What to Expect in This Edition

AI is reshaping the world—but not just through code and chips. Behind every model, every query, and every deployment is a physical system built on power, minerals, and infrastructure.

In this edition:

- The energy, copper, lithium, rare earths, and land needed to power AI’s future

- How AI is driving long-term demand for real-world assets

- Why investing in infrastructure complements traditional AI investing

- Four accessible ways to gain exposure: ETFs, REITs, royalties, and fractional platforms

- How to blend natural resource investing with AI-driven growth in your portfolio

If you believe AI is the future, this is the part of the story that shows what makes that future possible. At NOYACK, we’re actively building AI solutions ourselves—and we know the infrastructure that powers this revolution.

The Physical Backbone of AI: Where Natural Resource Investing Meets AI Investing

AI is often described as weightless—an ethereal network of models and algorithms living in the cloud. But beneath the cloud is something deeply physical.

Every model training run, every chatbot response, every AI-generated image requires massive inputs:

- Electricity to power the servers

- Copper to transmit that electricity

- Lithium to store it in batteries

- Rare earth minerals to enable chip performance

- Land to build the data centers, cooling systems, and substations AI depends on

This physical footprint is expanding fast—and quietly becoming one of the most overlooked investment opportunities of the next decade.

At NOYACK, as we develop AI-powered platforms, we’re reminded every day: it’s not just about building smarter code—it’s about making sure that code has somewhere to run.

What AI Really Needs to Scale

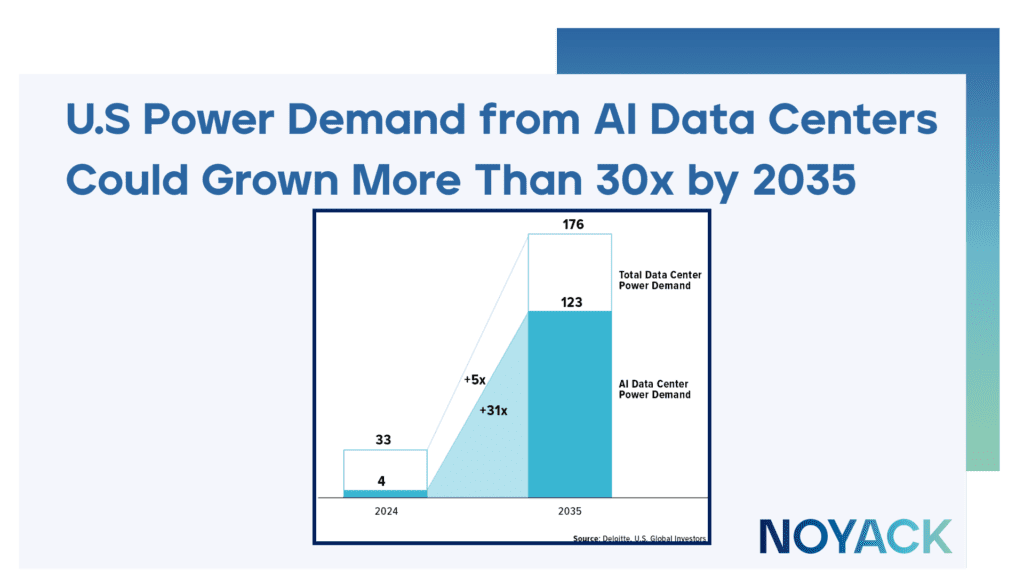

1. Electricity—Lots of It

AI data centers use 2–3× more power than traditional cloud facilities. And the more complex the model, the greater the draw. According to the IEA, by 2030, AI alone could consume up to 10% of U.S. electricity.

That’s not a niche statistic—that’s a full-scale shift in power infrastructure. And it requires major investment in:

- Grid expansion

- Renewable energy

- Transmission lines

- Backup storage systems

This is where energy and infrastructure investing starts to blend with the AI economy. It’s not just software that scales—it’s the power grid itself.

2. Copper and Conductive Materials

Copper is the lifeblood of modern energy systems. AI infrastructure—from GPUs to cooling to transmission—runs on copper. And demand is surging.

Industry analysts forecast that AI could increase global copper demand by 2–3% by 2030—on top of demand from EVs, renewables, and grid expansion.

That makes copper more than a commodity. It’s becoming a critical input to digital progress—and a rising focus of natural resource investing.

3. Lithium, Nickel & Battery Metals

AI isn’t always “always on” — it’s “always charged.” That means data centers need more than grid access—they need stable, backup, and stored energy. And that means lithium, nickel, and cobalt.

As battery storage expands from vehicles to buildings to data hubs, battery metals are becoming core infrastructure components.

This isn’t a future trend—it’s already here. And for companies like NOYACK working with compute-heavy workloads, energy storage is a mission-critical part of our AI planning.

4. Rare Earths & Strategic Minerals

AI chip innovation depends on rare earth elements like neodymium and gallium. These are essential to:

- GPU acceleration

- Magnetic components

- Miniaturized power systems

- High-performance AI edge devices

Access to these minerals is strategically limited—and supply chains are under pressure. That creates both volatility and opportunity for investors who understand their role in the AI stack.

5. Land and Physical Infrastructure

The AI economy is not just about the cloud—it’s about real estate.

From hyperscale data centers to chip fabs to energy-intensive industrial parks, land is now a computational asset.

What matters most?

- Proximity to power

- Cooling capabilities

- Fiber infrastructure

- Zoning for energy and industrial use

Companies need to navigate these realities as they scale AI systems—where to place compute, how to power it, and what kind of land supports it.

Why This Isn’t Just a Different Angle—It’s the Other Half of the Story

This isn’t about abandoning software or big tech. It’s about completing the picture.

