On July 4, 2025, President Trump signed into law the One Big Beautiful Bill Act (OBBBA), a sweeping piece of legislation with many moving parts—but one provision stands out for young families and forward-thinking Millennials alike: the creation of “Trump Accounts,” a new class of custodial IRAs designed specifically for children. While headlines focused on the politics, we’re more interested in the policy’s long-term wealth-building potential.

Think of Trump Accounts as the government finally leveling the playing field for middle-class families. For too long, the ultra-wealthy have had access to sophisticated wealth-building tools while everyone else was left with basic savings accounts. No more.

If you’ve ever wished your child could start life with a built-in financial advantage—this is your moment. Let’s walk through what these accounts are, how they work, and what steps you can take to make the most of them before the window closes.

The compound growth is staggering:

- $1,000 at birth → $81,000 at retirement (7% annual return)

- $1,000 + $5,000 annually for 5 years → $215,000 by age 30

- $1,000 + maximum contributions for 12 years → $400,000+ by retirement

So… What is a Trump Account?

Trump Accounts are a hybrid between a traditional IRA and a 529 plan—except they’re designed to start building wealth from birth, not from your first paycheck.

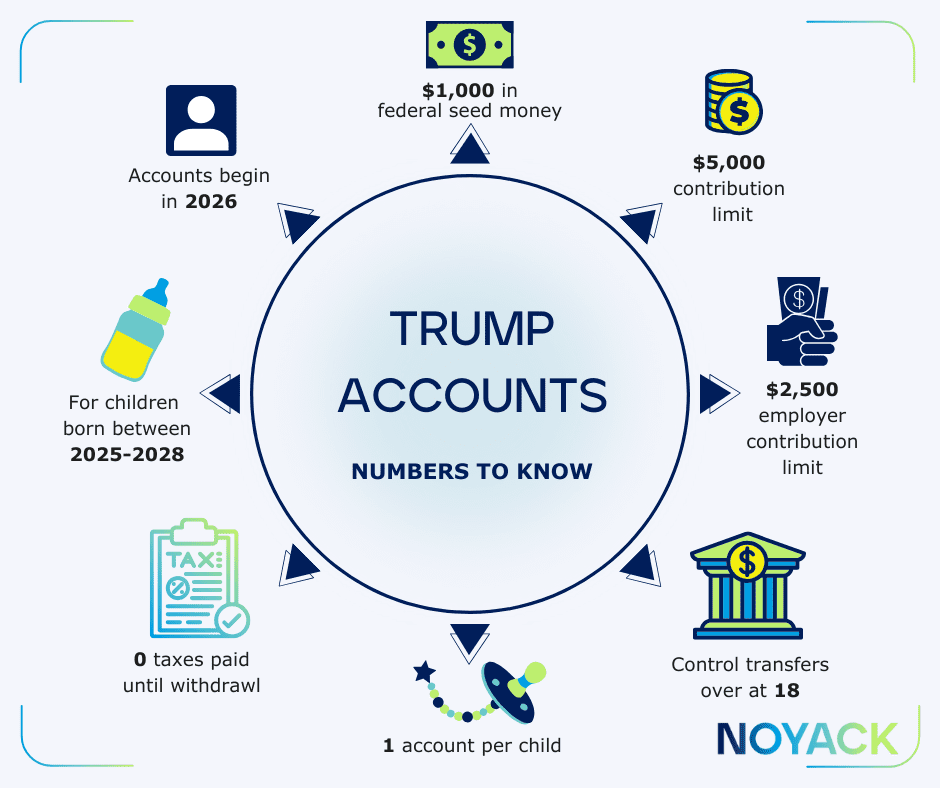

Key Features:

- Automatic $1,000 seed deposit for every baby born between 2025 and 2028.

- No earned income requirement for contributions before age 18.

- Annual contribution limit of $5,000 (with $2,500 sub-limit for employer contributions).

- Tax-deferred growth. Pay no taxes on investment gains until withdrawal.

- Restricted early access: No withdrawals before age 18. After that, standard IRA rules apply.

- One account per child. Duplicate accounts cancel out tax benefits.

- Default investment options limited to low-fee U.S. stock index funds (expense ratio ≤ 0.10%).

These accounts are custodial IRAs under the hood, meaning the parent or guardian controls them until the child turns 18. After that, it’s their asset—but with built-in guardrails that reward long-term planning.

Why This Matters for Millennials and Future Generations

If you’re a Millennial—or a HENRY (High Earner, Not Rich Yet)—this policy gives you a unique opportunity to create generational wealth with very little friction. Here’s why it’s a big deal:

1. The Compounding Effect Is Massive.

Even if you only contribute for the first few years, time does the heavy lifting. A one-time $1,000 seed invested at 7% annual return grows to $81,000 by retirement age—with zero additional contributions. Add the max $5,000 per year for 12 years, and you’re looking at $215,000+ by age 30.

2. Employer Leverage = Instant Gains.

If your company offers Trump Account contributions as a fringe benefit (and many will), $2,500 annually could be redirected from your paycheck tax-free—especially valuable if you’re in a high bracket. That’s an instant 37%+ advantage for top earners.

