TL;DR

Real saving isn’t about funding your lifestyle. It’s about protecting it—and expanding it. By dividing your money into three savings buckets—Emergency, Opportunity, and Freedom—you create clarity, purpose, and financial confidence.

- Emergency Fund = protection (3–6 months of essentials in safe cash).

- Opportunity Fund = “yes money” (5–10% of net worth; flexible, but not for lifestyle).

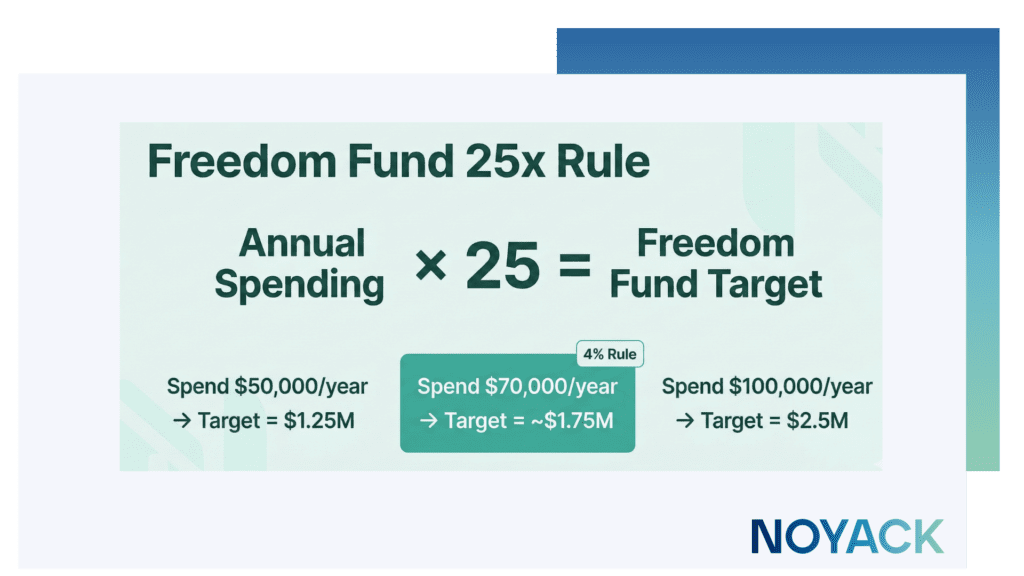

- Freedom Fund = long-term wealth (invested; target = 25× annual spending).

- A car fund is planned spending. Useful—but not savings.

Let’s break down how each savings bucket works—and why it matters.

Ready to build the system (not just read about it)? Share this newsletter with a friend

Most People Think They’re Saving—They’re Not

Most people feel like they’re saving because they’ve got money set aside: a travel account, a wedding fund, the “next car” stash. That’s not irresponsible. But it’s not wealth-building savings either. Those are future expenses with good PR.

Real savings does three things:

- Protects your lifestyle from chaos.

- Funds rare opportunities you’ll be glad you said yes to.

- Buys time—so work becomes a choice, not a requirement.

If you’re a Millennial HENRY (High Earner, Not Rich Yet), this matters even more. High income can hide weak foundations. You can earn a lot and still be one surprise away from stress. The fix isn’t more complexity—it’s a clearer system.

Enter the 3-Bucket Savings Plan: Emergency, Opportunity, Freedom.

🛟 1. The Emergency Fund – Your First and Most Critical Savings Bucket

This is where every adult’s savings plan must begin.

The Emergency Fund is the savings bucket that exists to protect your lifestyle from chaos. Think of it as your personal shock absorber for life’s financial curveballs. If you lost your job tomorrow, had a sudden medical bill, or your car broke down—could you handle it without panicking or going into debt?