If you’re investing in AI’s future, you need to understand its foundations. And those foundations are physical.

Companies like NOYACK don’t just build in the cloud—we build on top of real infrastructure. Which is why we pay attention to what the AI economy is actually made of.

✅ Real-World Scarcity

You can’t manufacture new copper overnight. Or fast-track lithium extraction. Or magically rezone industrial land near a power station.

That’s what makes these assets strategic—they’re limited, essential, and often underappreciated.

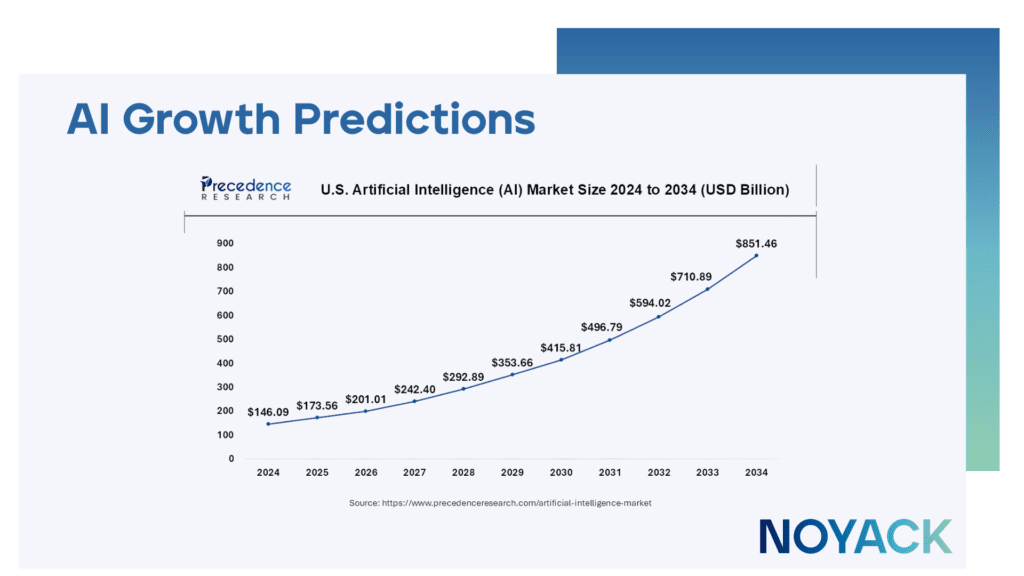

✅ Demand That Compounds

AI isn’t linear—it’s exponential. Every new model adds load. Every new use case creates new demand.

Infrastructure doesn’t scale at startup speed. That gap between demand and capacity creates price pressure—and opportunity.

✅ Diversification That Aligns

Most investor portfolios are over-indexed to the front end of tech: platforms, software, earnings multiples.

Natural resource investing offers a hedge—but more importantly, it offers thematic alignment: exposure to the AI economy without being entirely reliant on equity markets.

✅ Cash Flow + Upside

Resource and infrastructure assets often produce:

- Royalties

- Lease income

- Dividends

- Yield

All while appreciating as demand grows and supply tightens. That’s especially powerful in markets where both growth and resilience are in short supply.

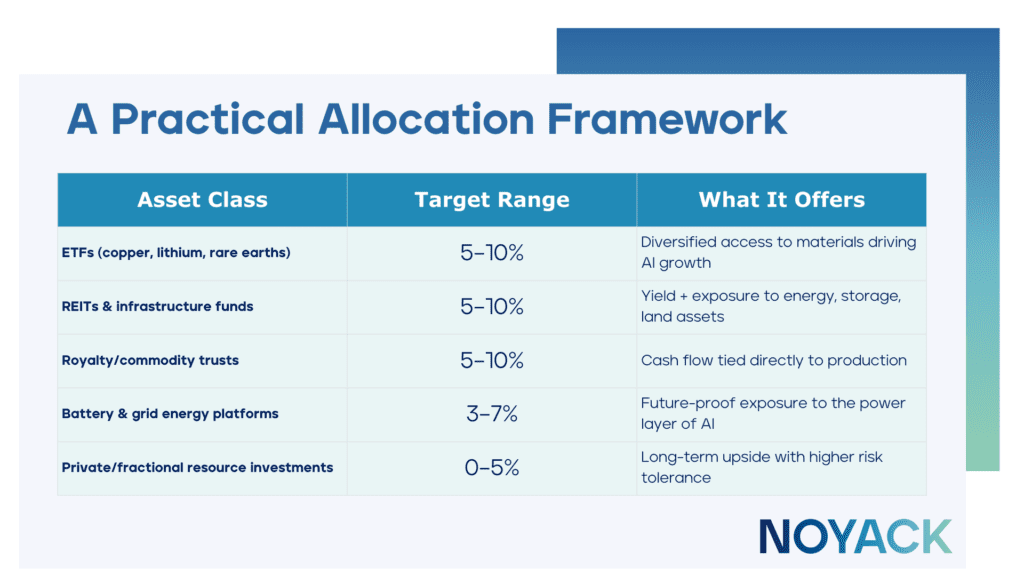

A Simple Portfolio Framework: Natural Resource + AI Infrastructure

You don’t need to own a mine or a microchip fab to tap into this theme.

Here’s a practical allocation framework:

Adjust by risk appetite, timeline, and how much of your portfolio is already tied to growth tech.

Final Thought: AI Runs on Real Assets

AI is shaping the next century. But it can’t run without:

- Electricity

- Copper

- Lithium

- Rare earths

- Land

- Cooling infrastructure

- Transmission networks

So as you think about the AI future, ask yourself: Do you own the assets AI can’t live without?

Because in the age of machine intelligence, the smartest portfolios will invest in the things that machines still depend on.

Build the brain. But don’t forget to own the body.