In a previous issue, we broke down how the SAVE Plan (Saving on a Valuable Education) was, for a brief and glorious moment, the most borrower-friendly repayment plan the U.S. Department of Education had ever rolled out. No hyperbole. Just facts. $0 monthly payments? Check. Government-covered interest? Check. Early forgiveness for lower-balance borrowers? Check. A genuine on-ramp to wealth-building for millions of student loan holders? Check, check, and check.

But in a matter of months, that runway has crumbled—and now, borrowers are headed straight into turbulence.

As of August 1, 2025, the SAVE Plan is all but dead. The courts have blocked its core protections. Interest is back. Forgiveness is no longer fast-tracked. And for borrowers who believed they were on a secure, government-approved path toward financial freedom, the ground has shifted—fast.

And here’s what most media coverage won’t say: this change could cost you tens of thousands in long-term wealth if you don’t act now.

We’re going deep on what’s changed, how it impacts your wealth goals, and what you can do to get back in the pilot’s seat—before the system does it for you.

SAVE Is Out, Interest Is Back, and a New System Is Coming

Let’s start with the facts.

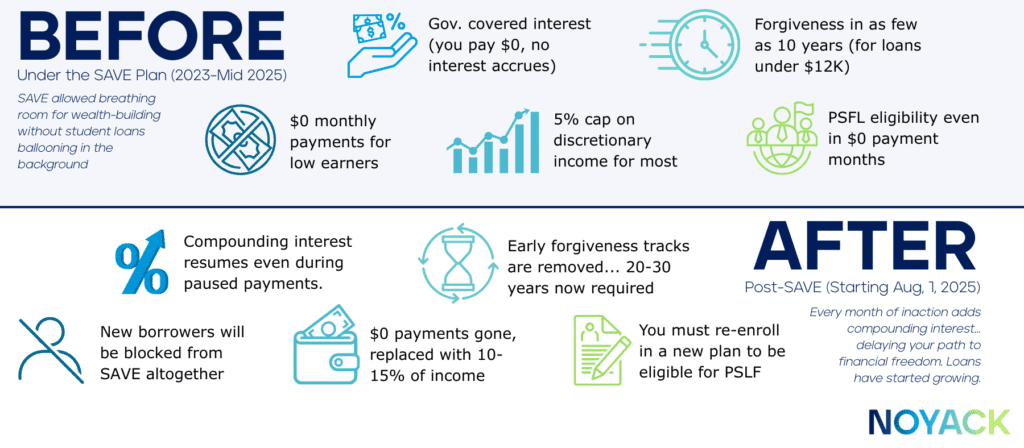

The SAVE Plan, launched under the Biden administration, was designed to replace REPAYE and expand the benefits of income-driven repayment (IDR) plans. For many borrowers, it offered:

- $0 payments for low earners

- Monthly payment caps at 5% of discretionary income

- Government-covered interest, even if your payment was $0

- Forgiveness in as little as 10 years for balances under $12,000

In short: it was the first repayment plan designed to keep people from drowning in debt and give them space to build wealth.

But the courts had other ideas.

As of August 1, 2025, SAVE’s interest subsidy is officially gone. That means your loan now accrues interest even while you’re not required to make payments. In the case of a $60,000 loan at 6%, that’s $3,600 per year in new debt. Over three years of forbearance, that’s more than $10,000 in interest—compounding monthly.

Even worse? That forbearance period—currently extended to 2028—is lulling many borrowers into a false sense of security. The pause on payments doesn’t mean a pause on debt. Every month you do nothing, your loan balance quietly grows, making it harder to reach forgiveness or pay off your loan in full.

