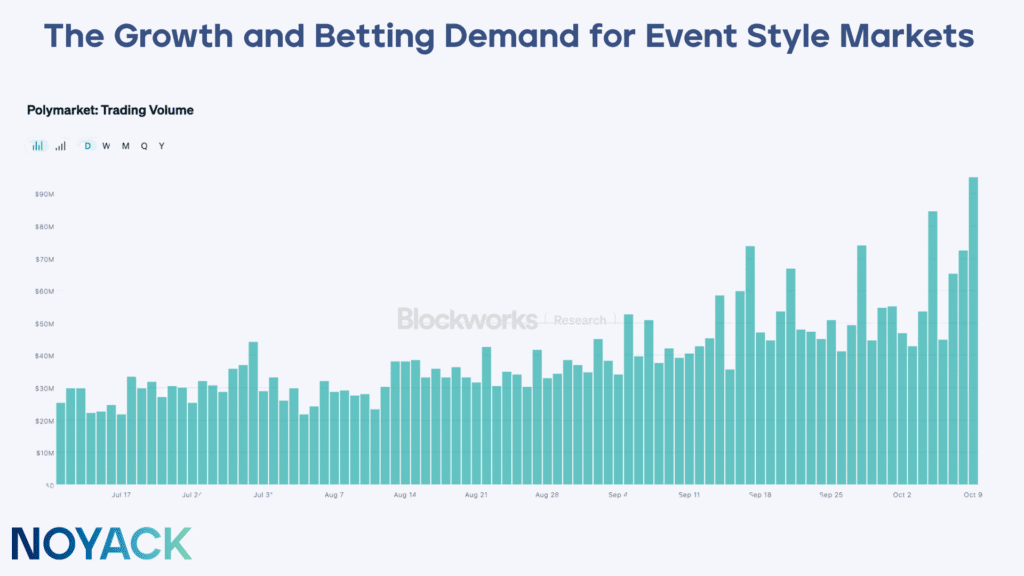

Prediction markets are graduating from the fringe to the front row. Money is pouring into places where you can bet on real-world outcomes, and that glow is rubbing off on “mirror tokens.” Here’s the unvarnished truth: mirror tokens act like wagers, not investments. You’re buying speed and a shot at a quick pop—not a slice of a business that throws off cash and compounds quietly in the background.

Think of them as headline bets with a slick wrapper. The mechanics feel familiar to anyone who’s glanced at Polymarket or placed a prop on DraftKings: odds move, clocks tick, and friction—spreads, fees, slippage—takes its cut no matter how sharp your take. That doesn’t make them evil; it just makes them something different from investing.

And that distinction matters. Mixing up gambling with investing is how solid plans get torched. If you still want to step into this sandbox, treat it like entertainment: tiny stakes, hard limits, written rules—then stick to them while your real investments do the slow, boring work that actually builds wealth.

What Mirror Tokens Are (Plain English)

Mirror tokens come in two common flavors. First are event-linked mirrors: “If X happens by Y date, pay Z.” Think: “IPO within 18 months pays $160 on $100.” Miss the window and you might get less—or nothing. Second are synthetic price trackers: tokens that try to mirror the price of something (gold, S&P, sometimes a single stock) around the clock. They use smart contracts and oracles, which usually hold…until they don’t. They are not traditional tokenized assets.

- Event-linked mirrors = binary, time-boxed bets with a posted payout.

- Synthetic trackers = 24/7 “price mirrors” that can wobble (de-peg) under stress.

- Neither confers dividends, voting rights, or ownership. You’re buying exposure, not equity.

That’s the core truth: you’re not building a stake in anything productive. You’re buying a ticket with rules.

How This Maps to Gambling You Already Know

If you’ve used Polymarket, you already speak the language: it’s Yes/No on headlines with settlement rules. Event-linked mirrors rhyme with that. If you’ve used DraftKings/FanDuel, you know the vig (house edge) quietly taxes every “win.” Synthetic trackers rhyme with in-play betting: your “vig” shows up as spreads, fees, funding, gas, and slippage.

- Polymarket → event-linked mirrors: “Yes/No by a deadline,” price = changing odds.

- DraftKings/FanDuel → synthetic trackers: scoreboard vibes, but the juice is spreads/fees.

- The house always gets paid: friction trims your gross into a smaller net.

So even when you’re directionally right, execution costs can turn a textbook +3% into +1–2%. That’s gambling math.

