TL;DR: What You’ll Get from This Week’s Edition

- Retirement isn’t about old age—it’s about having options, and the earlier you start, the more powerful those options become.

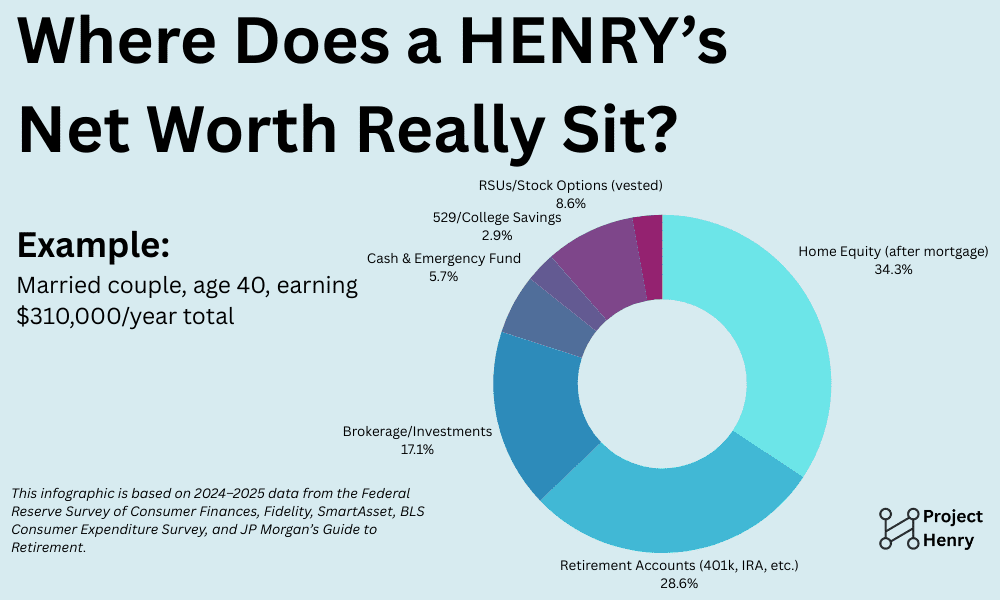

- High-earning Millennials and HENRYs have the income—but often lack the structure to turn income into lasting wealth.

- If you start investing in your 20s or 30s, you’ll need to save less over time and end up with more freedom.

- We’ll show you how to calculate your “Freedom Number,” automate a 20–25% savings rate, and diversify your wealth across tax-advantaged, taxable, and alternative investments.

- Plus: a simple checklist, top tools, and common myths to avoid. You don’t need to feel ready—you just need to get started.

Retirement Isn’t a Cliff You Fall Off—It’s a Path You Choose to Build

Let’s start with a mental image you probably don’t associate with retirement: freedom.

Not golf carts. Not Florida. Not working until 70 and hoping Social Security shows up.

We’re talking about the freedom to choose what you work on, when you work, where you live, and whether you need that next paycheck or you’re just working because you love the game.

That kind of freedom doesn’t show up out of nowhere. It has to be built. Brick by brick. And the most important bricks get laid in your 20s and 30s—the exact years when most high earners aren’t thinking about retirement at all.

If you’re a HENRY—earning well but not yet feeling “wealthy”—this message is for you. Because while your income is growing, your window for compounding your wealth is shrinking. And time—not income—is the real secret to financial independence.

Why High Earners Still Feel Financially Insecure

If you’re making $100K+, congratulations—you’re in the top 15% of income earners in the U.S. But if you’re still feeling like you’re behind, that’s not a personal failing. It’s structural.

The truth is, most high earners are surrounded by expensive cities, rising costs, student debt, and a culture that tells them “you deserve this” every time they make a new purchase. Add in the pressure to invest, give back, and not feel like a financial robot—and you’ve got a cocktail of earn a lot, save a little, and feel like you’re always catching up.

That’s where we come in.

Retirement planning—done right—isn’t about guilt. It’s about agency. And it starts by redefining what “retirement” actually means for our generation.

Retirement ≠ Stopping Work. It Means Owning Your Time.

Forget the retirement narrative your parents or grandparents followed. The idea of working 40 years at one company and getting a pension? That world’s long gone.

Today, retirement means having enough assets working for you that you no longer have to trade time for money.

