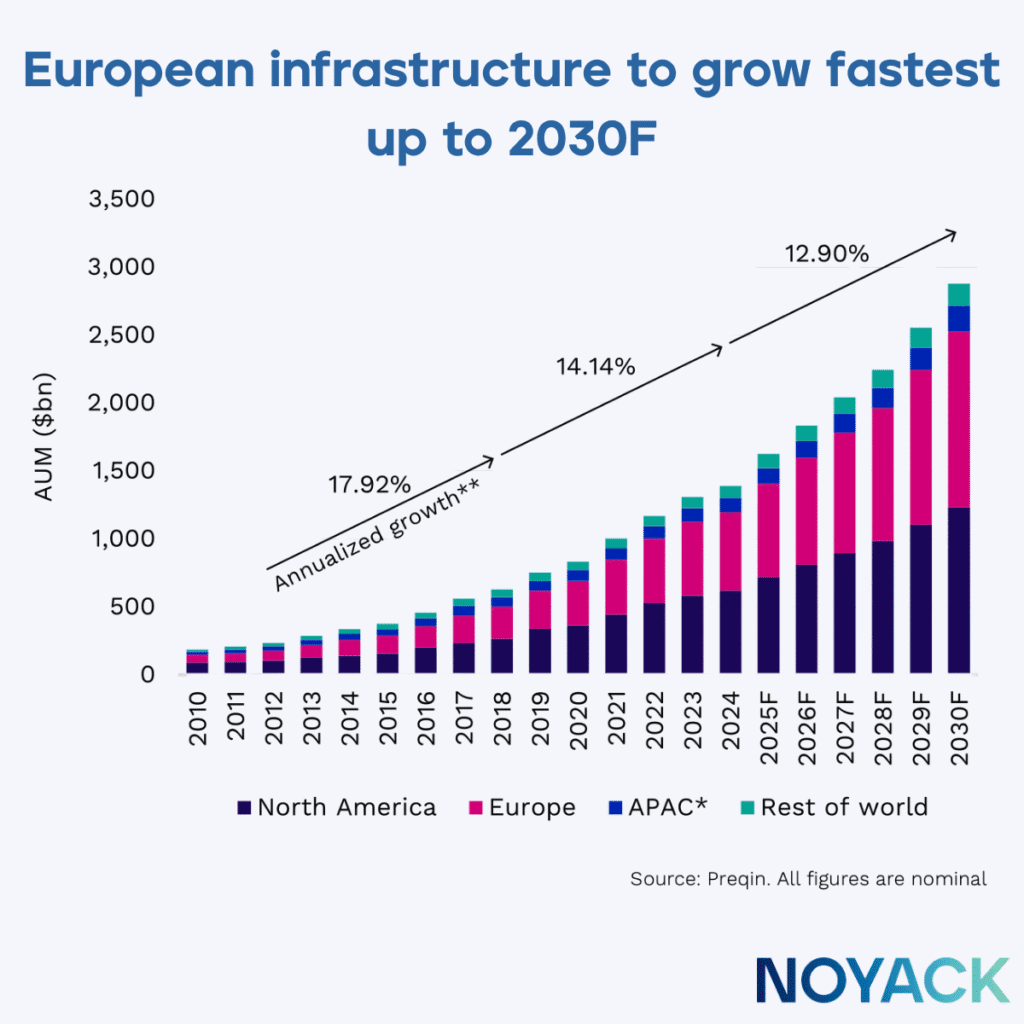

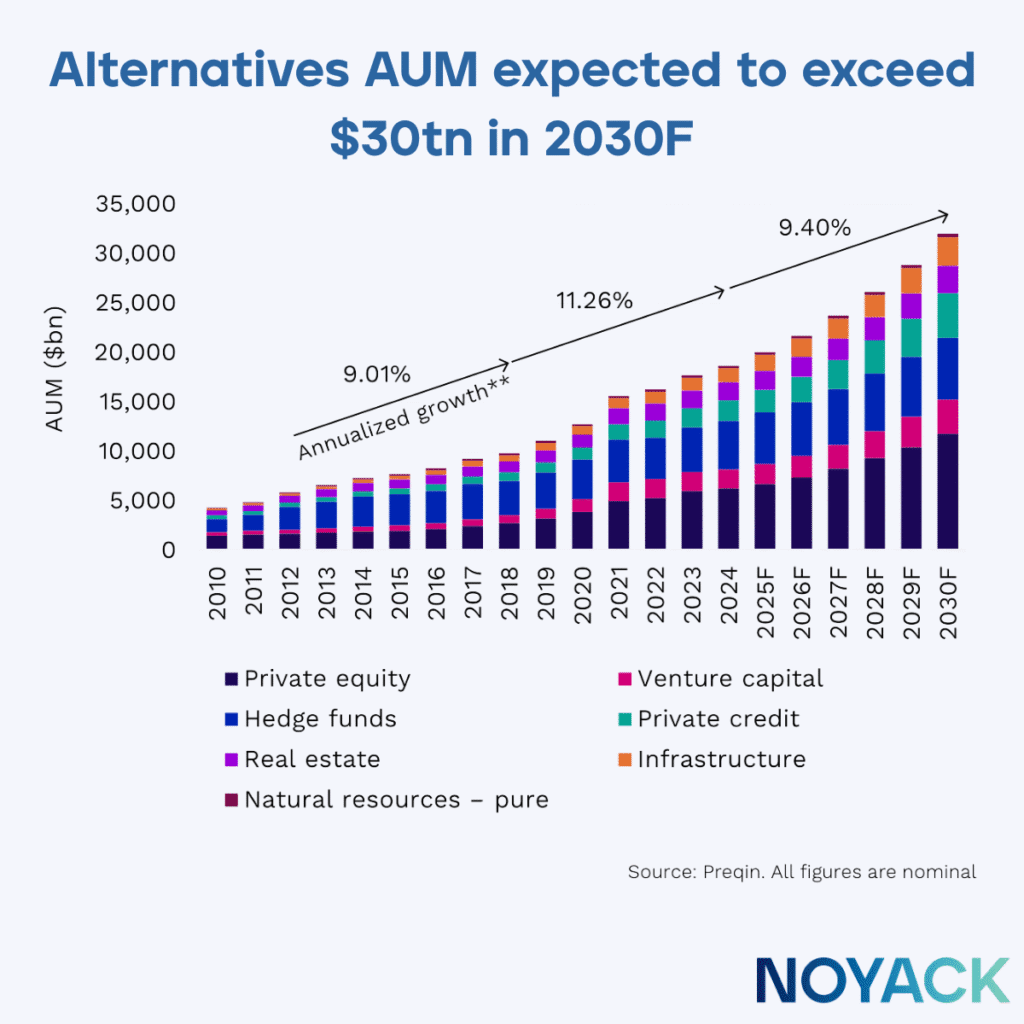

Preqin’s latest outlook signals a decisive backdrop for alternative investments. The firm expects global alternatives AUM to exceed $30T by 2030, with two standouts shaping the next leg: private credit entering maturity as more-liquid fund structures broaden access, and infrastructure accelerating toward ~$3T with Europe outpacing North America.

