What You’ll Learn Today

Crowdfunding lets you back startups, real estate, consumer products, and creative projects with smaller checks than traditional private deals. The catch: access doesn’t remove risk. Today you’ll learn what it is, who it’s for, how returns actually work, and a 90-day plan to test it responsibly.

Key takeaways at a glance

- Crowdfunding = online private markets. Invest via regulated portals in startups (equity), loans (debt), revenue shares, or pooled real estate.

- Illiquid and risky. Expect long holds and high variance. Size positions modestly; expect some zeros.

- Your edge is process, not deal-picking. Use checklists, stage/sector limits, and portfolio sizing rules.

- Where it matters now: AI is rewriting what’s possible—and opening the door to more (and better) crowdfunding deals.

What Is Crowdfunding? How It Works (Plain English)

Crowdfunding means investing smaller checks—often $100 to a few thousand—into private deals online through regulated portals. You’re not donating; you’re investing. Depending on the offer, you can buy ownership (equity), lend money (debt or revenue share), or join a real-estate deal.

These sites must follow securities rules and provide disclosures, but the investments are still risky and illiquid—plan on holding for years.

How Money Comes Back

Equity: You buy a small slice of a young company. There are usually no dividends and no easy way to sell. Most bets won’t work, and you may wait years. The upside is a few big wins (acquisition or IPO) can more than cover many losses.

Debt / Revenue Share: You act as the lender. You get interest on a schedule or a % of sales until a target is met. Payments can start sooner, but upside is capped and missed payments are possible.

Real Estate: You may earn ongoing rent/interest plus a lump sum at sale or refinance. Fees and execution meaningfully affect results.

What Matters Most

Price & Stage: Is the price fair for today’s progress? Earlier is cheaper but riskier; later is pricier but steadier. Entry price sets the bar.

People: Favor founders/sponsors with relevant experience, honest updates, and a record of shipping. Execution beats ideas.

Terms & Fees: Know your rights and every fee. Small costs add up and are paid before you. If you can’t explain it simply, pause.

Diversification: Keep positions small and spread across deals, sectors, and operators so one mistake can’t hurt you badly.

Why Crowdfunding Matters in 2025 (and When It Doesn’t)

Crowdfunding works as an alternative investment because it turns early customer demand into capital. The best campaigns solve a clear problem for a specific user and show it with a one-line promise and a simple demo. When the value is obvious, backers don’t need persuading—they self-select and pre-order.

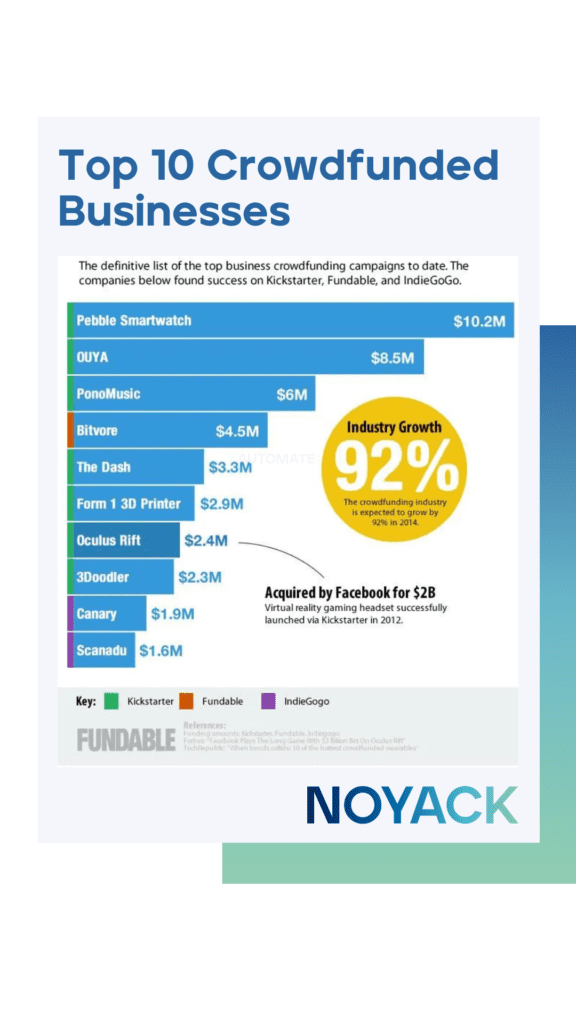

- Oculus (VR): Began with a ~$2.4M Kickstarter to build the Rift headset; acquired by Facebook for ~$2B in 2014—one of the most famous crowdfunding-to-exit stories.

- Exploding Kittens (games): Asked for $10k, raised ~$8.78M from 219k+ backers—the most-backed Kickstarter at the time—then scaled into a durable games company and IP.

- BrewDog (craft beer): Pioneered equity crowdfunding (“Equity for Punks”), raising an aggregate $100M+ from 200k+ investors over multiple rounds, helping fuel global expansion.