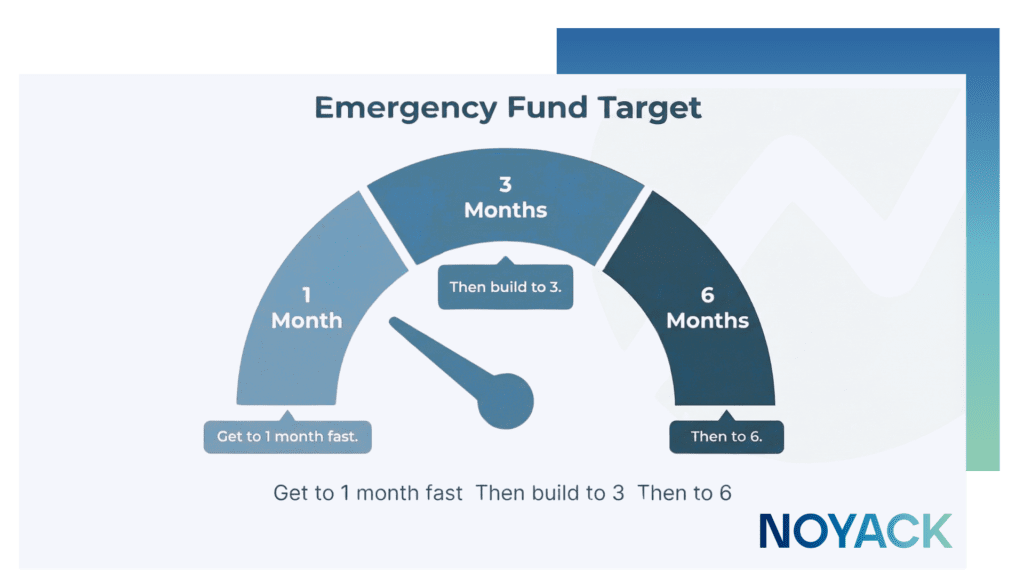

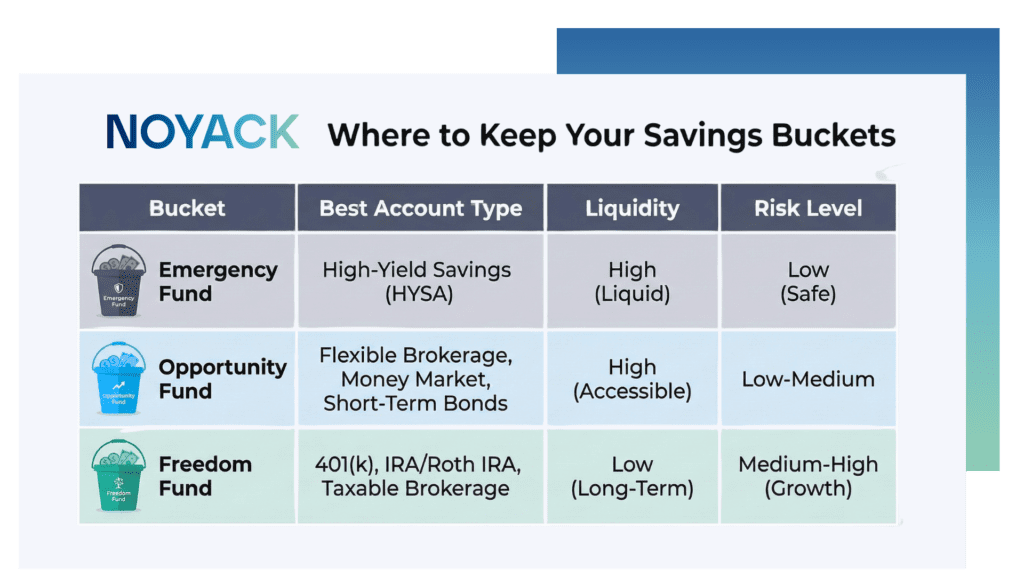

That’s what this bucket is for. It gives you the power to say, “I’ve got this,” when life throws punches. Aim for 3 to 6 months of essential living expenses in cash or a high-yield savings account. This bucket must be liquid and safe—not invested or at risk.

What should your Emergency Fund cover?

- Rent or mortgage

- Utilities

- Insurance premiums

- Food and transportation

- Minimum loan or credit card payments

What qualifies as an emergency?

- Job loss

- Medical or dental expenses

- Home or auto repairs

- Family emergencies

Why it matters:

Without this savings bucket, every minor crisis becomes a major one. With it, your savings plan becomes bulletproof.

