If your next $5,000 feels “not worth overthinking,” you’re exactly who needs a plan. Not because you’re doing anything wrong—because $5,000 is big enough to move your life forward, and also big enough to disappear into “life stuff” without leaving a mark.

Also: if your number is $500, don’t bounce. Same rulebook—just smaller splits.

Most people don’t mess up because they picked the “wrong” investment. They mess up because they skipped the boring stuff first, got fragile, and then life forced them to undo the plan. The fix is simple: don’t invest out of order.

Here’s the order that works for almost everyone:

- Stabilize cash flow

- Kill high-interest debt

- Build a starter emergency buffer

- Grab your 401(k) match

- Then invest for long-term growth

A few rules that keep you out of trouble:

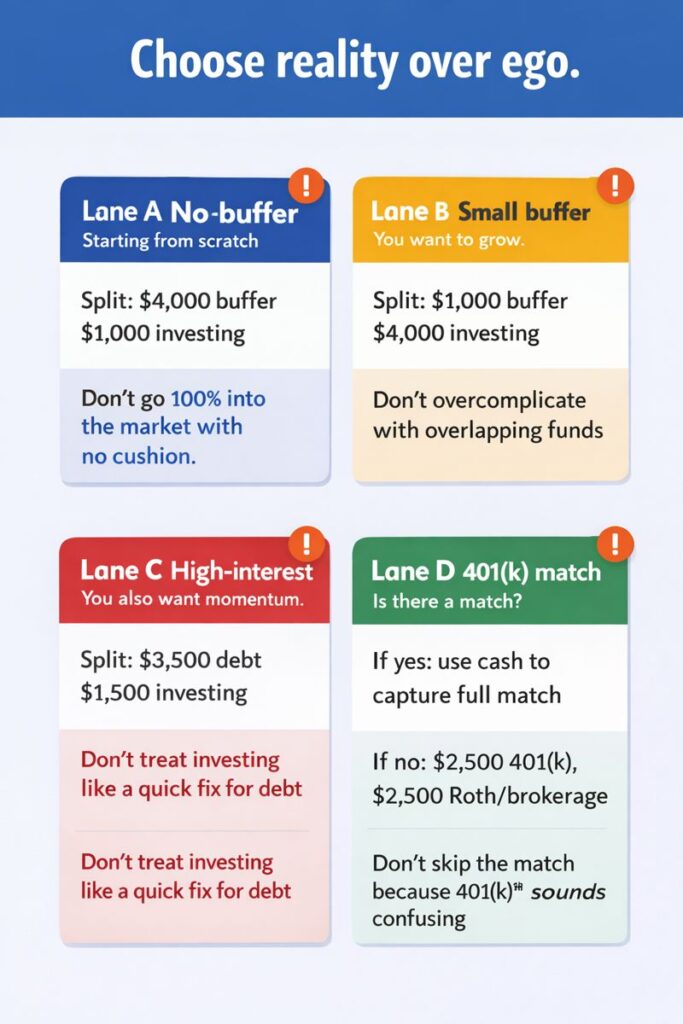

- Pick one lane that matches your real life, not your ego.

- Split the money once and move on—no endless tinkering.

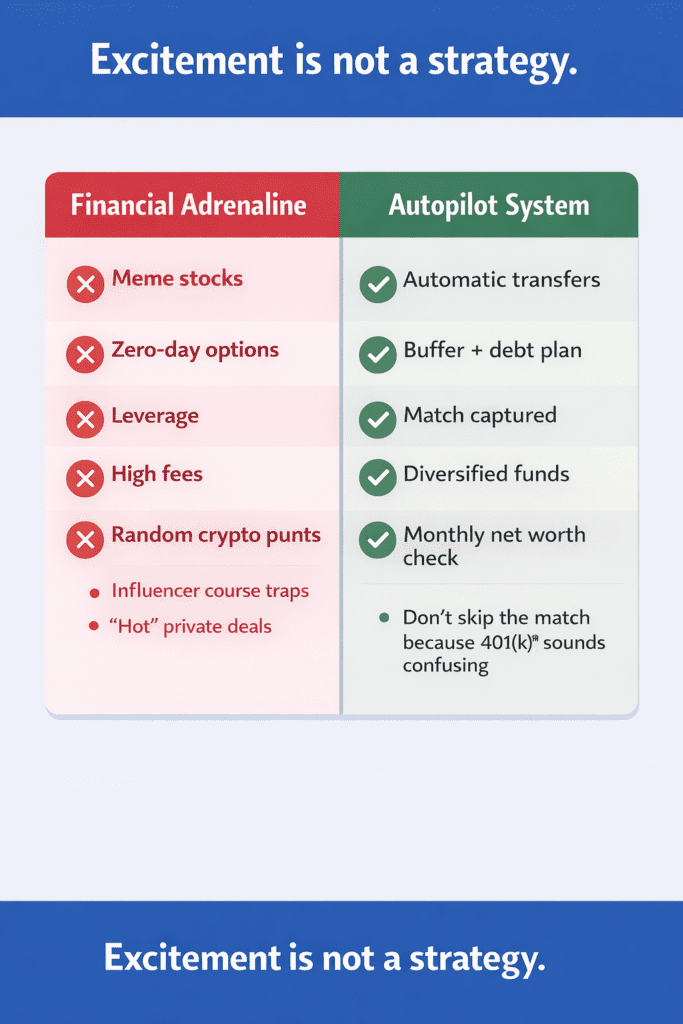

- Avoid “financial adrenaline” (meme stocks, zero-day options, leverage, high fees).

