If you’re a high earner living in a high-tax state, your current tax strategy might be costing you hundreds of thousands of dollars in missed opportunities. The One Big Beautiful Bill (OBBBA), signed into law on July 4, 2025, permanently changed the game for HENRYs (High Earners, Not Rich Yet), especially those earning between $150K and $500K.

With new tax breaks, expanded deductions, and the chance to optimize where and how you live, this bill gives you the tools to build real wealth—not just reduce your tax bill. By combining smart tax strategies with geographic arbitrage, HENRYs can unlock $4,000–$12,000 per year in savings and transform that into over $1 million in net worth within two decades.

Jasmine, 34, UX designer in NYC, was earning $225K—but saving none of it. After reading about the OBBBA, she formed an S-Corp for her side gigs, maxed her Solo 401(k), and redirected her refund into an HSA. She’s now saving $12K/year in taxes and investing it automatically. If she keeps it up, she’s on track to add over $1 million to her net worth by age 50—without changing jobs or moving.

How did she do it? Consistent, intentional strategy. Whether you’re in California, New York, Texas, or Florida, your location, tax structure, and investment decisions now matter more than ever.

📍 Tax Strategy Meets Geography: Relocate, Reinvest, and Multiply

One of the most overlooked yet powerful tax strategies is geographic arbitrage. The OBBBA raises the SALT deduction cap to $40,000 through 2029, giving some relief to residents in high-tax states. But if you really want to optimize your tax position, where you live could be the most valuable financial decision you make.

Example:

A HENRY earning $300K in California pays up to $40,000/year in state income taxes. Move to a zero-income-tax state like Texas or Florida, and you can redirect that money into investments.

Reinvesting that $40K/year at a 7% return yields:

- 10 years: $552,000

- 20 years: $1.6 million

- 30 years: $3.8 million

Even if you invest just half, you’re still compounding six figures in net worth over time.

Best States for Tax Strategy Optimization:

- No Income Tax: Texas, Florida, Nevada, Washington

- Low Tax + High Growth: Utah, North Carolina, Tennessee

- High Tax (Consider Moving): California, New York, New Jersey

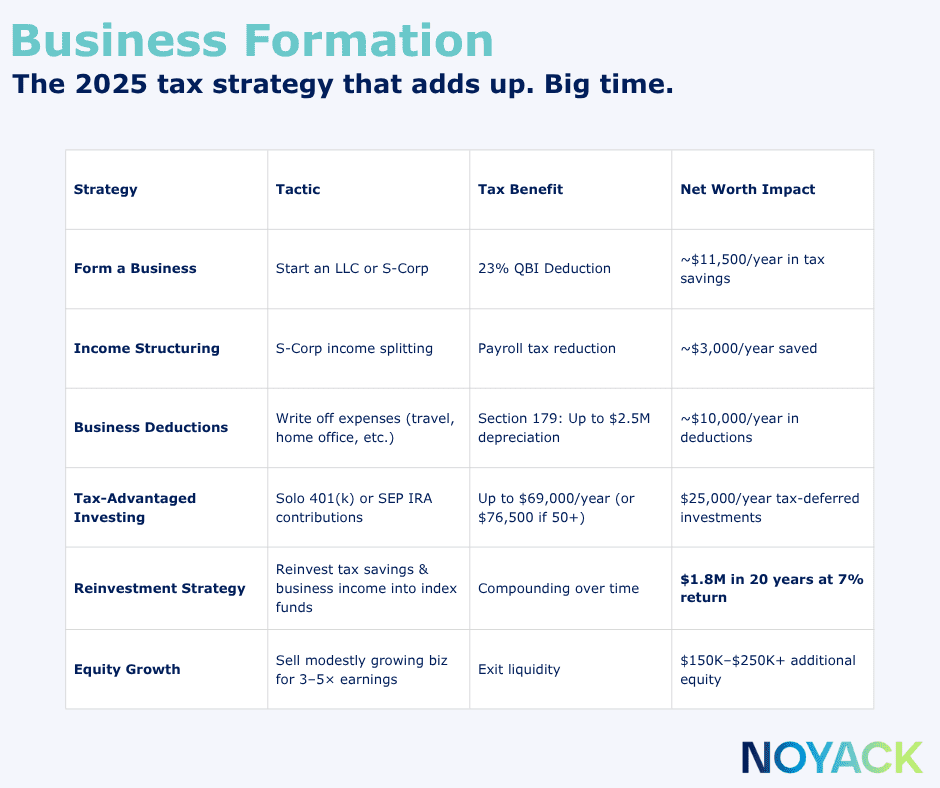

💼 Business Formation: The Core of a Modern Tax Strategy

Launching a business is no longer just a hustle—it’s a wealth-building tax strategy. With the 2025 tax law, forming an LLC or S-Corp opens up a host of benefits.

