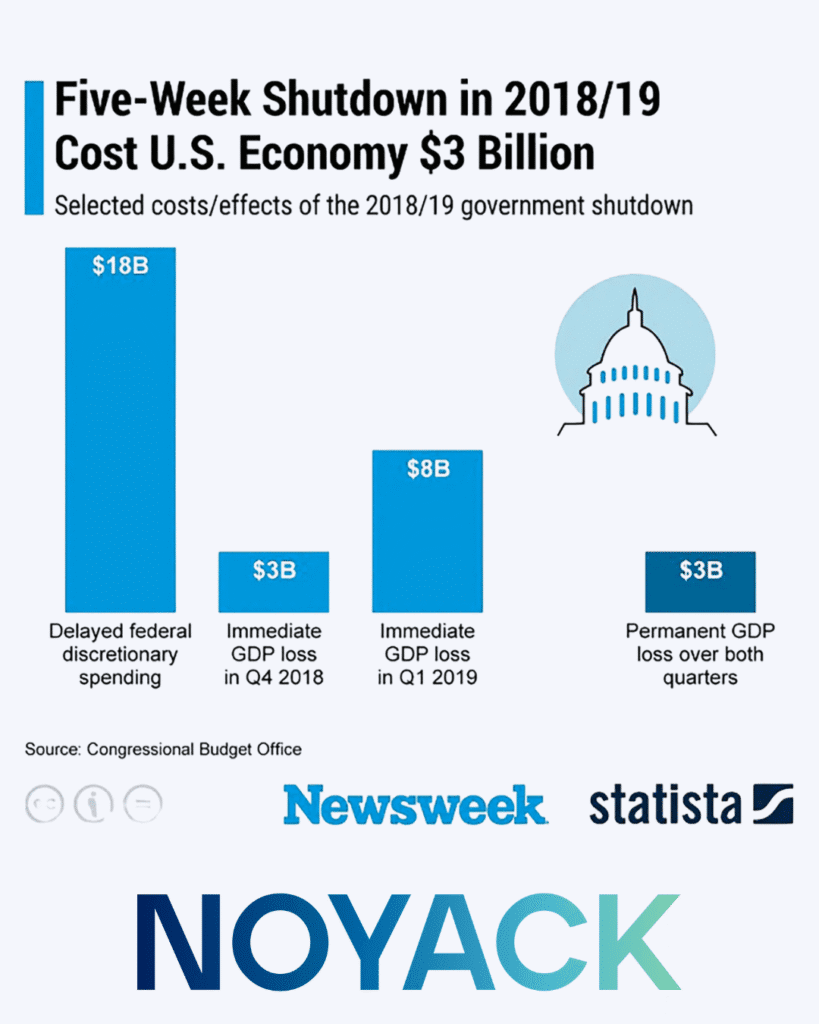

As you read this, Washington is still dark—and every extra day it stays that way raises your odds of costly timing mistakes. The shutdown that began Oct 1 is rolling into another week with no clean off-ramp: defense and stopgap votes failed late this week, and negotiators remain split over health-care subsidies.

Here’s the bottom line for your money: thinner data, slower agencies, and more friction exactly where execution matters—filings, trades, open enrollment, travel.

Give this three minutes now to avoid three months of cleanup later; below are the moves to make before Friday.