- Peloton (fitness hardware): Debuted its connected bike on Kickstarter in 2013, validating demand before scaling into a household brand.

Successful raises show proof before the pitch: waitlists that convert, pilot users, repeat usage, or pre-sales. That evidence reduces guesswork and signals product-market fit, which is the real engine of returns.

Storytelling and distribution make the momentum durable. Clear, honest updates build trust; channel partners or a community flywheel turn early adopters into ongoing sales, supporting follow-on rounds—or exits.

For investors, the edge is disciplined pattern recognition. Look for a tight “job to be done,” credible traction metrics, realistic timelines, and unit economics that can scale. If two pieces are missing, size the check tiny—or skip.

AI Crowdfunding — What’s Working (and What to Watch)

Crowdfunding is a proving ground for AI—agentic tools, vertical SaaS, and AI-enhanced devices. Winners do five things: (1) show a concrete, end-to-end job to be done; (2) highlight a data advantage (integrations, proprietary datasets, compounding feedback loops); (3) provide live proof (public demos, betas, usage metrics); (4) spell out privacy (what’s collected, how it’s used, opt-outs); and (5) share credible unit economics (software: ARPU/churn/support; devices: landed cost/ship dates/warranty).

Traction zones:

- Agentic productivity (calendar/email/CRM) that actually executes tasks

- Vertical AI where domain context beats model size (creators, trades, healthcare admin)

- Devices fusing sensors + on-device models for a tangible “wow”

AI diligence lens:

What’s fully automated (hands-off)? What data improves results and who owns it? Are outcomes reliable vs. “assistant you babysit”? Is there a path from backer hype to sustainable MRR or repeat orders? Keep per-deal sizing modest (≤0.30% of portfolio) and assume multi-year illiquidity.

Where This Fits in Your Wealth Blueprint

Crowdfunding belongs in the Growth layer of your blueprint.

This is the sleeve where you pursue higher potential returns and new return drivers. Crowdfunding and other alternatives fit here because they trade liquidity and simplicity for upside: early equity, niche real estate, private credit, and revenue shares can outperform when execution is strong.

They also diversify—outcomes hinge on product-market fit, lease-up, or cash collections, not daily index moves.

Use small checks to learn, test theses, and build pattern recognition. Cap overall allocation, keep per-deal positions tiny, diversify sponsors and strategies, demand clear terms and fees, and review on a cadence so the Growth sleeve adds value without dominating risk.

Sizing rule of thumb: Start with 0–5% of investable assets across all crowdfunding. Scale only after a year of results and discipline.

Where NOYACK Fits: Using Crowdfunding + AI the Right Way

NOYACK is building AI agents for personal wealth that move people from learning to action: one AI core powering Noyack.ai (education/behavior) and Prophit.ai (portfolio copilot in beta). The approach—mentor, copilot, orchestrator—is paired with steady product cadence (Noyack.ai live, Prophit.ai beta).

A prospective Reg CF community raise, if pursued, would run only through a registered intermediary and after filing; no funds or commitments before then. Why community? Millennials and Gen Z face complexity, fragmentation, and access hurdles during the wealth transfer. Community funding seeds a user base that stress-tests agents, supplies real workflows, and strengthens a moat of integrations and process data. Treat any allocation as long-dated, illiquid, and sized within your Alternatives sleeve.

How to Get Started: A 90-Day Roadmap

Weeks 1–2 — Guardrails & Field Study

Write an Alternatives addendum (target sleeve, per-deal max, “auto-decline” list). Pick one equity portal, one real-estate portal, one syndicate to observe. Build a one-page deal memo template.

Weeks 3–4 — Diligence Reps (No Checks Yet)

Score 5–10 live deals in your template. Hold a weekly 30-minute “IC” to force pass/advance. Track updates for revenue slope, CAC/payback, churn, GM, runway.

Weeks 5–8 — First Tiny Bets

Place 2–3 micro-positions within your per-deal max. For RE: verify basis, debt, sponsor track. For equity: sanity-check valuation vs ARR/users and runway to next milestone.

Weeks 9–12 — Review & Codify

Write a 1-page quarterly review. Decide ongoing cadence (e.g., 1–2 deals/quarter). Keep 90%+ of new savings auto-routed to your core.

Bonus: A Simple Pre-Investment Checklist

- Time & Liquidity: Okay never seeing this money for 7–10 years?

- Sizing: ≤0.30% of portfolio (or your rule)?

- Fees: Do you understand every fee and its impact on net IRR?

- Operator: Track record? Who’s in the deal with you?

- Unit Economics: Startups—GM, CAC/payback, retention. Real estate—basis, DSCR, exit cap.

- Catalyst: What must be true in 12–18 months?

- Kill Switch: What update would make you stop funding follow-ons?

Final Note

Crowdfunding is a tool, not a shortcut. Used with tiny checks, strict rules, and honest reviews, it can add interesting return drivers and sharpen your investor instincts. Used carelessly, it’s accidental tuition. Start small, learn fast, and let process—not FOMO—drive decisions.