3. Multi-Bucket Family Wealth Strategy.

Most Millennials are already balancing retirement, college savings, and housing goals. Trump Accounts add a new tax-deferred option—without competing with your 401(k), Roth IRA, or 529 plan.

4. Closing the Wealth Gap Starts Early.

Automatic enrollment and early funding echo the findings from “baby bonds” studies: early financial assets increase the likelihood of attending college, buying a home, and launching a business.5. Built-In Financial Education.

Statements, growth tracking, and eventual decision-making all encourage financial literacy from a young age. When a teen sees their account fluctuate with the market, it’s more educational than any app.

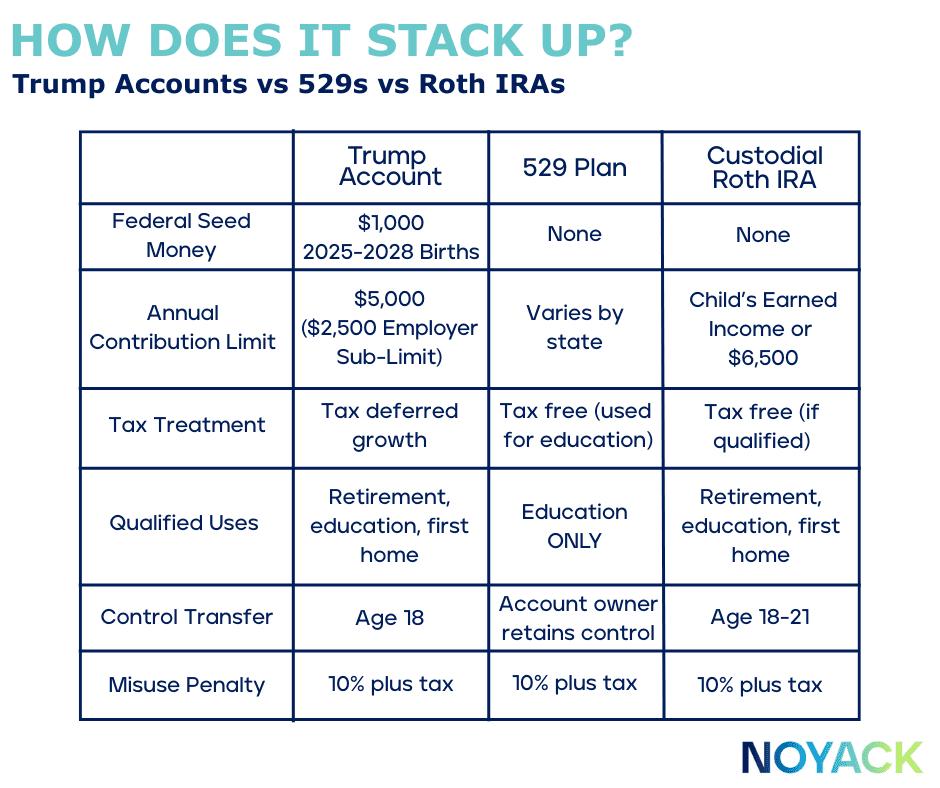

How They Stack Up: Trump Accounts vs. 529s, UTMAs, and Custodial Roth IRAs

Trump Accounts offer a middle ground—more flexible than 529s, more structured than UTMAs, and easier to fund than Roth IRAs. For families wanting multi-purpose, tax-advantaged growth, they’re a strong addition to the lineup.

The Bottom Line: This is where Trump Accounts become truly powerful—they don’t compete with your existing financial strategy; they enhance it.