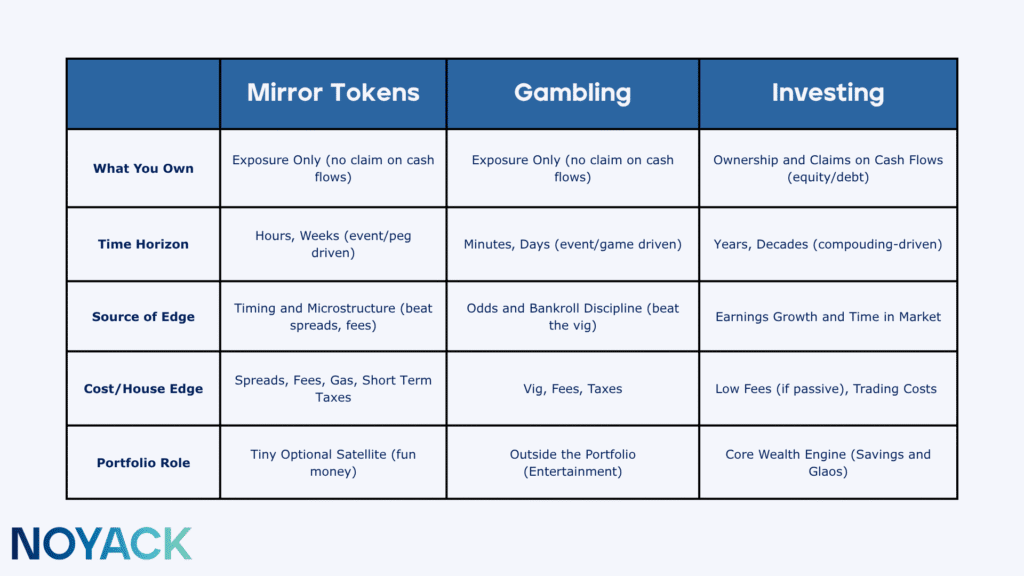

The Main Angle: Why Investing ≠ Gambling (and Why Mirror Tokens Are)

Investing is buying productive assets—businesses, real estate, cash-flowing funds—and letting time and earnings do the heavy lifting. You get rights, sometimes income, and the edge is compounding. Mirror tokens flip that: your edge is timing and execution around a catalyst, and you must beat the house edge every time. You can be right on direction and still lose on mechanics.

- Investing: ownership, cash flows, voting rights, compounding over years.

- Mirror tokens: outcomes, odds, slippage, fees, short horizons.

- Your real opponent isn’t the market—it’s the vig plus your own impulses.

That’s why we say mirror tokens are more like gambling: they reward quick reactions, not long-term patience.

Risks to Watch (Where People Actually Get Hurt)

The danger isn’t hidden; it’s practical. No ownership means no safety net of cash flows. Binary event risk can zero you if the clock runs out. Peg/design risk means synthetic trackers can fail during stress. Liquidity mirage means “24/7 trading” without depth—bad fills or no fills. And friction—spreads, fees, gas, short-term taxes—shrinks small wins.

- No rights: exposure ≠ equity (no dividends, no votes, no info rights).

- Binary risk: miss the event window → payout can be $0.

- Peg risk: synthetics can de-peg just when you need them.

- Thin books: exits can be worse than the last print—or unavailable.

- Friction = house edge: spreads/fees/taxes cut your take.

- Rules vary: platforms and jurisdictions differ; know your venue.

If you take one thing from this section, take this: execution taxes everything.

If You Still Want to Try Them (Treat It Like Entertainment)

This is where discipline lives. Use money you’d happily spend on a weekend hobby, not money earmarked for retirement or emergencies. Pre-write your exits—take-profit, stop-loss, time limit—and follow them like a pilot checklist. One or two experiments a year is plenty.

- Hard cap: ~1% of savings total (≤0.5% per idea).

- Pre-plan: take-profit, stop-loss, max hold (e.g., 45 days).

- No martingale: never double to “get even.”

- Core first: never skip retirement/index contributions or your cash buffer.

Run it like reps at the range: learn fills, slippage, and your own tilt—cheaply.

If You Actually Want to Invest

Keep building the boring core: emergency fund, retirement accounts, broad low-cost index funds, and, when appropriate, ownership-based alternatives with real claims on cash flows. Automate contributions. Extend your time horizon. That’s how real wealth compounds.

- Core stack: cash buffer → retirement accounts → low-cost index funds.

- Add selectively: true ownership alternatives when they fit your plan.

- Process beats prediction: save regularly, rebalance, stay the course.

Mirror tokens can be a tiny, tactical side quest. They are not the main game.

One Last Reality Check

Platforms and headlines can make this look sophisticated. Strip away the gloss and you’ve got odds, clocks, and friction. If you choose to play, price it like entertainment, respect the rules, and keep your real investing on a separate, safer track.

- Fun is fine; confusion is costly.

- Keep your bets tiny.

- Let your investments do the compounding.