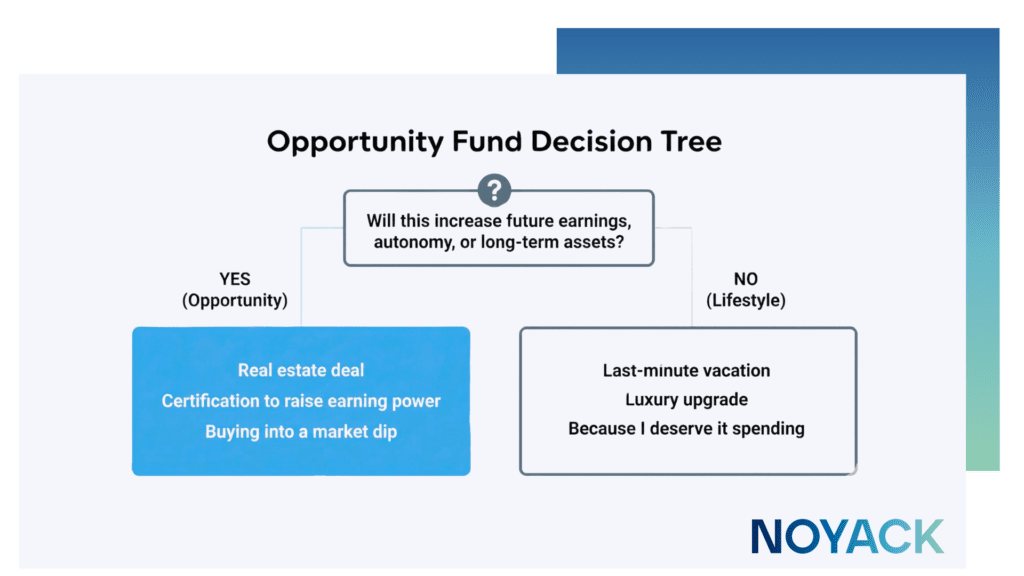

💸 2. The Opportunity Fund – Your “Yes Money”

Most savings plans only focus on avoiding disaster. But what about seizing the moment? That’s where the Opportunity Fund—your second savings bucket—comes in. This isn’t about defense. It’s about offense.

This savings bucket is designed to give you fast, confident access to capital when life presents rare chances—ones that can significantly elevate your financial position, career, or personal growth.

What might you use your Opportunity Fund for?

- Jumping on a real estate deal

- Investing in a startup or private fund

- Paying for a professional course or certification

- Buying into the market during a dip

- Funding a sabbatical or entrepreneurial venture

What not to use it for:

- Last-minute vacations

- Luxury purchases

- Lifestyle upgrades that don’t increase your future earnings or autonomy

Savings target:

Set aside 5–10% of your net worth in this bucket. This can live in a flexible brokerage account, short-term bonds, or a high-yield savings account—not locked up in retirement plans.

Why it matters:

Without this strategic savings bucket, you’re stuck watching others take action while you miss the moment.

When opportunities arise, you want to be the person who says “yes”—not “I wish I could.”

🕊️ 3. The Freedom Fund – The Long-Term Core of Your Savings Plan

This is the final and most powerful savings bucket. We call it your Freedom Fund—because that’s exactly what it buys: Time, options, and control over your life.

Unlike your other buckets, the Freedom Fund is not for emergencies or immediate use. It’s the centerpiece of your long-term savings plan—your retirement, your “work optional” wealth, and your legacy.

What does your Freedom Fund allow you to do?

- Retire early—or just retire well

- Take a career break or start a business

- Support aging parents or raise a family without financial stress

- Walk away from toxic situations without fear

- Leave a meaningful legacy for your family or community

Savings target:

Use the 4% Rule: Multiply your annual lifestyle cost by 25. If you spend $70,000/year, your Freedom Fund goal is $1.75M.

This bucket should be invested for long-term growth:

- IRAs and Roth IRAs

- 401(k)s

- Taxable brokerage accounts with diversified portfolios

- Alternative investments, like REITs or private equity, for diversification

Why it matters:

This savings bucket makes work a choice, not a requirement. It gives you power—not just over your finances, but over how you live your life.

🚘 But Wait… What About the Car Fund?

Let’s be clear. A car fund, travel fund, or wedding fund is not a savings bucket.