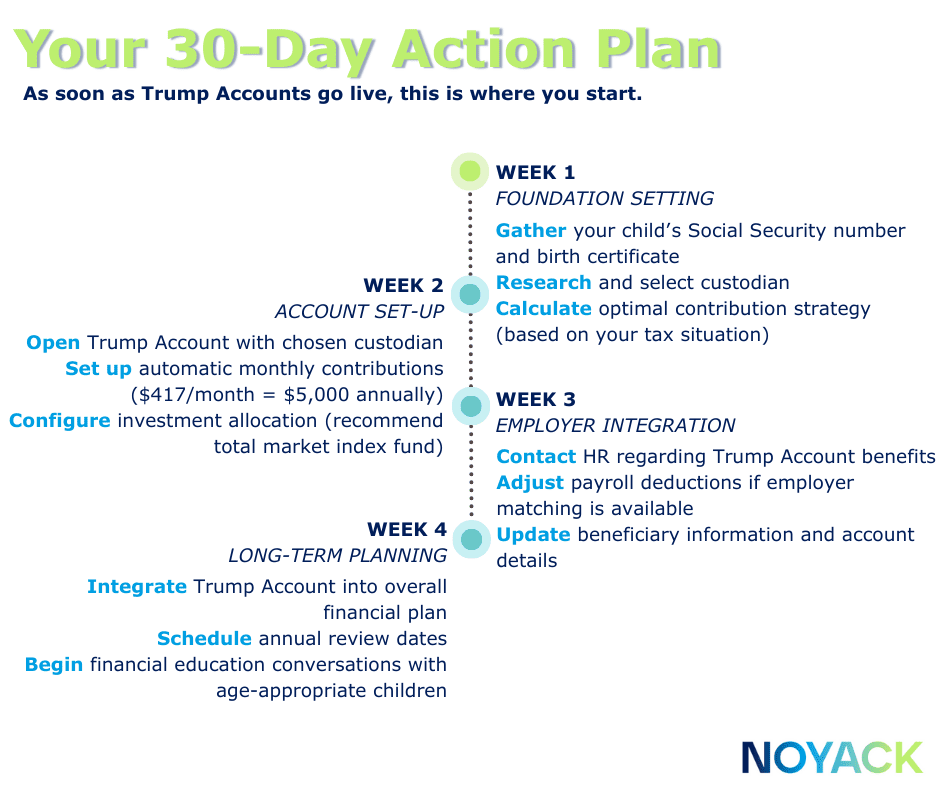

What to Ask, What to Do: A Step-by-Step Action Plan

Whether you’re a new parent, planning for a future child, or advising someone who is, here’s your roadmap.

1. Confirm Eligibility

The child must be under 18 and have a Social Security number in order to open a Trump Account. For the $1,000 seed: the child must be born between Jan 1, 2025 – Dec 31, 2028.

2. Choose—or Replace—the Default Custodian

If you don’t pick one, Treasury will assign one when you file taxes. You may want to choose a brokerage with low/no fees and better digital tools that aligns with your wealth-building strategy.

Questions to Ask Potential Custodians:

- “What are your annual account fees?” (Target: $0-25 annually)

- “Which index funds are available?” (Target: Total market funds with <0.10% expense ratio)

- “Do you support automatic contributions and employer matching?”

- “What digital tools do you offer for account management?”

- “Can I easily transfer to another custodian when my child turns 18?”

Recommended Custodians:

- Fidelity: Zero account fees, excellent index fund selection

- Vanguard: Industry-leading low-cost funds, strong reputation

- Charles Schwab: Comprehensive digital tools, competitive fees

3. Open the Account

Contributions start July 4, 2026 and have an annual limit is $5,000 per child—this includes employer contributions up to $2,500. Set up automated monthly contributions ($417/month = $5K/year) immediately after you open your account. That’s how you build wealth without thinking.

4. Avoid Pitfalls

- Opening multiple accounts voids tax benefits—stick to one per child.

- Exceeding contribution limits can trigger a 100% excise tax on the excess growth.

- Contributions must stop by December 31 of the year the child turns 17.

- Choosing high-fee custodians – Reduces returns by 15-20% over 18 years

- Forgetting employer benefits – Missing free money from employer matching

5. Employer Contribution Opportunities

Here’s where high earners can really maximize the benefit. Many companies are already exploring Trump Account contributions as employee benefits. If your employer offers matching:

- $2,500 annual employer match = instant 50% return on your contribution

- Tax-free benefit for you (no additional income tax on employer contributions)

- Immediate wealth acceleration for your child’s future

Action Step: Contact your HR department now to inquire about Trump Account benefits. Early adopters often get the best terms.

6. Plan for the Transition at Age 18

The child gains control, and IRA rules kick in. There also comes the question: what do I do with this money now? You can roll over to a new custodian, use funds for qualified expenses, or let the account grow untouched.

7. Integrate With Your Broader Strategy

- Use 529s for known education costs.

- Use Trump Accounts for longer-term goals (house, retirement, business).

- For working teens, layer in a Custodial Roth IRA to create both tax-free and tax-deferred accounts.

On it’s own, a Trump Account can help you build generational wealth for your child’s future. When mixed in with your strategy as a whole? That wealth building is unmatched.

🧭 Real Wealth Takeaways

| Key Insight | Why It Matters |

| Free money exists | A $1,000 seed is like depositing $3,800 at age 5 (7% growth). |

| One account per goal | Trump Accounts complement, not replace, 529s or Roths. |

| Use employer benefits | A $2,500 company match = 50% ROI on your contribution. |

| Low fees = higher gains | A 0.1% fund fee keeps 18% more of your return over 18 years. |

| Start ASAP | Missed years = missed compounding. Automate to stay on track. |

| Teach through ownership | A child who tracks their own account learns real financial habits. |

The NOYACK Advantage: Beyond Trump Accounts

Trump Accounts are just one piece of your generational wealth puzzle. At NOYACK, we help families access the complete toolkit that was once reserved for the ultra-wealthy.

This is exactly why we created NOYACK—to democratize wealth-building strategies and give every family access to sophisticated financial tools. Trump Accounts complement our broader curriculum on:

- Alternative investment strategies

- Tax optimization techniques

- Estate planning integration

- Multi-generational wealth transfer

- Private market opportunities

Ready to go beyond Trump Accounts? Explore our private investment opportunities and comprehensive wealth-building framework designed specifically for high-earning families.

Wealth isn’t just inherited—it’s built. And it often starts with a decision that seems small but compounds over time. Trump Accounts may not stay in the spotlight, but for families looking to create durable, multi-generational financial security, this policy is worth your attention and action.

You’ve got a short window to act—make it count.