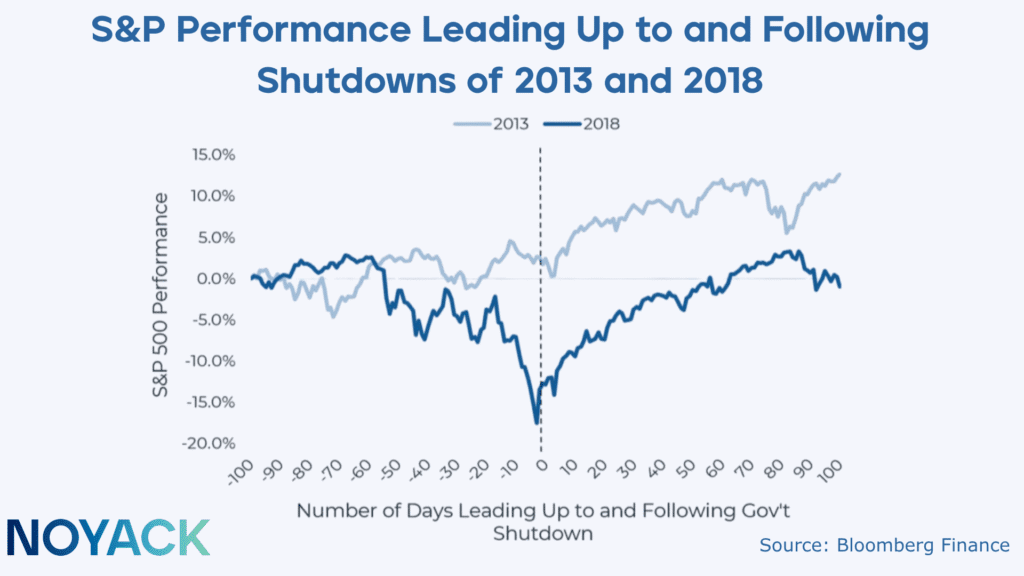

Markets during a government shutdown: less data, more noise (CPI Friday)

With official reports limited, markets trade on fewer signals and more guesswork—wider ranges, faster mood swings. Use the week to control risk, not to nail perfect entries.

Embed this in your week

- Monday: Reconfirm trade timing with broker/compliance; get written OK for sales/exercises/locks.

- Through Friday (pre-CPI): Widen limit ranges; split orders; avoid market orders in a thin tape.

- Equity events: Recheck blackout windows, T+1 settlement, and tax withholding (sell-to-cover vs. cash).

- Rate locks: Price extension options now; set a simple go/no-go rule.

- After CPI: Tighten bands back to normal; store confirms.

SEC & capital markets in a government shutdown: filings in, fast help out

EDGAR accepts filings, but staff aren’t fast-tracking approvals or routine questions. That affects IPO calendars, follow-ons, and “quick clarifications” that keep deals on time.

Embed this in your week

- Tuesday: Send a one-pager to deal teams: “SEC is accepting filings; no fast-tracking; deadlines still count business days.”

- Add 10–15 business days to term sheets, milestones, outside dates.

- Extend financing/commitment expiries to match the new timeline.

- Share an updated project plan the same day.

Taxes in a government shutdown: deadlines continue, live help lags

The IRS is pared back, but e-file and e-pay are up. Your obligations don’t pause—only human help does.

Embed this in your week

- By Wednesday: Pull YTD income (salary, bonuses/RSUs/options, K-1s, realized gains).

- Recheck safe harbor: pay ≥90% of 2025 tax or ≥110% of 2024 (100% if AGI ≤ $150k).

- Close the gap: update Q4 estimate and/or increase W-2 withholding (treated as paid evenly all year).

- Execute + document: pay via EFTPS/Direct Pay; save confirmations.

Healthcare costs in a government shutdown: Open Enrollment, IRMAA, small delays

Coverage choices this month can move thousands next year. Shop by total cost (premium + prescriptions + deductible/OOP + IRMAA).

Key dates

- Medicare: Oct 15–Dec 7

- ACA Marketplace: Nov 1–Jan 15 (enroll by Dec 15 for Jan 1 coverage; state dates can differ)

IRMAA basics (for 2025): Part B base $185. Surcharges start at $106k single / $212k joint and can push Part B to $628.90/mo; Part D add-on up to $85.80/mo. (2026 surcharges use 2024 income, so Q4 moves matter.)

Embed this in your week

- Mark dates above; lock ACA by Dec 15 for Jan 1.

- Compare total cost and save network/drug screenshots.

- IRMAA check: estimate 2024 MAGI; adjust year-end moves if near a higher bracket.

- Confirm telehealth benefits in writing; some non-mental-health flexibilities ended Oct 1.

Double-check figures and benefits on official Medicare/Marketplace pages before enrolling.