And for most of us, retirement isn’t about stopping work. It’s about:

- Starting your own thing

- Pivoting to something more creative

- Raising a family without financial panic

- Walking away from toxic bosses

- Moving to a different country or state because you can

We call this financial optionality, and it’s what every high earner should be aiming for.

How Much Is Enough? Here’s the Math.

Let’s get into the numbers.

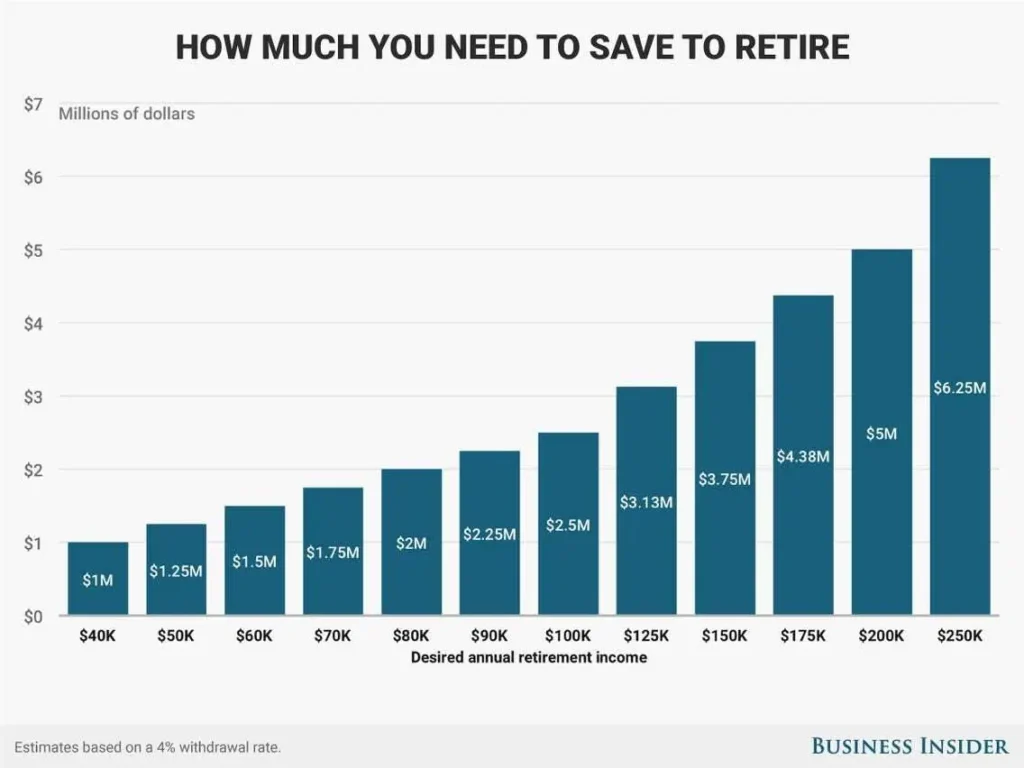

To replace $100K/year in retirement, a good rule of thumb is to save 25x your desired annual spending. So that’s a retirement target of $2.5 million if you want to live on $100K/year.

You might think, “Okay, but I’ve got decades to go—why stress now?”

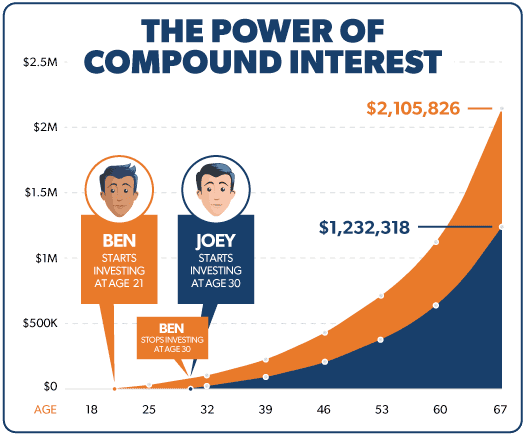

Because the math strongly favors the early starter.

📊 If you start saving $1,500/month at 30, and earn 7% returns, you’ll have $1.8M by 60.

Wait until age 40 to start—and you’ll only have $1.1M, even if you save the same amount.

Want to catch up? You’ll need to double your monthly contribution to over $3,000/month.

The kicker? Starting early doesn’t require massive income. It just requires consistent action and smart allocation.

