What you’ll get in this edition

Credit building isn’t a trick—it’s a way to make money cheaper and speed up ownership. In today’s high-rate world, lenders give their best deals to people who pay on time, keep balances low, and don’t borrow too much compared to their income.

Use credit to buy things that grow your wealth (homes, businesses), not to float a lifestyle. Raise your score, cut interest, and shift borrowing toward assets that pay you back.

Here’s why it matters:

- Opportunity: Lower-cost mortgages, smarter business credit, and better access to funds.

- Why now: Higher rates and stricter lenders reward disciplined borrowers.

- How it works: Keep debt-to-income around 30% or less, credit use under 10% of your limits, and aim for a 760+ score.

- Upside & risks: Cheaper interest and faster compounding vs. the money drain of high-interest debt.

- Where it fits: The Framework layer of your Millennial Wealth Blueprint.

- Action step: Run the 90-day improvement roadmap.

(Quick definitions you’ll see: “Debt-to-income” = how much you owe each month vs. what you earn. “Credit use” (utilization) = balances / credit limits.)

The Credit Illusion

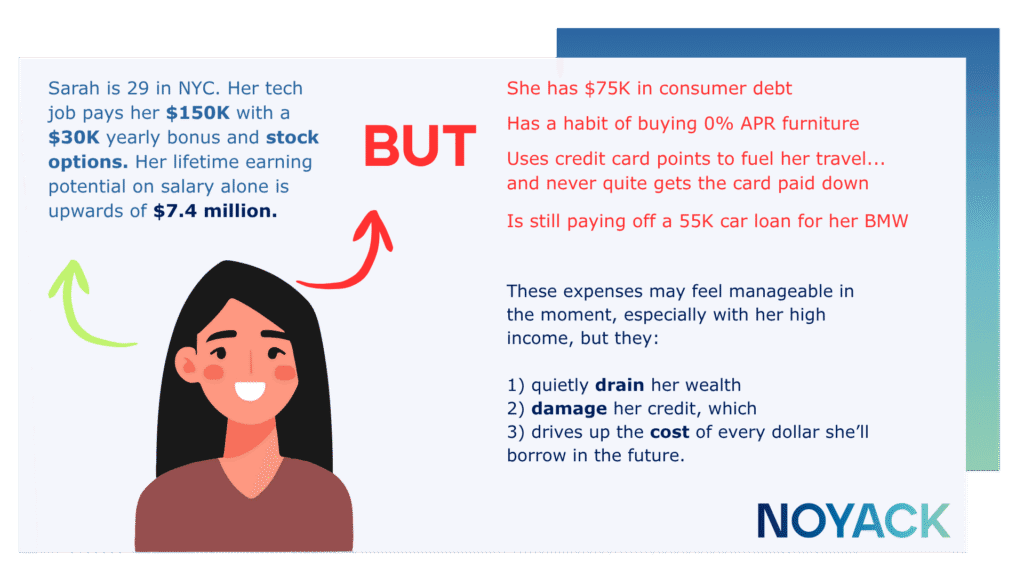

Imagine a 29-year-old in NYC with a $150k salary, $30k bonus, and promising stock options. On paper, it looks great—until you see $75k in consumer debt from “0% APR” furniture, points-fueled travel that wasn’t fully paid off, and a car loan that grew fast.

The problem isn’t effort; it’s using credit to prop up a lifestyle instead of to build ownership.

This is more common than people admit. High earners confuse income with wealth, and interest quietly eats the difference. The fix isn’t to live miserably—it’s to point credit at things that make you wealthier, not poorer.

Why Credit Building Matters in 2025

When rates are high, every fraction of a percent you save really counts. A better score can mean a much lower mortgage rate for decades. Lenders look closely at your debt-to-income, how much of your limits you use, and whether you pay on time—habits, not hype, set your rate.

Big picture, a massive wealth transfer is underway, and the people who can move fast—and close cleanly—will get the deals. If your paychecks depend on vesting or bonuses, strong credit is your safety net when timing is messy.

Four reasons to act now:

- High rates mean each score jump saves real money.

- Tougher lending rules favor clean, organized borrowers.

- Competitive markets pick buyers who are “paperwork ready.”

- Money you don’t spend on interest can be invested to compound.