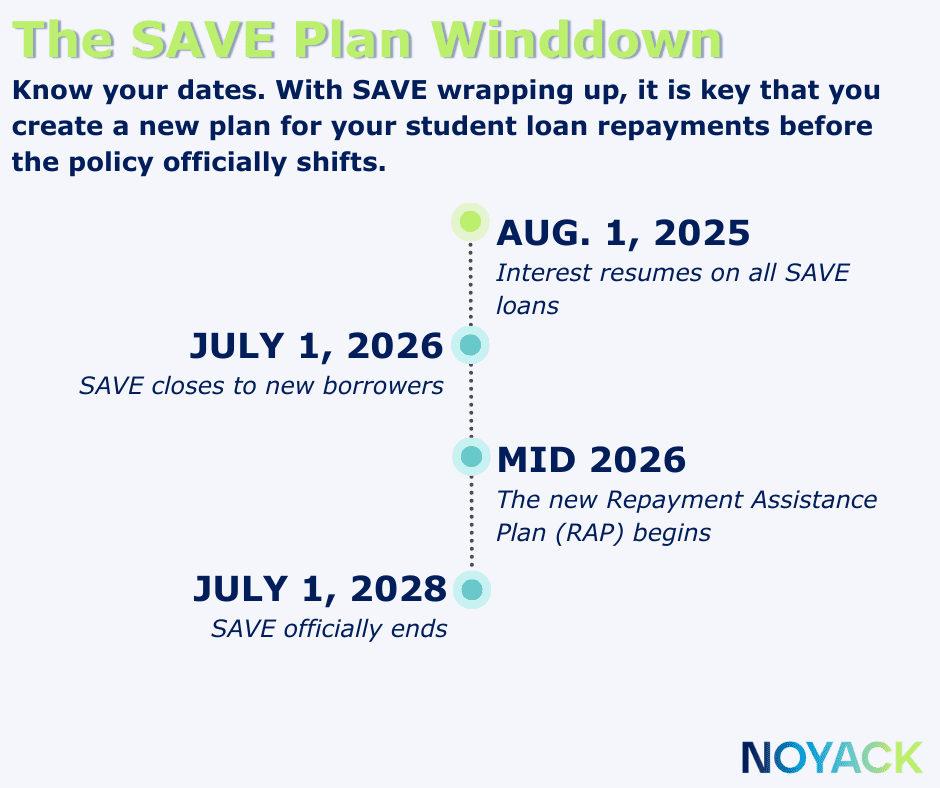

As if that weren’t enough, SAVE applications are being processed at a crawl, with 460,000+ already denied and 1.5 million still pending. And beginning July 1, 2026, no new borrowers will be allowed to enroll. By July 1, 2028, SAVE will be fully shut down.

In its place? A new system built around two options:

- A Standard Repayment Plan (likely fixed over 10 years)

- A new Repayment Assistance Plan (RAP), launching mid-2026

But RAP, despite being billed as a simplified version of IDR, comes with some fine print:

- Payments up to 15% of discretionary income

- Forgiveness timelines up to 30 years

- Limited or no interest subsidies

In other words, it looks a lot like the old, pre-SAVE system—only repackaged for a new era.

What Inaction Could Cost You

Let’s talk about what this actually means for your financial future.

We’re not just dealing with student loans here. We’re dealing with opportunity cost—the money you could have used elsewhere but now have to throw at interest, compounding balances, and longer repayment schedules.

Let’s do the math.

Say you’re earning $55,000/year. Under SAVE, your payment was around $115/month. Under RAP, your payment could increase to $345/month—more than triple. Over 10 years, that’s a $27,600 difference.

That’s money that could have:

- Been invested in a Roth IRA or 401(k)

- Covered a 10–15% down payment on a starter home

- Funded a career break, relocation, or even a small business launch

And if you were banking on early forgiveness (as many low-balance borrowers were), that window is now gone. The new RAP plan expects borrowers to repay for 20 to 30 years, even for balances under $12,000.

If you were planning to hit the forgiveness mark by 2027 under SAVE, you may now be carrying your debt into the 2040s. The compounding interest alone could add $15,000–$30,000 to your total repayment obligation.

For Public Service Loan Forgiveness (PSLF) borrowers, the risk is even higher. You must now manually re-enroll in a qualifying IDR plan to stay eligible. Miss the deadline, or stay enrolled in SAVE too long, and your count toward forgiveness could reset—costing you years of qualifying payments and forcing you to start from scratch.

And if you’re married and filed separately to lower your SAVE payment? That strategy might not even be possible under RAP, which may begin counting household income across the board. That could mean:

- Higher monthly payments

- Lost tax efficiency

- Fewer ways to optimize your repayment strategy

All of this adds up to one hard truth: your student loans are no longer just a liability—they’re now directly competing with your ability to build wealth.

