What You’ll Learn

Traditional budgets micromanage every dollar, then collapse the first weekend you forget to log coffee. The anti-budget flips that script: automate the important stuff first, then guilt-free spend the rest. In this guide, you’ll learn why classic budgets fail, how to set up a pay-yourself-first system in under an hour, and how to handle real-life chaos—variable income, debt, big goals, and surprise expenses—without living in a spreadsheet.

Key takeaways

- Save first, spend the remainder. Automate your goals on payday; your checking account becomes your “allowance.”

- One decision beats 100 mini decisions. You choose targets once, not every time you tap your card.

- Friction where it helps, ease where it matters. Make saving automatic; make spending visible, not painful.

- Good enough > perfect. Review monthly, adjust quarterly, keep moving.

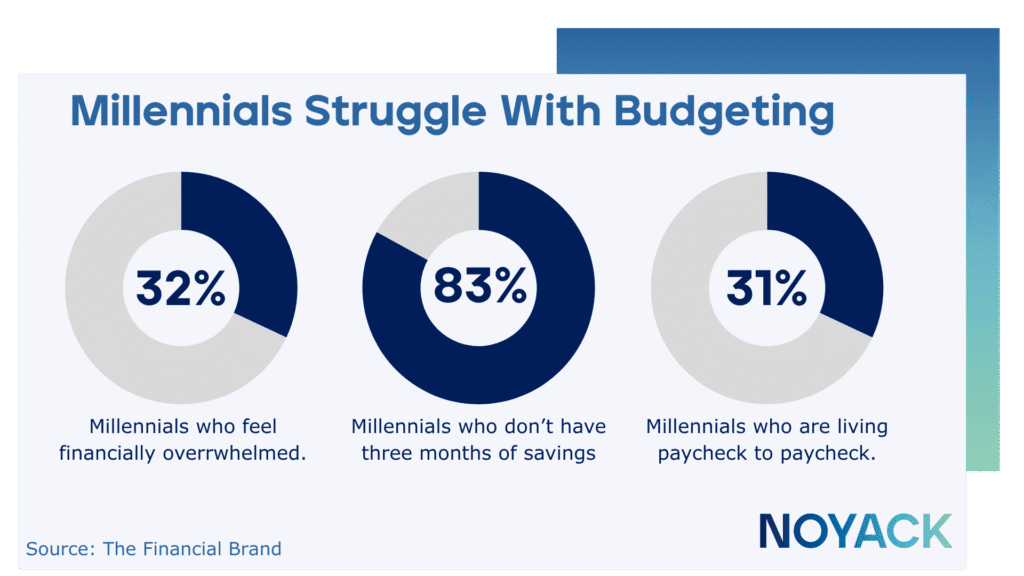

Why Traditional Budgets Fail (And What to Do Instead)

Classic budgets demand constant tracking, willpower, and time. Most people don’t have three. The anti-budget solves this by removing daily decisions. You set a few big targets, automate them, and let the system work in the background. Instead of chasing categories, you guard the top of the funnel: what leaves your paycheck and where it lands.

The mindset shift

- From perfect tracking → to reliable automation

- From guilt over lattes → to confidence in funded goals

- From after-the-fact cuts → to before-payday decisions

The Anti-Budget

Pay yourself first—automatically—then spend the rest without shame.

That’s it.

Your “budget” is simply a short list of automatic transfers that fire on payday. If the goals are funded, you’re on track.

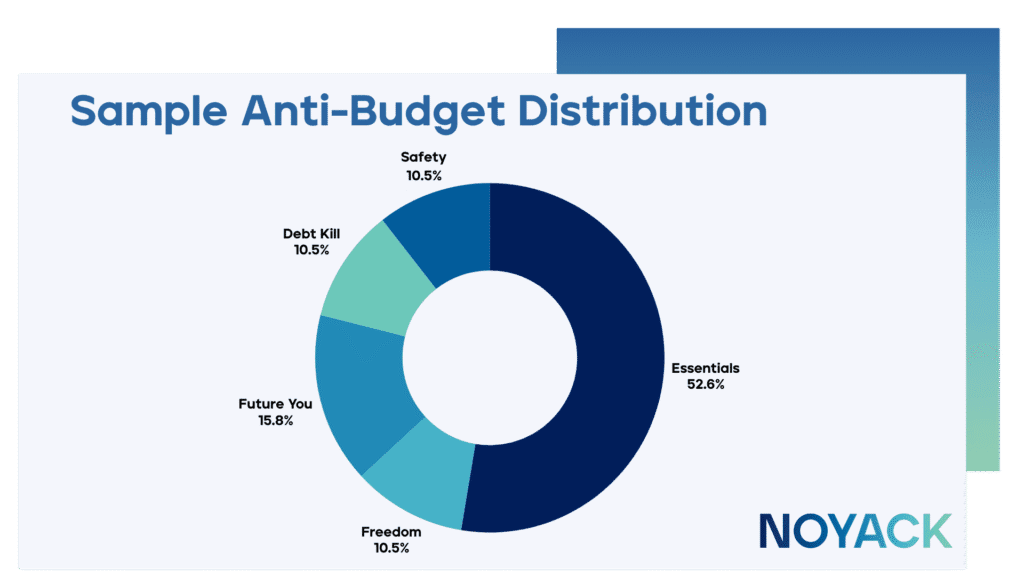

The 5 Buckets (Set It and Forget It)

Use these as defaults. Tweak the percentages to your life, not the other way around.

- Essentials (Checking): Rent/mortgage, utilities, groceries, insurance, transport. This is where your debit/credit spending happens.