Credit as a Ladder (Not a Crutch)

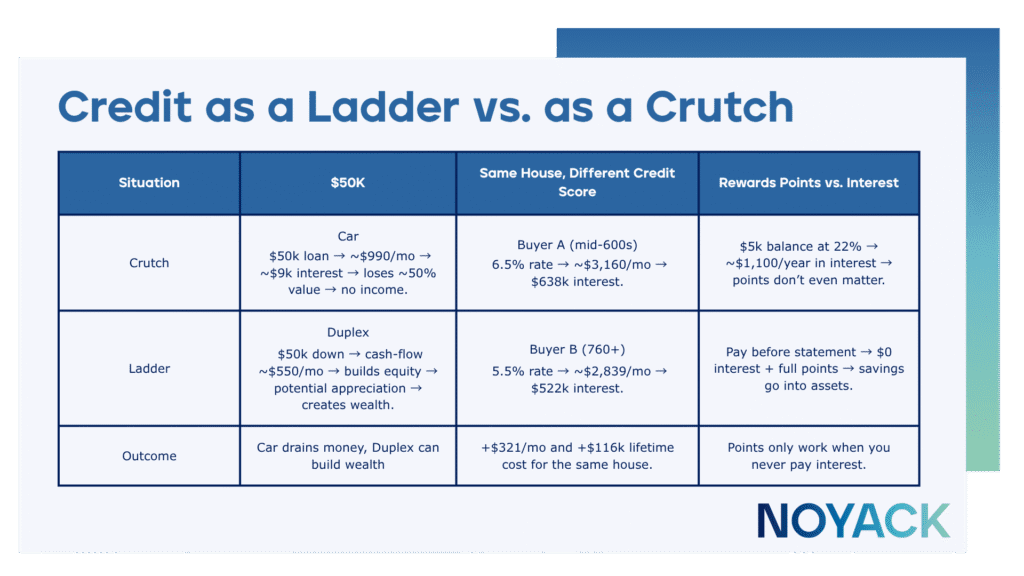

Think of “credit as a ladder” like this: only borrow when what you’re buying is likely to pay you back more than the interest you’ll pay.

That could be a duplex down payment, funds to launch or grow a business, or training and tools that raise your earning power.

A “crutch” keeps up appearances; a “ladder” builds ownership and cash flow. That mindset flips credit from consumption to wealth-building.

How to make the ladder work:

- Qualify cheaply: Aim for a 760+ score, credit use < 10%, and debt-to-income ≤ 30%.

- Borrow for assets: Put credit toward things that hold or grow value and can produce income.

- Mind the gap: Only borrow when your expected benefit is clearly bigger than the interest cost. Refinance later if rates drop.

Guardrails: How Credit Goes Wrong

High-interest credit card debt is a wealth leak. Teaser rates that jump later can crush your budget. Long loans on things that quickly lose value—cars, gadgets, furniture—slowly drain your net worth.

The fix is simple rules: pay on time, keep balances low, avoid opening cards you don’t need, and only borrow for things that help you build wealth.

Guardrails to adopt:

- Never miss a payment—use autopay for at least the statement balance.

- Pay before the statement closes so low balances get reported.

- Skip “debt for toys”—borrow for assets that hold value or earn money.

- Stress-test your budget for higher rates, a vacancy, or a slow month.