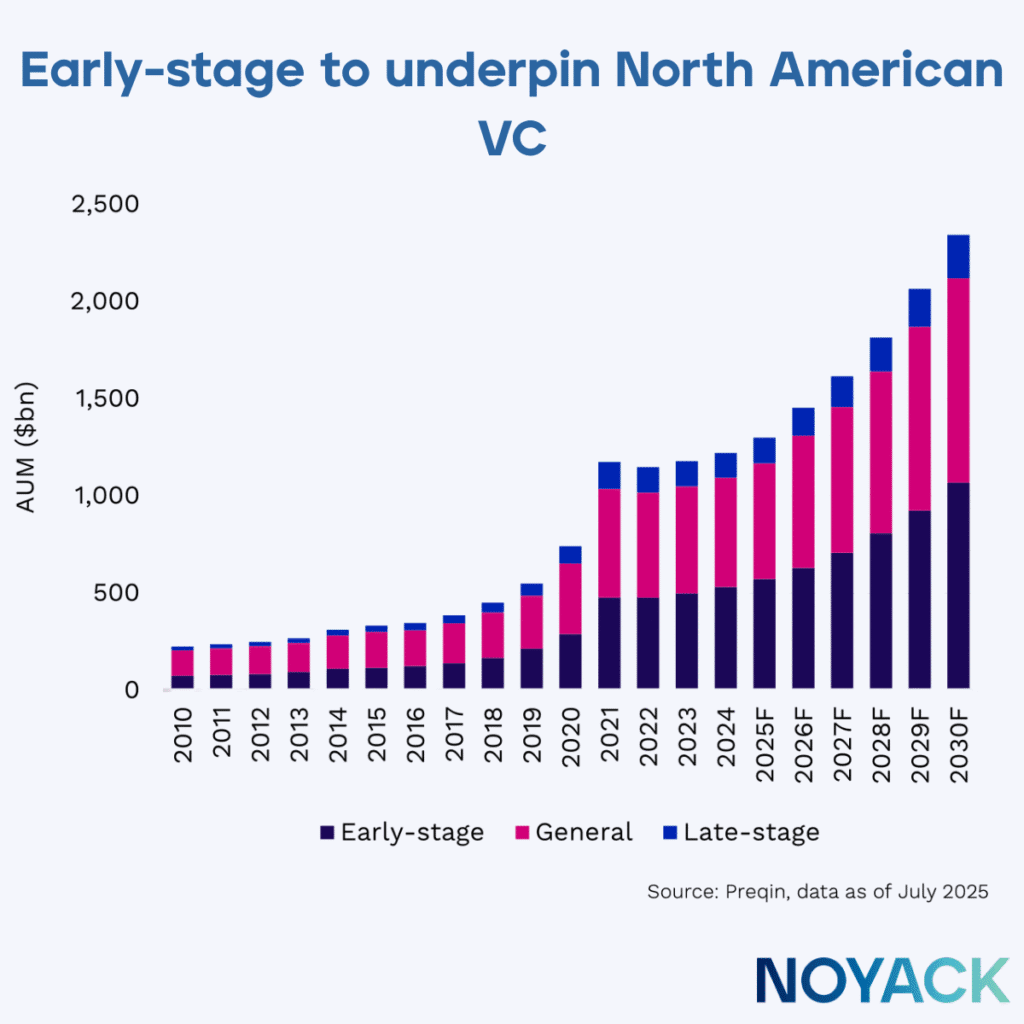

Add a growing private-wealth channel and an AI tailwind for both venture formation and PE operating efficiency, and you have a practical setup to build one small, purposeful sleeve you can actually hold through noise.

This week, we break it down—your essential guide through year-end.

The quick take: why alternative investments matter now

Markets look set to thaw. Preqin thinks more companies will find buyers again, which could start a new upswing in private markets as interest rates settle, prices between buyers and sellers line up, and more money shifts from public stocks to private deals.

In that setting, fund structures are improving, not just the assets themselves: private credit is rolling out more flexible vehicles that make putting money in (and taking some out) easier. Infrastructure is also moving to the front of the line as countries spend on energy and the digital backbone, with assets on track to near $3T by 2030—Europe leading that push.

Everyday investors like you will see more ways in as the private-wealth channel grows, and AI is boosting both new company formation and the efficiency of businesses owned by private equity. Bottom line: pick one clear job for your sleeve—income, inflation defense, or a small shock absorber—and build it on purpose.

Key signals at a glance

- Alternatives AUM expected to exceed $30T by 2030.

- Private credit is “entering maturity” with more-liquid fund structures to support growth.

- Infrastructure AUM approaching ~$3T by 2030; Europe growing fastest.

- The private-wealth channel is set to take a bigger share of fundraising by 2030.

- AI tailwind: more start-ups and operational efficiency in PE-backed companies.

Five Preqin trends to design around

The backdrop to plan against

Deals are starting to close again, which can restart activity across private markets as interest rates settle and buyers and sellers get closer on price. In that setup, private credit is rolling out more flexible funds that make it easier to put money in—and get some out on a schedule—so it’s competing more directly with banks.

Infrastructure is moving up the priority list as countries spend on energy and the digital backbone; the category could be near $3T by 2030, with Europe out in front. Meanwhile, everyday investors matter more as the private-wealth channel grows, and AI is doing double duty—helping launch new companies and making private-equity-owned businesses run smarter.

Bottom line: pick one clear job for your allocation—income, inflation defense, or shock absorber—and build it deliberately.

What this means for you

- Build allocations you can actually hold. Fund terms and access points are improving, so set rules you can stick to.

- Look wider in infrastructure. Expect more opportunities globally—especially in Europe.

- Assume AI will shape winners. It’s fueling new startups and making portfolio companies more efficient, which can drive returns.

Where alternative investments help—and where they don’t

When you use alternative investments the right way, they do a specific job in your plan.

- For income: diversified senior private credit can anchor a steady paycheck. It’s mostly floating-rate loans with lender protections, and newer fund options make it easier to add money on a schedule.

- For inflation defense: core infrastructure (think utilities, energy pipelines, data centers) often has regulated or contracted cash flows that adjust over time, which helps your spending power keep up. The category is growing fast, especially in Europe.

- For shock absorption: keep a small slice in a liquid diversifier (like managed futures/global macro) that can sometimes move differently from stocks and bonds.

Watch-outs to remember

- Semi-liquid isn’t instant. Caps, gates, and queues can slow redemptions—plan for multiple windows.

- Rising rates bite leverage. Buyouts and real estate can get squeezed when debt costs jump or loans need refinancing.

- “Smooth” marks can lag. Private valuations often update slowly, so drops may show up later.