Total tax-efficient savings and contributions could be $45,000/year. At 7% annual growth, you add $1.8 million to your net worth in 20 years. Even if your business grows modestly, you could sell it for 3–5× earnings in the future—adding $150K–$250K+ more in equity.

Key Action Steps:

- Register an LLC (or elect S-Corp if you’re earning six figures)

- Set up a business bank account

- Track every deductible expense (home office, travel, subscriptions)

- Open a Solo 401(k) or SEP IRA

- Reinvest profits into the business or index funds

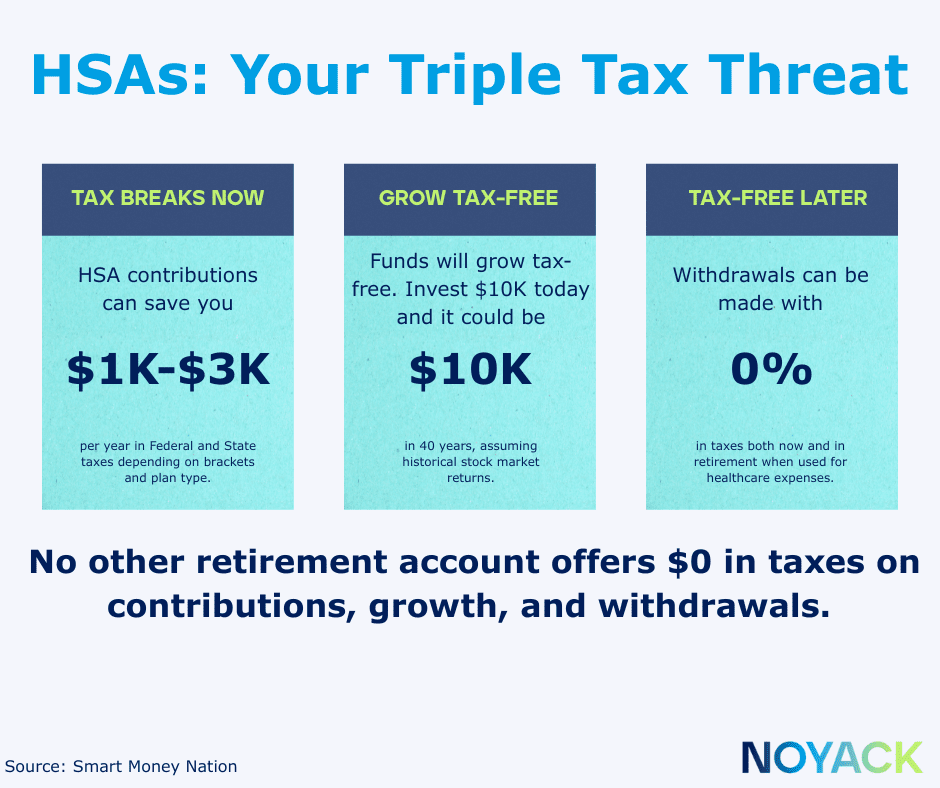

🏥 Health Savings Accounts (HSAs): The Most Underrated Tax Strategy

An HSA is one of the few accounts offering triple tax advantages.

In 2025, you can contribute: $4,150 as an individual, $8,300 as a family, Add $1,000 more if you’re 55+

Long-Term Net Worth Impact:

A 30-year-old investing $8,300/year into an HSA at 6% annually will have:

- $663,000 by age 65, tax-free for healthcare

- Withdrawals for non-medical expenses (after 65) are taxed like an IRA—no penalty

Treat it like a stealth retirement account, and let compounding do the work.

Advanced Tips:

- Invest HSA funds in low-fee ETFs

- Pay out-of-pocket for medical costs now, save receipts, and reimburse yourself later tax-free

- Maximize any employer contributions—that’s free money

💸 Deductions That Directly Boost Net Worth

Every dollar deducted is a dollar that can be reinvested. OBBBA expands deduction eligibility and accelerates depreciation, giving you more control over your after-tax cash flow.

Key Deductible Strategies:

- Home Office Deduction: Up to $1,500 with simplified method; thousands more with actual-expense

- Section 179 Depreciation: Instantly deduct up to $2.5M in business purchases

- Education & Coaching: Write off courses, conferences, masterminds, and executive coaching

Long-Term Impact:

If you deduct $10,000 annually and invest it at 7% return:

- After 10 years: $138,000

- After 20 years: $400,000 in net worth added

- After 30 years: $820,000+

That’s from spending smarter—not earning more.