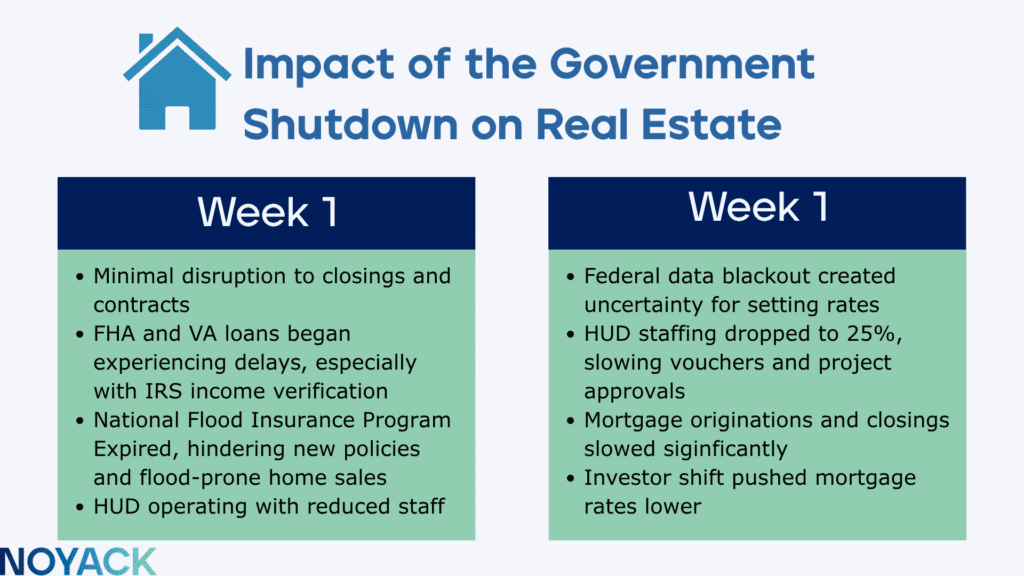

Mortgages in a government shutdown: lock early, build buffers, keep closings on track

Rates can swing into CPI, and shutdowns slow back-office steps (e.g., IRS transcripts). Small delays get expensive if your lock is near expiry.

Embed this in your week

- Know your lock: expiry date, extension cost, float-down option.

- Upload docs today: 2023–24 returns, W-2/1099/K-1, recent pay stubs (or YTD P&L). If transcripts lag, ask for a lender workaround.

- Prep for closing: appraisal in, title clear, insurance binder issued. Wire a day early; avoid last-hour Friday closings.

- Price structure: points breakeven months; ARM caps; prepayment rules.

- Tight timing: compare short lock + extension vs longer lock; consider HELOC or SBL for backup liquidity.

Deals & M&A in a government shutdown: HSR filings keep moving—with limits

Antitrust (HSR) filings are accepted, but hours are shorter and no early terminations are being issued. Waiting periods still run (typically 30 days, 15 for cash tender offers).

Embed this in your week

- File earlier than usual; aim before 5:00 p.m. ET.

- Tell sponsors/lenders to assume the full wait—no early closes.

- Add 10–15 business days of buffer to outside dates and loan commitments.

- Pre-clear internal plans (forms, pull-and-refile) since Q&A help is limited.

Travel & operations in a government shutdown: fly like you mean it

Controllers and TSA are working, but staffing is tight—small snags ripple fast.

Embed this in your week

- Book nonstops and first departures; if you must connect, budget 90+ mins domestic / 2+ hours international.

- For board/diligence days, fly in the night before; pad 15–30 mins around meetings.

- Carry-on only; hold a refundable backup; enable app alerts.

- Align stakeholders on buffers and agree on a virtual fallback if delays >45 mins.

Why these moves matter (especially for healthcare)

- Data scarcity raises execution costs. CPI offers one anchor in an otherwise dark calendar; forcing fills before Friday is risky.

- Agency slowdowns punish poor timing. SEC accelerations paused; IRS live help thin. Favor documentation, electronic compliance, and buffers.

- Healthcare is the near-term swing factor for high earners. IRMAA tiers and telehealth rollbacks can add thousands to 2026 outlays; Marketplace premiums could shift with subsidy changes. Plan selection + MAGI management now converts know-how into cash savings.

Bottom line for high earners:

The government shutdown isn’t changing the rules—it’s changing the rhythm. Build the week around Friday’s CPI, add buffers everywhere else, and price coverage after IRMAA and subsidy noise, not before.

Education only—this is not tax, legal, or investment advice. Verify specifics with official sources and your advisors.

FAQ: Government shutdown & your money

How does a government shutdown affect stock market data?

Fewer official reports can increase volatility; traders lean on alternative data and positioning until core releases resume.

Does the SEC stop all filings during a shutdown?

EDGAR generally remains open for filings, but staff may not fast-track reviews or answer routine questions quickly.

Are my tax deadlines paused in a government shutdown?

No. E-file and e-pay systems typically remain available; penalties still apply if you miss payments.

Will HSR early termination be granted during a shutdown?

Plan for no early terminations and assume the full statutory waiting period.

Does a shutdown change Medicare/ACA enrollment windows?

Open Enrollment windows remain; expect slower service and verify plan details directly on official sites.