- Manager > label. Results are driven by underwriting quality and all-in fees more than by the category name—do the diligence.

Quick selector: pick the sleeve that fits the job

If income is the job → Favor private credit (diversified senior); the market is adding more-liquid structures that support steady, periodic flows.

If inflation defense is the job → Use core infrastructure—a category approaching ~$3T with Europe as a key growth driver; focus on regulated/contracted cash-flow linkages to usage or escalators.

If shock absorption is the job → Keep a small liquid diversifier; size it so the hedge never becomes the headline.

Reminder: Labels don’t protect you—structure and sizing do.

What to do (now → year-end): a practical month-by-month plan

The goal is a right-sized sleeve of alternative investments that supports your plan without straining liquidity. Here’s a cadence that moves you from intent to implementation.

Late October (this week): define the sleeve & the rules

Start by protecting flexibility—hold 6–12 months of essentials and 12–24 months of known big spends outside alts.

Write one line that forces clarity: “My alternative-investments sleeve is for [income / inflation defense / shock absorber].” Then match the wrapper to the job:

- If the job is income: compare semi-liquid interval/tender funds with closed-end drawdowns. Newer, more-flexible credit funds make steady, scheduled adds easier.

- If the job is inflation defense: pick infrastructure—listed, semi-liquid, or private—aiming for regulated/contracted cash flows. Europe is an expanding opportunity set.

- If the job is shock absorption: use a daily-liquid diversifier (e.g., managed futures/global macro) and keep it small.

Before you commit, write down the three must-knows for any fund: notice period, gates/caps, and payment timing—so you can predict how it behaves under stress.

End-of-month check: could you leave this sleeve untouched for a few windows if markets wobble? If not, resize it.

November: pick the wrapper, then the manager

Week 1 — Pick the fund type (fit your cash rhythm)

If your goal is income, see if a semi-liquid fund (scheduled purchase/redemption windows) fits how you get paid and save.

If your goal is inflation defense, stick with infrastructure—choose listed, semi-liquid, or private based on your timeline and cash-flow needs.

Weeks 2–3 — Build a shortlist (then pressure-test it)

- Private credit: aim for diversified senior funds. Ask for a realized loss write-up, examples of covenant enforcement, and a sample underwriting memo.

- Infrastructure: favor operating assets with regulated rates or clear escalators; check cash-flow durability under different scenarios.

- For any fund: read the docs out loud for notice period, gates/caps, and payment timing. If it breaks your rules, cut it.

Week 4 — Set size and pacing

Cap the sleeve as a % of investable assets after cash, and phase in (e.g., three equal additions over upcoming windows/quarters).

If any legacy positions don’t match the sleeve’s job, plan a deliberate reshape (scheduled trims or secondaries), not a fire drill.

End-of-month check: you should have a chosen fund type, a ranked manager shortlist, and a written plan for size and add cadence.

December: paper the process & automate it (hello, AI)

First half: deepen diligence.

Ask each manager for:

- Two realized loss write-ups (what went wrong and what they learned)

- Performance by year and sector

- A sample investment/credit memo

- Capacity limits (how much they can prudently manage)

- GP commit in dollars (how much of their own money is in the fund)

Tie every item back to your sleeve’s job (income, inflation defense, or shock absorber).

Second half: write the one-pager and automate it.

Create a one-page Alternative Investments Policy that spells out: job, target %, min/max range, add/trim rules, the liquidity terms you’ll accept (notice period, gates/caps, payment timing), and your exit plan. Then automate it: use a tool to schedule contributions, set reminders for notice and redemption dates, and run simple “what-if” tests (taxes, tuition, home projects) against each fund’s terms so you stick to the plan when headlines get loud. And, of course, NOYACK.ai is here to help with your questions.

Year-end check: start January with your cash buffer set, the sleeve’s job defined, the fund type chosen, and your automations in place.

6) The role of AI (markets + your workflow)

AI sits on both sides of the table. On the market side, Preqin calls it a core driver for VC and a source of operational efficiency for PE-backed companies—two levers that can lift productivity and shape future dispersion.

On the allocator side, AI should reduce behavior tax: it can remember notice windows, forecast cash-flow clashes, and nudge you to follow your plan when headlines glare. If AI improves company productivity, let it upgrade your allocation discipline too.

Bottom line

Alternative investments are tools to build staying power—not trophies to collect. The win is a sleeve you can hold through queues, gates, and headlines. Make liquidity your anchor, clarity your compass, and discipline your map: decide the job, match the wrapper, and pre-write how you’ll add, trim, and exit—before the next test. Explore NOYACK’s investment options → wearenoyack.com/invest