- Freedom (Fun): Dining out, travel, hobbies. Treat it like a pressure valve—fund it on purpose.

- Future You (Invest): 401(k)/IRA/HSA/Taxable investing. Automate at the employer and brokerage level.

- Safety (Cash Cushion): Emergency fund and short-term sinking funds (car service, gifts, annual renewals).

- Debt Kill (If applicable): Extra principal on high-APR debt until it’s gone.

Starter targets (HENRY-friendly)

- Essentials: 50–60%

- Freedom: 10–20%

- Future You: 15–25% (blend of retirement + taxable)

- Safety: 5–10% until you reach 3–6 months of expenses

- Debt Kill: All excess if APR > 8–9% (temporarily shrink Freedom)

45-Minute Setup (No Spreadsheet Required)

Step 1 — Name the goals (10 min)

List the must-fund items: retirement %, emergency fund target, big upcoming purchases (move, wedding, travel), and any high-APR debt.

Step 2 — Map payday automation (20 min)

- At your employer: set/raise 401(k)/HSA contributions.

- At your bank: create auto-transfers on payday +1:

- To Safety savings (emergency + sinking funds)

- To Freedom checking (or separate debit)

- To Debt Kill (extra payment)

- To Safety savings (emergency + sinking funds)

- At your brokerage: schedule recurring buys (Roth/IRA/taxable).

Step 3 — Right-size checking (10 min)

What’s left after automation is your real, guilt-free spend. If you chronically overspend, add gentle friction: turn off credit card auto-pay for full (still on-time, of course) until your Freedom rhythm stabilizes; or route Freedom to a separate card you pay weekly.

Step 4 — One page, visible (5 min)

Write your five buckets and amounts on a phone note. If it’s not visible, it’s optional. Not optional.

How to Handle Real Life (Without Breaking the System)

Variable income (freelancers, commissions)

- Set a base paycheck equal to your worst-case monthly income. Automate buckets off that base.

- Hold extra inflows in an Income Smoothing account; on the 1st, “pay yourself” the base.

- Quarterly, sweep any surplus: 50% Future You, 30% Safety, 20% Freedom.

High-APR debt

- If APR > 8–9%, move most of Freedom to Debt Kill until gone.

- Keep a modest Freedom line to avoid binge-spend backlash.

- Celebrate each $1,000 knocked out—then re-aim that payment at Future You.

Big goals (down payment, sabbatical, wedding)

- Create a named Sinking Fund per goal with a fixed payday transfer.

- Price the goal backward: (Total ÷ Months) = Transfer.

- Keep it in high-yield savings; don’t risk timeline money in stocks.

Couples

- One shared essentials account, two personal Freedom accounts.

- Agree on automation; stop arguing over receipts.

What to Do Each Week and Month

You do not need to track every latte. You do need to confirm the automation hit.

Weekly (3 minutes)

- Glance at checking: bills cleared? Freedom balance healthy?

- Skim card transactions; flag fraud, not feelings.

Monthly (15 minutes)

- Confirm transfers ran.

- If checking ends with a consistent surplus/shortfall, nudge bucket sizes by 1–2%.

- Review one money “lever” (insurance quote, phone bill, subscriptions).

Quarterly (30 minutes)

- Re-aim raises/bonuses: 50% to Future You, 25% to Safety/Sinking, 25% to Freedom.

- Increase retirement deferral by 1% if you’re below your target.

Suggested Targets by Season of Life

These are ranges, not rules. Pick the closest lane and adjust.

- Starter (building cushion, some debt):

Essentials 60%, Freedom 10–15%, Future You 10–15%, Safety 10–15%, Debt Kill as needed. - HENRY sprint (income rising, goals stacking):

Essentials 50–55%, Freedom 10–15%, Future You 20–30%, Safety 5–10%, Debt Kill (if high APR). - Family phase (childcare + housing heavy):

Essentials 60–65%, Freedom 10–15%, Future You 15–20%, Safety 10%, Sinking Funds for predictable spikes. - Deleveraging (post-debt, ramp investing):

Essentials 50–55%, Freedom 15–20%, Future You 25–30%, Safety top-ups only.

Make It “Stick” with Light Friction

The anti-budget works because it’s easy. Add only the friction that improves outcomes.

- Separate Freedom card with a weekly auto-pay from Freedom account.

- Bill due-date clustering (e.g., 5th and 20th) to see cash rhythm.

- Bank alerts: low balance, large transaction, transfer success.

- Unsubscribe sprints once a quarter; capture quick wins.

Anti-Budget for Advanced Users

When the base system hums, consider these upgrades:

- Rule of 3 Investing: 3 automatic buys (retirement, HSA, taxable index fund).

- Annual Big-Ticket Calendar: Pre-load sinking funds for travel, insurance, holidays, property taxes.

- Raise Rule: Every raise gets pre-split before it hits checking.

- Windfall Split: 70% long-term (invest/debt), 20% medium (sinking funds), 10% fun (on purpose).

30-Day Anti-Budget Challenge

- Day 1: List five buckets + set initial percentages.

- Day 2: Turn on payroll and bank transfers.

- Day 7: Open/label accounts (Safety, Freedom, Sinking).

- Day 14: Verify the first automation cycle worked; adjust by 1–2%.

- Day 21: Cancel/renegotiate one bill; redirect savings to Future You.

- Day 30: Snapshot balances; raise retirement deferral by 1%.

Bottom Line

If budgets haven’t stuck, the problem isn’t you—it’s the tool. The anti-budget funds your future first, then lets you live on the remainder without a spreadsheet. Start with five buckets, automate on payday, and review lightly. When the important things happen by default, you can stop negotiating with yourself and start making real progress.