The Metrics That Actually Move the Needle

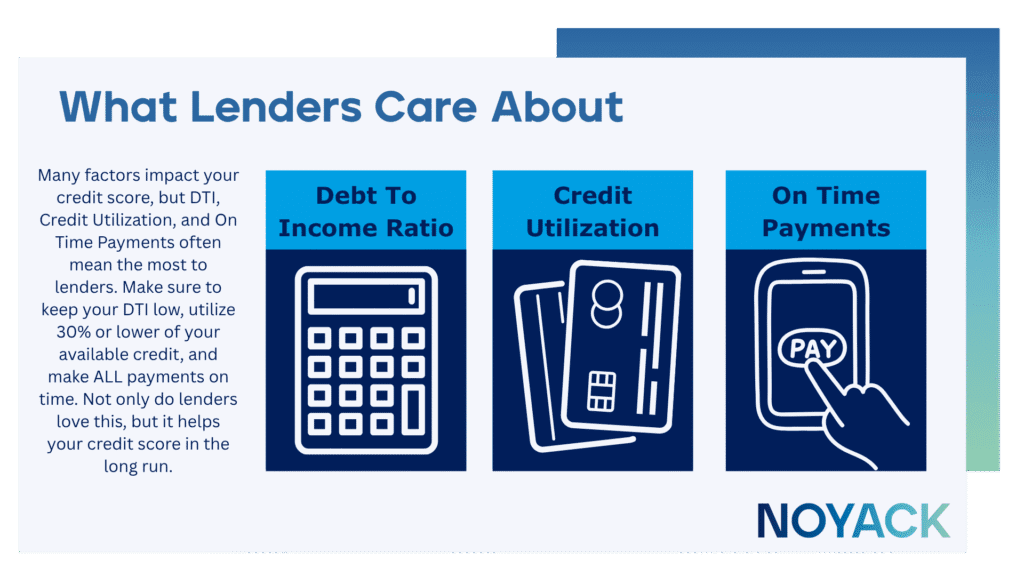

You can control the main things lenders care about.

- Debt-to-income at or below 30% shows you aren’t stretched.

- Credit use under 10% (for each card and overall) keeps your score healthy and steady.

- Score bands rise with on-time payments, an older credit history, and a mix of loan types—one 30-day late can hurt for years.

It’s simple to keep up with this. Keep old accounts open to protect your credit history length, pay small balances off so most cards report $0 at statement time, ask for soft-pull (no hard credit check) limit increases on clean accounts twice a year, and check your reports every few months and dispute mistakes.

How it Impacts Your Wealth

Credit building lives in your Framework layer of Your Wealth Blueprint: the “infrastructure” of your money life.

When that framework is strong, your cost of money drops and your access to money rises. Cheaper, easier capital makes every Growth move (real estate, market investing, or carefully chosen alternatives) more profitable.

Over years, that cost advantage compounds into a real wealth gap.

- Smaller monthly payments without buying worse assets.

- More approvals in hot markets when timing is tight.

- Better negotiation power because you can close on time.

- A steady flow of “interest I didn’t pay” going into investments.

A stronger score and low debt-to-income often unlock better rates and lower fees. Even a small rate improvement can mean tens of thousands less in interest over time. Those dollars don’t vanish—they’re free to be invested. Invested dollars then earn returns, creating a second engine of compounding on top of your assets themselves.

From “Good Intentions” to Better Terms In 90 Days

Days 1–7 — Diagnose.

- Pull all three credit reports and make sure everything is accurate.

- Freeze your credit to block fraud and keep it locked when you’re not applying.

- Map your month: when you get paid, when bills hit, where cash leaks.

- Choose a payoff plan—avalanche (highest interest first) or a hybrid that also pulls any single card below 30% and then under 10% before the statement closes.

Days 8–30 — Quick wins.

- Get each card’s reported balance under 9% of its limit before the statement date.

- Ask for soft-pull limit increases on clean accounts to lower your usage ratio without new hard inquiries.

- Turn on autopay to avoid late fees and score hits.

- Dispute any errors and send a short goodwill note if you have an old one-off late payment.

Days 31–60 — Lower the load.

- Refinance or consolidate only if it truly lowers total interest and you won’t swipe those cards back up.

- If your credit history is thin, consider one low-fee secured card or a small credit-builder loan—just don’t open several new lines at once.

- Keep old accounts open to protect your average age and total available credit.

- Build a small emergency cushion so surprises don’t become late payments.

Days 61–90 — Put credit to work.

- Get pre-approved and run the numbers for a house hack, small multifamily, or a specific business use where payback is clear.

- Keep 3–6 months of reserves and stress-test your plan (what if rent dips or revenue arrives late?).

- Choose fixed-rate debt when you can, and write down your “refi trigger” (a target rate or equity level).

- Set your standing rules: credit use < 10%, debt-to-income ≤ 30%, no lifestyle debt, and borrow only for assets.

Final Word

Our approach is simple: be fundamentals-first and build for durability. Credit building done right follows the same playbook—strong file, low cost of money, smarter access to opportunities.

As your profile improves, strategies like a NOYACK REIT-style approach or curated alternatives become realistic. In that world, credit is a careful bridge to ownership—not a leash that keeps you spending.

Credit building isn’t a trend; it’s infrastructure for your money life. From Foundation to Framework to Growth and Legacy, your credit sets both cost and flexibility—and that shapes everything you’ll own later.

Borrow for assets, protect your cash flow, and stick to the few habits that matter most. Do that consistently, and credit becomes the ladder to real, durable wealth—not a shiny drain on your future.