It’s a planned spending account—and it’s important, sure. But it doesn’t protect you. It doesn’t grow your net worth. And it definitely doesn’t build wealth.

You can (and should) budget for those goals—but don’t confuse them with savings. True savings protects, multiplies, and frees you. Lifestyle spending doesn’t.

📊 Why This 3-Bucket Savings Plan Actually Works

The average person has money scattered across accounts with no clear purpose.

That leads to confusion, anxiety, and missed goals.

The 3-Bucket Savings Plan fixes all of that.

Here’s why it works:

- ✅ Clarity: Every dollar has a job—no confusion about what goes where

- ✅ Purpose: Each savings bucket is tied to a real-life outcome: protection, opportunity, or freedom

- ✅ Simplicity: You don’t need a finance degree to follow this plan

- ✅ Scalability: Whether you make $50K or $500K, this plan adjusts with you

- ✅ Behavioral strength: You’re less tempted to misuse funds when you know the bucket’s purpose

🔁 How to Set Up Your Savings Buckets Today

- Label your current accounts: Rename them based on your savings buckets—Emergency, Opportunity, Freedom

- Calculate your targets:

- Emergency Fund = 3–6 months of essentials

- Opportunity Fund = 5–10% of net worth

- Freedom Fund = 25x your desired annual lifestyle

- Emergency Fund = 3–6 months of essentials

- Automate transfers: Set it and forget it—automate a % of your income to each bucket

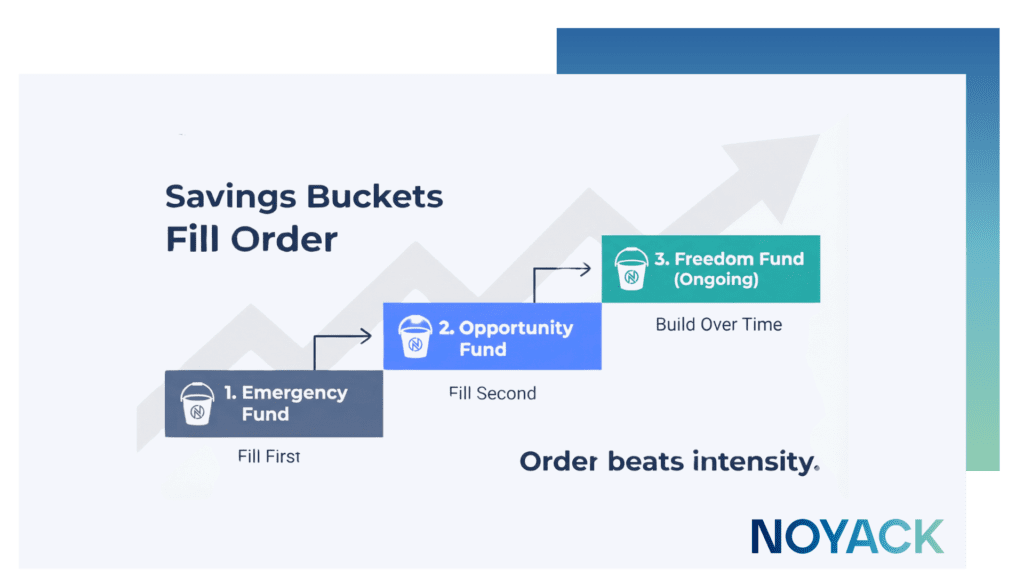

- Fill your buckets in order:

- Start with Emergency

- Then Opportunity

- Finally, build your Freedom Fund over time

- Start with Emergency

- Review quarterly: Your savings plan should evolve as your income, goals, and life change

🧠 Final Thought: Your Savings Plan Should Match Your Life Plan

Most people think of savings as a number. At NOYACK, we teach it as a strategy.

With this 3-Bucket Savings Plan, you’re not just saving for “someday”—you’re building the foundation of a life you control.

Each bucket plays a role:

- One protects your lifestyle

- One elevates your lifestyle

- One eventually frees you from needing a lifestyle at all

When your savings plan is this clear, you stop reacting—and start designing your life.

📬 Ready to Level Up?

NOYACK’s Web app walks you step-by-step through real personal wealth systems—from savings to investing, taxes to legacy.

We don’t just teach theory. We give you the tools and access to build it for real.