or generate income (index funds, real estate, etc.), not just lifestyle upgrades. Diversify your investments and avoid putting all your eggs in one basket (like your employer’s stock).

Live below your means (even as you earn more): Avoid lifestyle creep. If you get a raise or bonus, boost your saving and investing rather than instantly upgrading your spending. Future-You will thank you.

Final Note

High income is the fuel; net worth is the vehicle. When you start measuring the right thing, you naturally build the systems and habits that increase it. Remember, the goal isn’t just a bigger paycheck – it’s a life with more options, more flexibility, and the ability to say “yes” to what truly matters.

Ready to build real wealth instead of just making money? Start your journey by taking the Wealth IQ Quiz today.