The 3 Most Dangerous Myths HENRYs Believe

Let’s address the biggest excuses that stop high earners from building their retirement base early:

Myth #1: “I’ll Save More Later, When I’m Earning More”

This is the lie lifestyle creep loves to hear. As income rises, so do expenses—new apartment, nicer car, spontaneous trips, the upgraded grocery store.

Unless you build your savings habits while money still feels tight, you won’t save “more” later—you’ll just spend more.

Automating a 15–25% savings rate today is easier than trying to make up for lost time in your 40s.

Myth #2: “My 401(k) Is Enough”

It’s not.

A 401(k) with an employer match is a fantastic starting point—but most people with only a 401(k) end up with nowhere near enough to support a 30-year retirement.

You need to build across three wealth buckets:

- Tax-advantaged: 401(k), Roth IRA, HSA

- Taxable brokerage: Accessible capital for flexibility and early retirement

- Alternative investments: Real estate, private credit, VC, fine art—assets that grow differently than stocks

You’re not just building a portfolio. You’re building a system that gives you resilience and flexibility.

Myth #3: “I Don’t Know What I Want Retirement to Look Like Yet”

That’s exactly why you need to start now.

Planning for financial freedom isn’t about scripting every detail of your future. It’s about creating the foundation for a life you get to design later—without money being the constraint.

Think of it like this: you don’t have to know the final destination to start fueling the rocket.

What Should You Be Doing Right Now?

Here’s the 2026 Wealth Builder Retirement Starter Plan, simplified and streamlined for busy HENRYs.

✅ Step 1: Calculate Your Freedom Number

Use the 25x Rule: Multiply your desired annual income by 25.

$100K/year = $2.5M portfolio goal.

$80K/year = $2M.

🔧 Tools to help you run the math:

- Empower Retirement Planner

- MadFientist’s FI Lab

✅ Step 2: Lock in a 20%+ Automated Savings Rate

The best time to automate was yesterday. The second-best time is today.

Split it between:

- Your 401(k) (at least up to the employer match)

- Roth IRA (if income-eligible or via backdoor)

- Taxable brokerage

- Alternative platforms like NOYACK’s VC and private credit funds

Start small if you need to. But automate it. Set it and forget it.

✅ Step 3: Reroute Lifestyle Creep

Every raise = 50% to the future, 50% to lifestyle.

You still get to celebrate your wins—just not at the expense of your freedom.

✅ Step 4: Build a 3-Bucket Wealth System

| Bucket | Examples | Purpose |

| Tax-Advantaged | 401(k), Roth IRA, HSA | Long-term compounding |

| Taxable | Brokerage accounts, ETFs | Mid-term access + flexibility |

| Alternatives | Private credit, REITs, fine art, VC | Non-market-correlated growth + yield |

🛠 NOYACK makes it easier to start with alternatives that don’t require $250K minimums or institutional access.

✅ Step 5: Protect Your Progress

You’re not just building wealth. You’re building a life. Protect it:

- Term life insurance if anyone depends on your income

- Basic will or trust (try Trust & Will)

- Update beneficiaries on all accounts annually

Real Talk: You Don’t Need to Be Rich to Plan Like You Are

The mistake most high earners make is assuming they’ll start thinking about retirement when they feel ready. But readiness doesn’t come with age. It comes with structure, confidence, and repetition.

By saving early, automating well, and building a plan that actually flexes with your life—not just your tax bracket—you’re giving yourself the one thing money can’t buy later: time.

Your Wealth Building Retirement Checklist

📌 Calculate your Freedom Number

📌 Automate 20–25% savings/investment rate

📌 Max out 401(k) match + explore a Roth IRA

📌 Build your three wealth buckets (tax-advantaged, taxable, alternatives)

📌 Reroute raises toward savings/investments

📌 Protect your family with insurance and estate tools

📌 Revisit your plan once a year—on your birthday, or tax day

The NOYACK POV

At NOYACK, we believe personal wealth management isn’t just about investments—it’s about access, education, and freedom. You don’t need a private banker to build a powerful wealth engine. You need the right mindset, tools, and playbook—delivered in language you actually understand.

We created the NOYACK Wealth Weekly, the NOYACK Investing Club, and our soon-to-launch Academy because we saw the gap: A generation finally earning—without a map for what to do next.

Let this newsletter be your compass.