- Automation beats motivation every time.

The goal here isn’t perfection. It’s making one smart move you can repeat.

The $5,000 Game Plan: pick your lane

This isn’t about building the perfect strategy. It’s about making one move that reduces stress, builds momentum, and keeps your investing simple. You’re aiming for a plan that you’ll still follow on a random Tuesday when work is insane and you’re tired.

So instead of trying to do everything at once, pick the lane that matches where you are right now.

Lane A) You’re starting from scratch (no real emergency fund)

If a surprise $500–$1,000 expense would send you straight to a credit card, this is your lane. You don’t need a “better” investment—you need a floor under your feet. That floor is what keeps you from selling investments the first time life happens.

Split the $5,000 (80/20):

- $4,000 → starter emergency buffer

- $1,000 → start investing (to build the habit)

Where it goes (categories, not tickers):

- Buffer: high-yield savings account (separate from your spending account)

- Investing: a broad diversified index fund/ETF, or one all-in-one diversified fund

Why this works: the buffer protects your investing. Without it, you invest everything, something breaks, a surprise bill shows up, and you’re forced to undo the plan. That’s the moment people decide “investing doesn’t work,” when really their foundation wasn’t ready yet.

Common mistake: going 100% into the market with no cushion. That isn’t bravery—it’s gambling on your life staying quiet.

Lane B) You’ve got a small buffer and you want to grow

This lane is for people who can handle a minor surprise without it becoming a crisis. You’re stable enough to prioritize long-term growth, but you still want to reinforce your base so you don’t get knocked off course. Think: growth, with guardrails.

Split the $5,000 (20/80):

- $1,000 → strengthen your buffer

- $4,000 → long-term investing

Where it goes:

- Buffer: high-yield savings

- Growth: diversified index funds/ETFs (whole market), or a target-date fund if you want “set it and forget it”

Why this works: you’re investing meaningfully while lowering the odds you’ll have to stop or sell later. Most wealth isn’t built by big dramatic moves—it’s built by staying in the game.

Common mistake: creating a “fund salad” with too many overlapping picks. Simple usually wins.

Lane C) You’ve got high-interest debt, but you want to start investing too

If you’re paying credit card interest, you’ve got a leak in the boat. Plugging that leak is a guaranteed win. But I get it—you also want momentum, and momentum matters, because habits are half the battle.

Split the $5,000 (70/30):

- $3,500 → pay down your highest-interest debt

- $1,500 → start investing (habit + progress)

Where it goes:

- Debt: highest APR first

- Investing: broad diversified index fund/ETF or a simple diversified fund

Why this works: it’s a realistic compromise. You’re putting out the fire and still building the “I invest every month” identity. Once the debt is under control, you can ramp investing without needing to become a totally different person.

Common mistake: treating investing like a miracle cure for debt. If the interest rate is high, debt payoff is the sure thing.

Lane D) You have a workplace 401(k): the match question

If you have a 401(k), the only first question is: do you get a match? If you do, that match is part of your compensation. Skipping it is basically turning down money you already earned.

If there IS a match

Use your $5,000 as a temporary cushion while you crank up your payroll contributions until you’re getting the full match. You’re not “spending” the $5,000—you’re using it to give your paycheck room to do something smarter for a few months.

How the $5,000 gets used:

- It becomes a paycheck-replacement buffer while contributions rise

Where the 401(k) goes:

- A target-date fund for maximum simplicity, or

- A broad diversified index option if available

Common mistake: skipping the match because it feels confusing. Confusing is fixable. Missed match dollars are usually gone forever.

If there’s NO match

Now you’re choosing between structure (401k) and flexibility (Roth IRA/brokerage). You can do both—without overthinking it.

Split the $5,000 (50/50):

- $2,500 → 401(k) (habit + possible tax benefits)

- $2,500 → Roth IRA or brokerage (flexibility + tax diversification)

Common mistake: picking high-fee “fancy” options because the description sounds impressive. If you don’t understand the fees, pause.

Where NOT to put your next $5,000

If it’s built to spike your adrenaline, it’s probably built to separate you from your money. Your $5,000 is supposed to buy you stability and momentum—not a story to tell your group chat.

Skip:

- Meme stocks and story trades

- Zero-day options

- Leverage/margin

- High-fee products you can’t explain

- Random crypto “punts” (learn first, keep it small and intentional)

- Influencer course traps

- “Hot” private deals you don’t understand (illiquid can mean stuck)

A good rule: if you can’t explain the downside in two sentences, you’re not ready to put $5,000 into it.

The Habit Loop: turning $5,000 into something that lasts

The real secret is boring: automation. The best plan is the one that runs even when you’re busy, tired, or in a “treat yourself” mood. You don’t need a big number—you need a repeatable rhythm.

Start with what you can actually stick to:

- $100/week if that feels doable

- $25/week if you’re building confidence

- $10 twice a week if you’re starting from zero

Then give yourself an upgrade path:

- Every time income goes up, increase contributions by $25–$100/month

- Every time a bill disappears, redirect that exact amount into your lane

- Track net worth monthly—don’t check your portfolio daily (volatility isn’t a personal attack)

Support NOYACK

If you want to support what we’re building, we’re raising on Wefunder. Investing involves risk, including loss of capital, so only invest what fits your situation and timeline.

Invest in NOYACK on Wefunder →https://wefunder.com/noyack

Final Word

You don’t need to do this perfectly. You just need a lane, a split, and one next step you’ll actually repeat. Make it simple enough to stick with, and boring enough to run on autopilot.