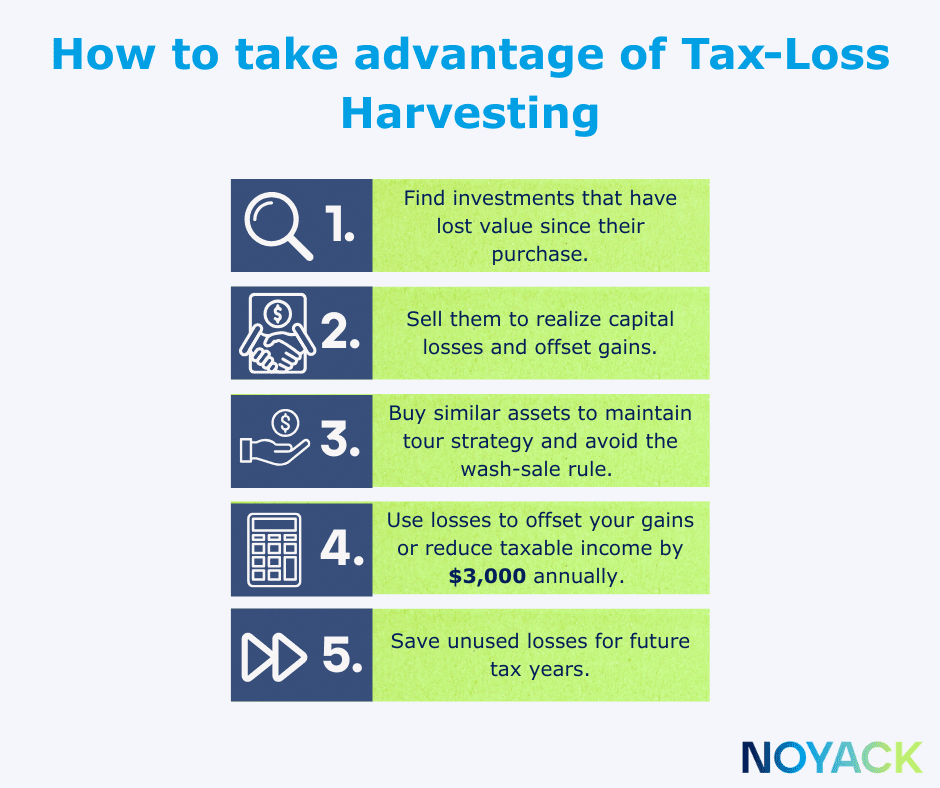

📈 Investment Structuring: The Final Layer of Tax Strategy

Once your income and deductions are optimized, how and where you invest matters even more.

Asset Location Strategy:

- Bonds, REITs, actively managed funds → tax-advantaged accounts (IRA, HSA, 401(k))

- Index funds, growth stocks → taxable accounts (lower capital gains)

Tax-Smart Tactics:

- Tax-Loss Harvesting: Offset gains and deduct up to $3,000/year against income

- Backdoor Roth IRA: Contribute to traditional IRA, convert to Roth for tax-free growth

- Mega Backdoor Roth: Use employer plan to stash up to $69,000/year tax-free if allowed

Compounding Results:

Saving just 1.5% in annual tax drag on a $500K portfolio adds $375K+ in 20 years. Combine this with other tax strategies, and you’re easily into seven-figure net worth territory.

🎯 30-Day Tax Strategy Sprint

Week 1: Foundations

- Calculate your net worth

- Audit tax returns for inefficiencies

- Research business structures and geo-arbitrage options

Week 2: Build Your Infrastructure

- Form your LLC or S-Corp

- Open a Solo 401(k) and HSA

- Track business expenses and deductions

Week 3: Strategic Deployment

- Execute Backdoor Roth IRA

- Harvest tax losses

- Allocate assets tax-efficiently

Week 4: Automation & Growth

- Automate contributions to tax-advantaged accounts

- Set reminders for quarterly CPA check-ins

- Reinvest all tax savings

- Begin tracking net worth monthly

🔁 Tax Strategy Isn’t Just About Saving—It’s About Building

The One Big Beautiful Bill gives you the structure. Your job? Execute.

The difference between a high-income earner and a high-net-worth individual is one thing: a tax strategy that scales with your life.

✅ Move to a lower-tax state

✅ Start a business and compound deductions

✅ Maximize your HSA, Roth, and Solo 401(k)

✅ Reinvest every tax dollar saved

This is the year you stop asking “How much can I save?” and start asking “How fast can I build wealth?”

Til next Sunday,

– CJ & The NOYACK Team

AccessGranted™