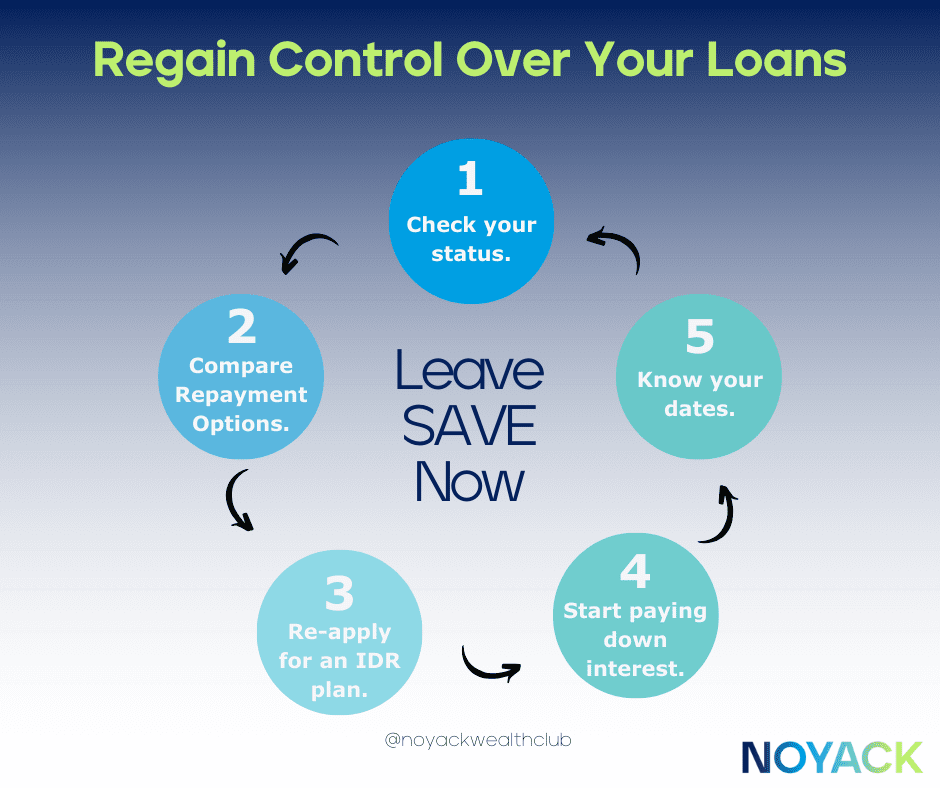

The 5-Step Game Plan to Regain Control Now

This isn’t a drill. Every month that passes under the new SAVE-less system increases your debt burden and reduces your flexibility down the road.

Here’s what you should do—now—to stop the bleeding and take back control:

✅ 1. Check Your Status

Log into studentaid.gov or your loan servicer account and confirm:

- Whether you’re currently enrolled in SAVE

- Whether your application is pending or denied

- Whether interest has resumed

- If you’re in administrative forbearance, and what that means for your balance

Don’t assume your plan is still active. Check.

✅ 2. Compare Repayment Options

Use the Loan Simulator Tool at studentaid.gov to explore your options under:

- IBR (Income-Based Repayment)

- ICR (Income-Contingent Repayment)

- The Standard 10-Year Plan

- And when it becomes available, RAP

Run multiple scenarios: one with your current income, one with a projected raise, and one assuming you’re married (if applicable). Knowledge is power—especially when policy is shifting fast.

✅ 3. Re-Apply for an IDR Plan

If you’re still in SAVE—or your application was denied—reapply at studentaid.gov/idr. When prompted, select:

- “I want the lowest monthly payment”

- Do not select SAVE (it will be phased out and is no longer protected)

- Upload current income documents to ensure accuracy

This is especially important if you’re pursuing PSLF—because only active, qualifying IDR plans count toward your 120-payment requirement.

✅ 4. Make Voluntary Interest Payments

Even if your loans are in forbearance, interest is adding up every single month. Don’t let it pile up.

For example:

A $50,000 loan at 5% interest accrues about $208/month. If you can afford to, start paying that amount voluntarily now. You’ll keep your balance flat and avoid years of interest compounding against you.

Can’t pay that much? Start smaller. Even $50/month makes a meaningful difference.

✅ 5. Mark Your Calendar

Stay ahead of the system. Write these down:

- Now – Interest has resumed on all SAVE loans

- Late 2025 – RAP applications expected to open

- July 1, 2026 – SAVE closes to new borrowers

- July 1, 2028 – SAVE fully dismantled

Knowing the timeline keeps you ahead of bad surprises.

Final Take: This Isn’t About Fear—It’s About Financial Power

We’re not here to fearmonger. We’re here to tell the truth—and help you act on it.

This is about more than loans. It’s about what your student loans are costing you elsewhere: your timeline to buy a home, your investment growth, your business ambitions, your legacy planning.

Every dollar unnecessarily trapped in debt is one less dollar earning for your future. That’s not just debt—that’s lost power.

So whether you’re in your first job, chasing PSLF, or trying to scale a family business, you need a student loan strategy that protects your bigger wealth plan.

The system is changing—again. Don’t let it change your future without your input.